Welcome to my corner of the internet!

Table of Contents

Let’s be Sharks

Did you know that sharks have survived five mass extinction events, including the one that wiped out the dinosaurs?

How many mass extinction events has humanity survived?

…and no, COVID does not qualify as a mass extinction event1, but climate change might be the first due to its potential to disrupt ecosystems on a global scale.

Sharks have been around for 400 million years.

Homosapiens? barely 300,000 years.

Sharks are survivors.

Sharks are skilled.

Sharks are strategic.

That is why winning poker players are called sharks while the losing ones are called fishes. Sharks thrive by identifying and exploiting fishes as they are easy targets for sharks because of their lack of skill.

How is this relevant to stock investing?

A winning poker player has to get the opponents to fold2 when they should play and convince them to play when they should fold.

The same skill is needed in investing; you should convince someone to sell when they should buy and vice-versa. Thankfully, we don’t need to convince anyone, as Mr. Market does that job for us.

I could argue that stock investing is slightly easier to beat than poker. While in poker you have to be right about the strength of your hand, the weakness of your opponents and the likelihood that he plays or folds, in stock investing, you just need to be right directionally whether the price is going up or down (options are a bit more complex as you also need to be right on timing and level of share price increase or decrease).

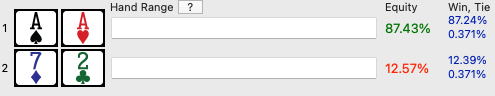

Poker players rely on probabilities rather than certainty, understanding that even the best hands can lose. The best initial hand in poker is AA, and the worst is 72. Still, an AA hand wins 87% of the time against 72.

This means that 13% of the time, even the best hand can lose. Poker players understand this and approach the game strategically, using Game Theory Optimal (GTO) strategies to make the best decisions over many hands.

Stock investing is the same, you can have the best company in your portfolio with a great return on capital, amazing margins and a commanding market share. But a black swan event could happen and leave you in ruin. For example, unexpected events like corporate fraud, natural disasters, or financial crises can disrupt even the strongest companies. That is why a stock investor is probabilistic, he knows that XYZ investment has a 75% chance of being a winning investment. But if it is not, it is fine as it is one of the many quality investments in his portfolio.

That is why my stock investment philosophy has been to become like a shark. I have a well-diversified portfolio where I hope to make money from 80% of the companies, break even on 10%, lose some money on 8%, and 2% of companies go to zero.

Also, I am strategic like a shark, I go shopping when I smell blood in the waters and sell at a premium when fishes are ready to overpay.

About the newsletter

Beating the Tide is not just about surviving but thriving when the odds are against you, just like sharks navigating unpredictable waters. The stock market, much like the ocean, is filled with waves of fear, greed, and irrationality that can pull investors in the wrong direction. Most investors get swept away by the tide, chasing overpriced stocks or panic-selling at the worst moments. But like a shark cutting through the currents, disciplined investors take advantage of these swings—buying fear, selling greed, and positioning themselves ahead of the herd.

This newsletter is about navigating these market currents, identifying when to ride the wave or swim against it, and ultimately beating the tide of conventional thinking.

Beating The Tide is designed to help you improve your investments by leveraging the strategy I have used since 2011 for myself, family, friends, and high-net-worth clients. This approach has delivered 30%+ annual returns since 2011—far outperforming the 12% growth of the S&P 500 over the same period.

About me

In a nutshell, I am a guy who is passionate about making money by investing in stocks and have been doing it successfully since 2012.

I started my career as an engineer and started investing in 2006, I got lucky at first and then unlucky. That is when I took it seriously, read almost every investing book out there, and obtained an MBA and a CFA.

However, the real investing education I got was as an investment analyst at one of the largest asset managers in Latin America. At first, I covered junk bonds, but within six months, I was covering stocks as well. When I left that role for a corporate development one, I started investing freely and opened a small fund for family, friends and high-net-worth individuals, which I still manage.

