Weekly #21: Why You Should Aim to Make a Living Rather Than Making a Killing

In this Weekly, despite the market’s dip, we regained some ground—and I share why sustainable investing beats chasing quick profits.

Happy Sunday, my fellow Sharks!

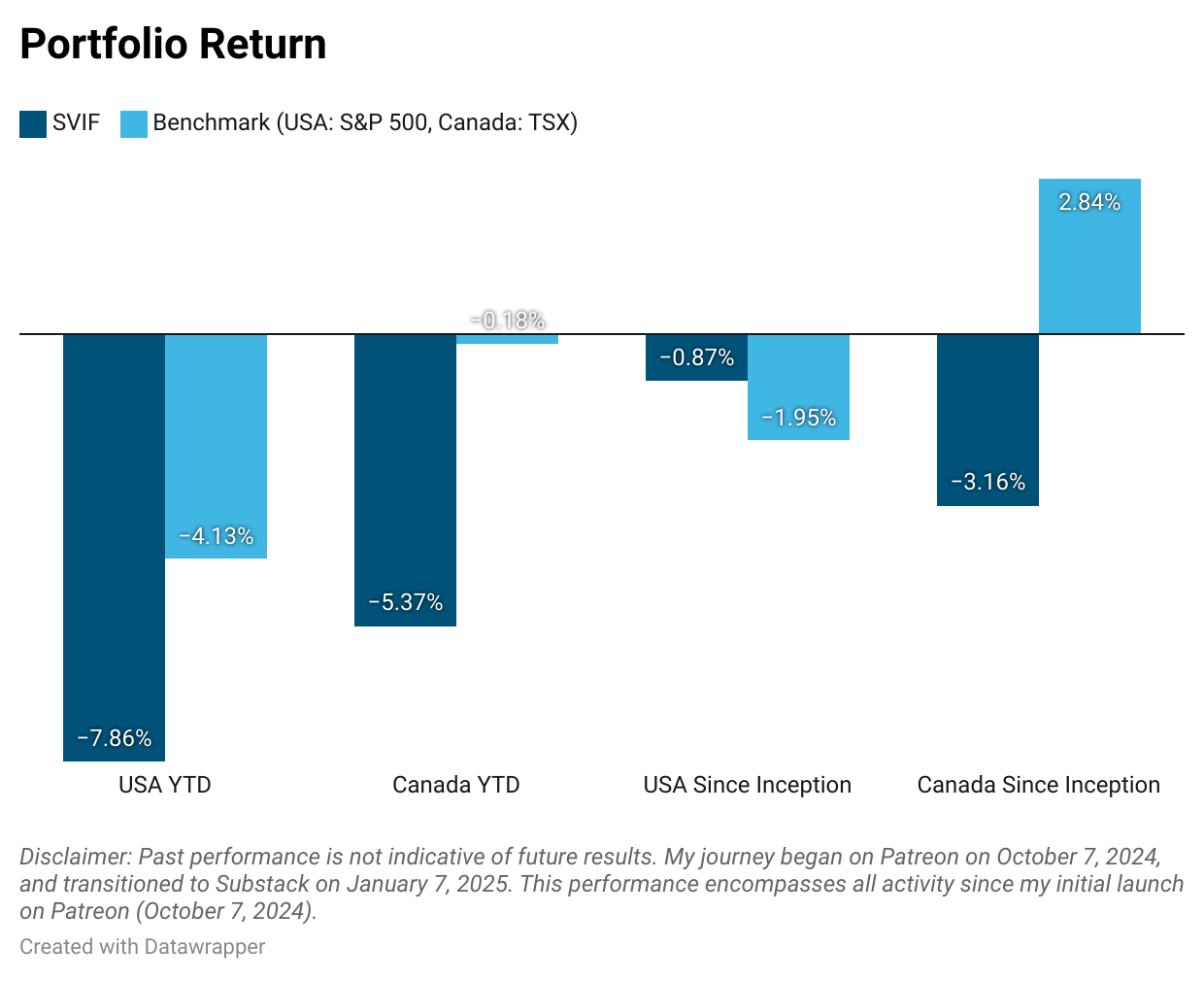

This week, the USA portfolio improved slightly while the S&P 500 declined, narrowing the gap from -603 bps to -373 bps YTD. The Canadian portfolio underperformed the TSX, widening the gap from -474 bps to -519 bps.

