You Cannot Win Them All: Why I Cut My Losses on Abercrombie & Fitch (ANF)

I sold ANF after a 16% loss and rotated into a stable dividend-paying financial stock built for medium-term growth.

As Thomas the engine learned in this episode, ‘You can’t win them all’.

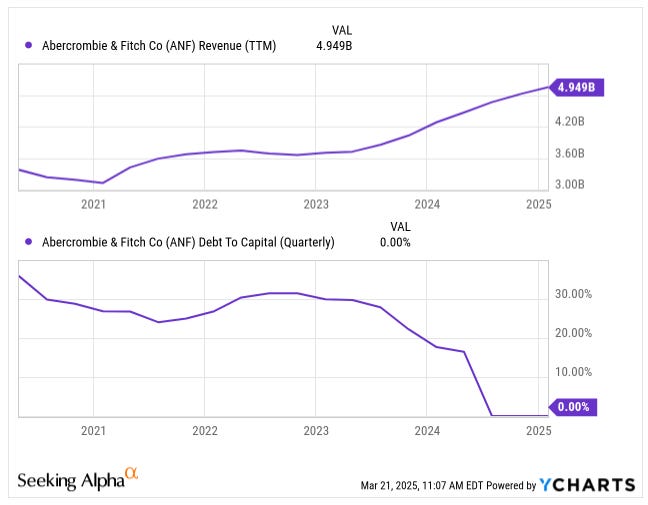

So, I finally pulled the ripcord on my ANF position. It’s been a rollercoaster, but let’s start with why I bought it in the first place. Essentially, I saw Abercrombie & Fitch scoring an impressive turnaround in sales and profit margins—they had steady revenue growth, minimal debt, and an upscale brand pivot that seemed legit.

Anyway, ANF’s Q4 results were technically decent—net sales rose to $1.58B, operating margin hit 16.2%, and EPS came in at $3.57. That all sounds good, but frankly, their forward outlook just didn’t excite me. I see the stock drifting sideways or even heading lower in 2025, so I decided to exit.

For context, I picked it up in early January at $95, and now I’m closing out at roughly a 16% loss. That’s extra disappointing, given that also in June it traded around $185—would’ve been amazing if I’d timed it perfectly. But hey, you can’t always catch the peak. Enough for me to call it quits on this one.

I’m redeploying the proceeds into another company with a completely different business model—one that looks built for stable, medium-term growth. It has:

A balanced approach to profitability, with a strong focus on driving returns on equity.

A track record of consistent dividend payouts plus buybacks that return a big chunk of earnings to shareholders.

A robust capital position—especially in terms of regulatory buffers—suggests the firm can handle choppy economic waters.

Solid net interest margins and structural tailwinds for interest income, thanks to its ongoing ability to reprice certain assets.

A broad customer base, including core retail and SME clients, helps it maintain healthy loan and deposit growth.

Prudent risk management that keeps its exposure to high-risk segments relatively low.

Below are the details.