I am a believer in KISS (keep it simple, stupid) and I have streamlined and automated most of my life, that is why I have been able to manage that fund, keep executive corporate roles at Fortune 500 companies, write some of my investment ideas on Seeking Alpha and even write a book about investing.

In the last couple of years, I started feeling that I had outgrown corporate life, so I chose to leave it for good. Right now, I am focusing on a couple of small ventures other than stock investing, and I thought about this service as well.

Why am I writing this newsletter?

I am not going to pretend that I am doing this for some altruistic purpose. As you get to know me, you will see that I am straight to the point, I avoid buzzwords, and I am very practical, logical and analytical.

I am doing this because I want to maximize the earnings per hour of the research I do, get feedback on my ideas and because it has been fun so far!

Before I decide to invest in a company, I read 10ks and quarterly reports, talk to the company, and sometimes do site visits and other channel checks. As all the legwork is already done, I can increase the value of that research by selling the advice. The marginal cost should be minimal (creating this newsletter and maintaining it).

That is why there won't be many bells and whistles. Other 'investing groups' offer you what they call 'value-adds' such as analysis of the market, trend analysis, technical analysis, 1:1 video calls, chats, and the list goes on forever. They do that just to justify charging you a hell lot for something that you don't need or want.

You will see that my membership plans are very affordable. Please do your homework, and if you find a better plan, let me know. I am not charging less than the rest because I value my time less or the quality of my work is inferior (the returns should speak for themselves); I charge less because I just provide what you need to invest successfully, and I will not offer the value-adds others offer.

The Free membership includes a weekly newsletter, sent every Sunday, along with occasional stock ideas. The newsletter features commentary on portfolio performance and an idea section. This idea could be a stock recommendation, a market opinion, investment education, or anything I believe will help you become a better investor.

The Paid membership provides buying and selling recommendations, access to the full portfolio and one in-depth stock analysis per month.

What does this newsletter NOT offer?

I will not offer:

Personalized trading advice. If you want my opinion on a certain stock you heard about, this service is not for you.

Investing in 'sophisticated' asset classes. If you want to invest in crypto, real estate, bonds, options, forex, futures or any other asset other than stocks, then this service is not for you.

You want to have market and company updates. If you want weekly industry analysis, macrotrends, recaps or weekly/monthly updates on stocks in the portfolio, this service is not for you.

You want to day trade. If you want to day trade, this service is not for you.

In a nutshell, I will not offer anything that is not already in my investing process (besides the weekly newsletter, which in some way is already in my investment process). That way, I can keep my costs down and offer you a great investing service for a low price.

What does this newsletter offer?

I will keep it very simple for you. What you can expect from this service is:

As a Free Subscriber, you get:

1. The Weekly newsletter

This is sent on Sundays. The Weekly includes the performance of the portfolio and my thoughts for the week. The thought can be a stock idea, an opinion on the market, an investment philosophy, personal finance, or anything I believe would be of value to you. Everything is free except for the performance of each stock, which is under a paywall at the bottom of the Weekly.

You can find previous Weeklies here.

Here is a sample Weekly,

Weekly #22: Stop Believing the Stories You're Told—Including This One

Happy Sunday, my fellow Sharks!

2. Occasional stock idea

A piece that would go into detail about why I like or dislike a certain company, including a dissection of their strategy, stock valuation and risks.

You can find previous stock ideas here.

Here is a sample of a stock idea,

As a Paid Subscriber, you receive everything Free Subscribers get, plus

1. Weekly stock performance

On Sunday Weeklies, I will include the performance of each stock in the portfolio. This will be at the bottom of the Weekly, behind a paywall.

2. Real-time buy/sell alerts in my portfolio

Whenever a position is added or sold in the portfolio, I will post the trade. I tend to send those notes between 10 am and 2 pm. The note will have a rationale behind the thesis. Those positions tend to stay in the portfolio for 6 months to 1.5 years, but I have had some that closed in 2 months and some that have been in my portfolio for 7 years (and are still open).