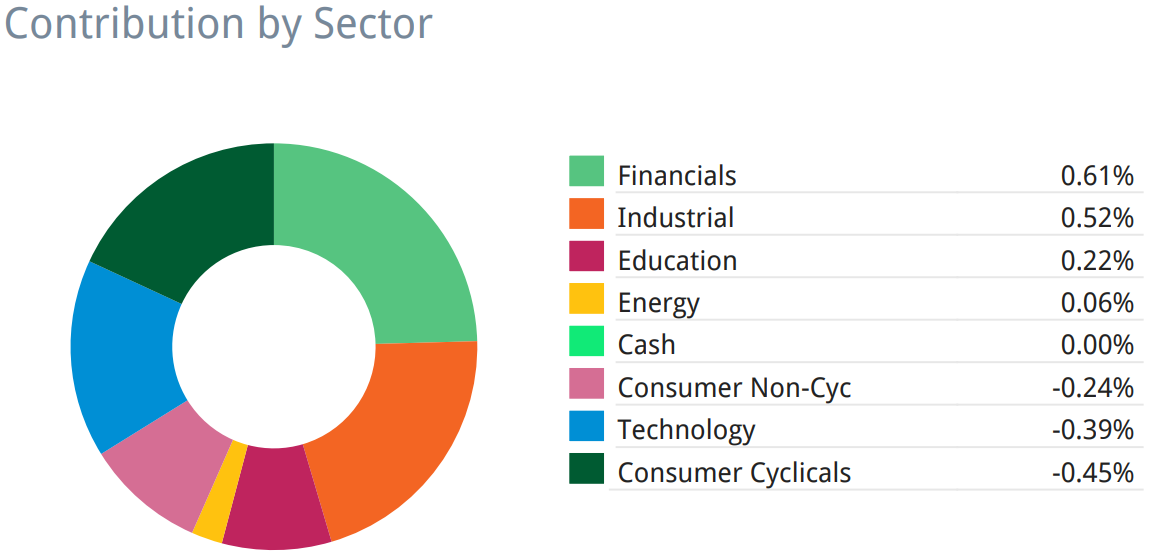

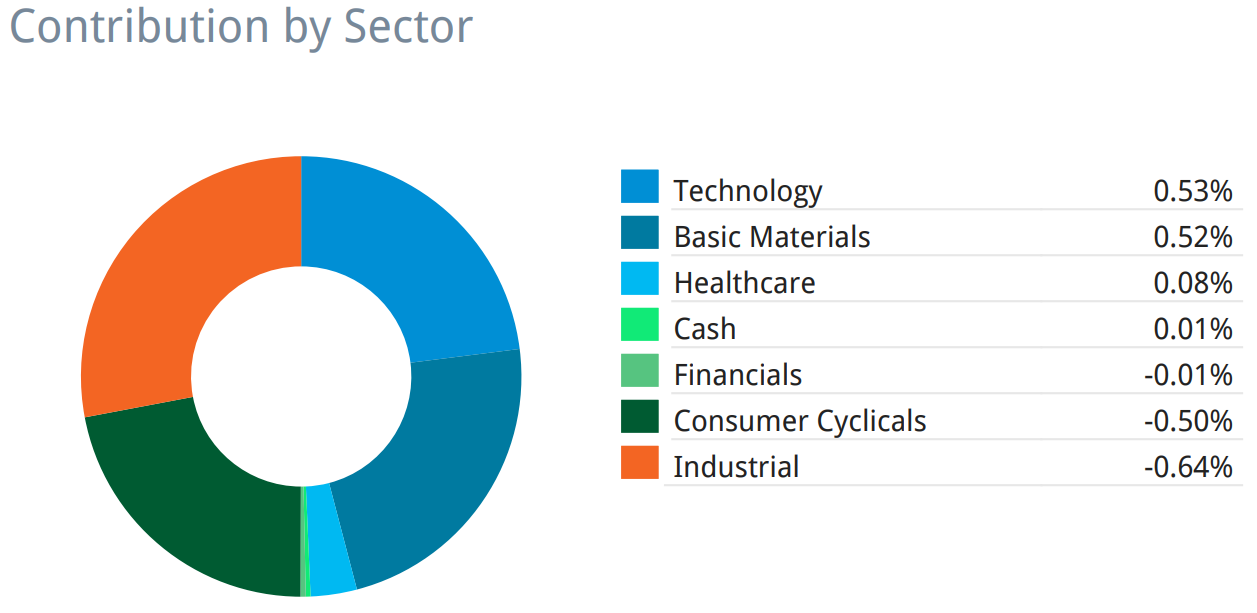

This week, the top-performing sectors were financials and industrials for Portfolio USA and technology and basic materials (gold) in Portfolio Canada. As for the worst sectors, consumer cyclicals dragged down both portfolios, while technology struggled in 🇺🇸 and industrials in 🇨🇦.

Portfolio USA

Portfolio Canada

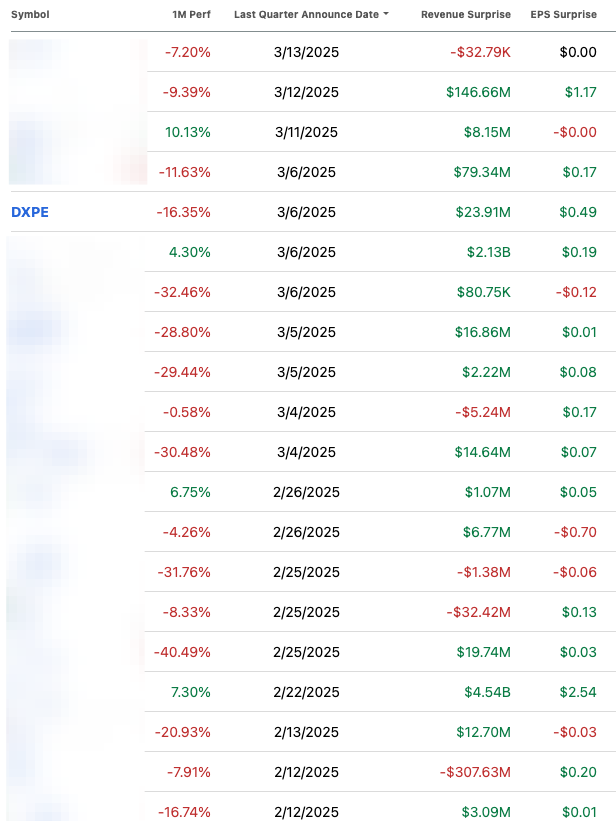

Here is the weekly performance of each stock in our portfolios: Weekly Stock Performance Tracker

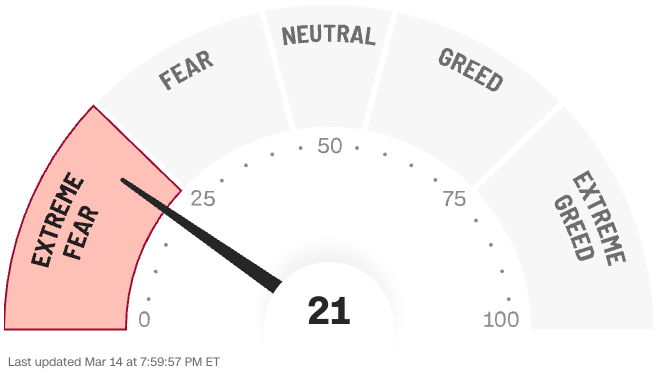

The market may continue to decline, as CNN’s Fear & Greed Index indicates extreme fear. However, this does not mean you should remain on the sidelines.

However, we don’t know how long the market will continue dropping, so if you have cash on the sidelines, consider buying in portions each week rather than going all-in at once. Also, one thing I started doing and already sent alerts to my paid subscribers is to rebalance my positions. While I am still bullish on every stock in my portfolio, the drop in the last couple of weeks has changed the risk-reward profile of many positions. I am concentrating my bets on the best risk-reward opportunities to increase the upside when the market turns around.

While only 20% of the portfolio missed their EPS targets, 80% of the companies are in the red 🤔

Since the last update on earnings results (Weekly #16), 20 companies have released earnings; five missed revenue estimates and four missed EPS, but 16 are in the red. One more reason I am not worried about this drop in the portfolio returns.

Thought of the Week: Why you should aim to make a living rather than making a killing

Be it bad or good, the movie Wall Street impacted my life in many ways. If you haven’t watched it, you should!

One quote from the movie stuck with me for a long time and even guided some of my decisions: “Greed is good.”