You can find my historical trade alerts here.

Here is a sample trade alert,

DXP Enterprises (DXPE): A Hidden MRO Powerhouse with Significant Upside

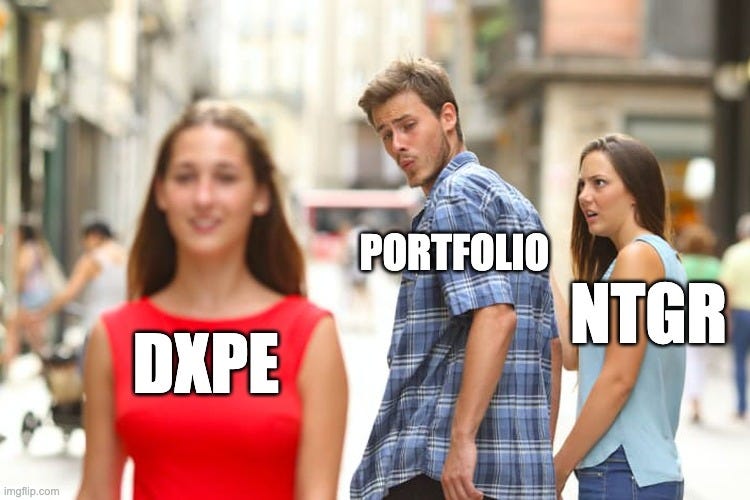

Finally, the deep dive is here. I noticed I went overboard on the details so I summarized with the help of ChatGPT the most useful information. Note that we are closing NTGR and redeploying most of that capital to DXPE.

3. Access to my portfolios

On the right-hand panel in the Home tab, you can find the portfolios under ‘Paid Membership’.

Below is a sample portfolio,

4. One in-depth stock idea per month

Once a month, I will send a detailed investment analysis for a company I am adding to the portfolio.

Here is a sample deep dive that I did for TSMC (7,400 words),

TSMC Stock: Why This Semiconductor Giant is My Highest-Conviction Buy

In Romy and Michele's High School Reunion (1997), there is a scene that was a very common dynamic in high school. Romy excitedly gets invited to prom by a guy, but later, he cancels on her because one of the popular girls becomes available. It’s a classic case of ditching someone for a more desirable option.

What is my investment process?

My detailed investment process is explained in over 359 pages in my book (fun stuff!). Below is a summary:

I use a filter I have refined over the years to find companies that are cheaply or fairly valued and have healthy profitability metrics.

For companies that pass the initial filter, I analyze their 10-K reports and other filings in detail.

If it passes, then I will read more 10ks and quarterly reports, listen to earnings calls, talk to investor relations (or the CFO or CEO, depending on the size of the company), and finish off with channel checks.

I develop a valuation model based on discounted cash flows (DCF), and come up with catalysts and a target price.

Based on the catalysts, I would trigger a buy or wait for the right risk/reward mix and catalyst visibility. Many stocks stay in this stage for months till a buy alert is triggered. At any time, I have 20-30 stocks on this list.

Disclosure

Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. I am not a licensed securities dealer, broker, US/Canadian investment adviser or investment bank. I am not licensed or certified by any institute or regulatory body.

To qualify as a mass extinction event, it has to satisfy five requirements:

At least 75% of all species on Earth must be lost within a relatively short geological timeframe.

The event must affect ecosystems across the entire planet, not just isolated regions or specific groups of organisms.

The extinction must occur abruptly in geological terms, causing widespread and catastrophic biodiversity loss over a short period relative to Earth's history.

These events are often driven by major environmental disruptions, such as asteroid impacts, massive volcanic eruptions, rapid climate change, or the collapse of ecosystems.

The loss of biodiversity during a mass extinction significantly alters the course of evolutionary history, shaping the species and ecosystems that follow.

In poker, fold means to discard your hand and forfeit the current round, avoiding any further bets.