The Oxford dictionary defines greed as…

[noun]

intense and selfish desire for something, especially wealth, power, or food

It took me years and many life lessons to realize how flawed that quote was. I have done many things and not done some because of that quote. While wanting things is fine and actually good, as ‘necessity is the mother of invention’, greed is bad as that selfish desire has many collateral damage, such as:

The desire for wealth led many talented engineers to move to the financial markets to financially engineer products that led to the 2008 financial crisis. Imagine if those engineers stayed in engineering; maybe we would be on Mars by now.

The 10 wealthiest people in the world could end world hunger that impacts 733 million people. Stopping world hunger could be done with only $330 billion (source), the 10 wealthiest individuals own $1.5 trillion, if each one pitch in $33 billion, world hunger would be eradicated without impacting their status as the 10 richest people in the world. But they rather see a bigger number on their screen that they know there isn’t a way they can spend all of it.

These are just two examples—also consider:

Pharmaceutical Profiteering Over Lives

The Housing Crisis and Artificial Scarcity

Big Oil Stalling Green Energy for Decades

Tech Giants Hoarding Innovation

Water Privatization: Profiting from a Basic Human Right

…

But let’s forget about others, be selfish for a second. Greed is also bad for you. One clear example: greed in investing can hinder your returns and even knock you out of the game for good.

There are around a dozen ways that being greedy can kill your returns from overtrading and FOMO to day trading. Here, I’ll focus on two ways greed pushes you into bad long-term decisions: reckless use of margin and misusing options.

Margin or Leverage can knock you out of the game

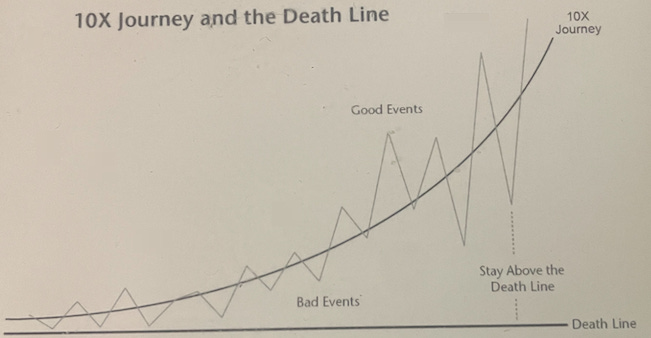

In the book Great By Choice, Collins suggests that the difference between the 10X companies and the rest is not that the 10X get luckier, but that the 10X know how to take advantage of the luck they get; they have a higher ROL (Return on Luck). For companies to survive, during bad events, they must stay above the Death Line so that they can survive to fight another day till the luck winds change.

In the stock market, we will all experience good luck (e.g. you own Stock A and the main facility for a competitor, Stock B, was hit by a tornado) and bad luck (you own Stock B). So you may experience a +25% to -25% swing in your portfolio due to the tornado. If you are using a 4-to-1 margin, you could double your money (+100%) on that good luck event, but if your facility gets hit by the tornado, you're wiped out (-100%)—game over.

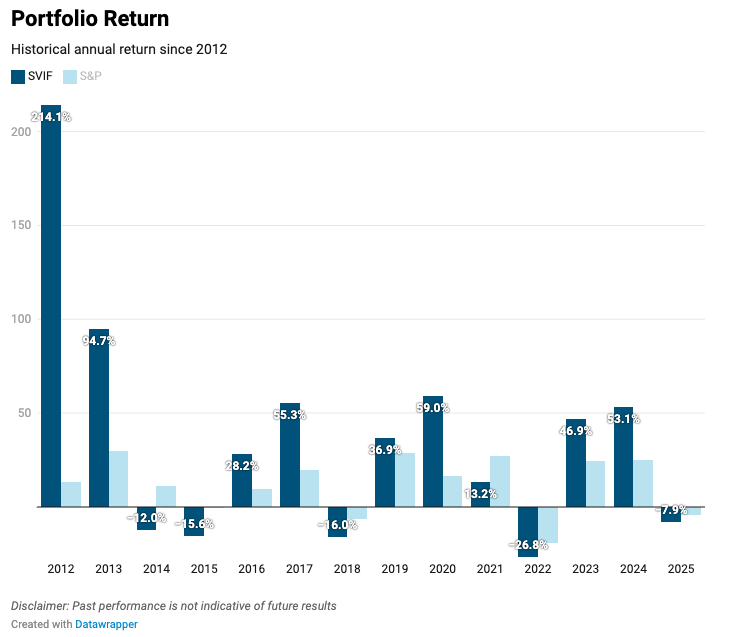

So, don’t be greedy—don’t risk an almost guaranteed bright future for the sake of instant gratification. Even if we assume the risk-reward is 1-to-1 (which it isn’t, since I only invest with a minimum 1-to-2 risk-reward profile), you only need a 54% probability of having a good year rather than a bad year to avoid ruin. Since 2012, I only had 4 negative years, that is 70% of good years.

But if you use leverage, you need an impeccable track record for 30 years—there's no margin of safety.

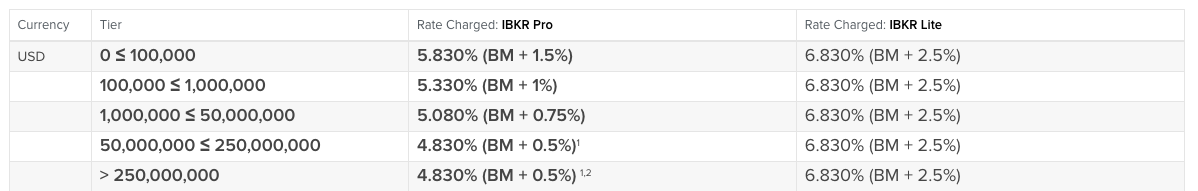

But margin can be used smartly. I use margin as more of a tactical tool. Let’s say I am fully invested and I want to sell Stock A to buy Stock B. Maybe my Stock B order has already been filled, and I am waiting for my Stock A order to be filled. Also, whenever I need a loan, I would use my Interactive Broker (IBKR) margin account rather than taking a loan.

Funny coincidence because my pet needs surgery. But rather than paying 9.99% for a bank loan, I will be taking from my IBKR account, where the current rate is 4.83%, and depositing biweekly the payment I would have paid the bank; that way I close the margin faster.

However, my margin has never gone above 20% of my portfolio value. A very safe level.

Options: What is easier, guessing one or nine outcomes?

Some investors speculators think earning 30% a year is too little and too slow; they rather chase 100% gains in a week using options. While there are reasonable ways of using options, these speculators use it in such a way that it works as leverage on steroids.

If you think about it, stock picking is relatively easy; all you have to guess is whether the stock price is going up or down. Yes, it is that simple, if you bought XYZ shares at $100, you will be a winner at $101 and a loser if the stock is at $99. So the best investors have either a larger portion of their holdings increasing in value or a few holdings that go up by a larger amount offsetting the downside from the other holdings (think Venture Capitalists). Some people use charts, some use fundamentals, some look at the stars for guidance and some let monkeys throw darts at company names. No matter the approach, the variable you need to answer is one, that is if the price will go up or down.

But when you buy an option, you have to guess not just the direction of the price (up or down) but also you have to guess:

the time by which the price will go up or down

whether the price will move beyond the minimum hurdle price

whether the premium for the option is fair, expensive or cheap

So you need to guess four variables. So even if you had a monkey throwing darts at a bullseye (a 50/50 chance), your odds of making money drop from 50% to 6.25% (50% × 50% × 50% × 50%). In reality, it’s even lower since some variables aren’t binary—but let’s keep it simple.

But that’s not all—you could use more advanced option strategies like vertical spreads, iron condors, and straddles, to name a few. For those strategies, you need to be right on an additional five variables (volatility, price range, time decay, interest rates / dividends and skew in implied volatility), so a total of nine variables.

So the odds that our poor monkey will make money just dropped to 0.2%.

Having said that, options are not intrinsically bad, it is the way people use them due to greed. Some reasonable ways of using options is:

To hedge your position

To buy insurance on the market or a stock. I bought a put on the market right before COVID, I still lost money on that, long story for another Weekly 😉

To buy stocks at a cheaper price (that is, secured puts).

The most common way I use options is to sell secured puts. In a nutshell, if I want to buy XYZ but I think it is too expensive at the moment (let’s say it is trading at $100), I would sell a put at $75 (my desired purchase price). I would collect today the premium for the put I sold and if the stock price drops below $75, I would also own XYZ at the price of $75, the price I was willing to pay for the shares. If the share price never drops below $75, I am okay as I collected the premium for selling the put. A win-win scenario.

Using options and leverage speculatively are symptoms of the greed culture that has infected us. Below, I will elaborate that eliminating the root cause, greed, could not just make your investments flourish, but also give you the freedom to live life to the fullest.

But first I want to clarify one thing so there are no misunderstandings, I am not saying capitalism is bad and that we should hold hands and sing kumbaya. I love capitalism and I thank capitalism for many things. Also wanting things is fine and actually good. I have many toys including a Rolex Submariner 16618.

But what I am arguing is that greed is driving capitalism to extremes that is hurting us.

With that off the way, let’s see the better way.

The joy of just making a living

I know it sounds unambitious, mediocre and boring to just make a living rather than making a killing but hold on with me for a couple of paragraphs.

More time to enjoy life

One of my last corporate positions before I pulled the plug was a well paying job. Besides a very high salary, I had a very generous bonus package, stock option plan and many perks. I liked the company, my boss and my team. But there was a huge drawback—the hours were killing me.

Even though I had a team of five high-performing individuals, the workload was overwhelming. I worked from 7 am to 2 am almost every weekday. I worked sunday evening and some saturdays. I remember in the first year I took no free day at all. It caused me and my girlfriend (now my wife) to break up and my health worsened as my daily movement was reduced to 20 steps to the bathroom.

But I kept at it for a bit more.

Why?

The pay was good.

But one night—exactly 2:36 AM (I still remember it)—my brain froze for a second. It was a weird feeling, hard to describe, but it felt like my mind had shut down and rebooted. Somehow it gave me perspective. Why am I still awake at 2:36 am fixing a 45-page presentation that I know the CEO won’t get past page 5?

Yes, the pay was good, but converted to an hourly rate, it wasn’t so great anymore. Also, what is the point of that money if I have to spend it on my health, I shortend my life expentancy, I don’t even have time to enjoy that money and I am all alone.

It made ZERO sense.

Next day I decided to scale back at work. Obviously that didn’t go with the company ‘culture’ so at the first opportunity I was out.

When I was out I proposed to my girlfriend, we travelled, we got married and I wrote my first book. I got pulled to another opportunity, fewer hours, nice company and nice culture. But after I had taken the red pill, I realized life is too short to do something just for money.

An explotion of innovation and creativity

Being greedy robs you from your true calling. Think of the engineers example I gave earlier. I bet all those engineers didn’t go to engineering school with the drive to graduate, go to an investment bank and construct MBS, CDOs, ARMs, and CMBS.

Think about movies: I haven’t seen many interesting ones lately. They are all iterations of the same formula. The Marvels is terrible, running out of ideas I guess. Why would you gamble millions on a new story line that may succeed or fail if you can just make some mediocre film that will make money?

If you forget about greed and try to maximize for profits and money and rather try to enjoy the process, not just you will be better but the world will thank you for it.

When I started this newsletter, I got bombarded with Substacks that guarantee you growth by optimizing tag usage, SEO, timing of posts...

But rather than spending hours gaming the system, if you spend that time on doing what you really like, you might not make the most money from your newsletter but you will actually enjoy the process.

I am writing an ultra deep-dive on TSMC, hopefully I will finish it this coming week. So far it is 6,000 words and I am 80% completed. I didn’t plan for it to be so long but doing the research and writing the thesis was one of the most enjoyable things I have done in a while. It woke up my engineering curiosity again, reminded me of the old days, reconnected me with friends in the industry and actually is one of my best investment theses in a while.

…and don’t worry, this time, I will be releasing the deep-dive for everyone.

Room for new generations to try the high seat

My final provocation for you is regarding how greed is hurting the new generations. There are many factors that almost guarantee that Gen Z will be renters for life. But the main two reasons are soaring home prices and stagnant wages. Let’s ignore the first one and focus on the second, stagnant wages.

CEOs have suppressed wages, hoarded profits at the top, and overstayed their time at the helm.

Imagine, what would happen if CEOs would step down and give an opportunity to the new person once he makes $10 million? (yes, most likely the CEO right now is a he)

It would move the entire chain, the #2 would become the CEO, the #3 would take the spot of the #2 and so on all the way down to the Gen Z analyst.

Also, what would happen if Walmart suddenly paid a living wage to its employees? The CEO may get a few millions less but will still be a millionaire.

A better world

I know this Weekly turned out more philosophical than I planned to but I hope it sparked something in you to think about. By putting a rational limit on your desires, you will become less selfish that will overspill the benefit to the world. Imagine if the richest 10 people decided to stop world hunger tomorrow.

What if Donald Trump weren’t so greedy, squeezing money from every interaction? What if Big Pharma charged reasonable prices? What if, instead of throwing away millions in food, restaurants donated it to the poor and homeless?

That is it fellow Sharks!