Why the New Loan Won’t Move the Valuation Needle for RAIL

How the new loan reshapes RAIL's financials, from the capital stack and interest rate to cost of capital, capex, and valuation.

The Art of the Long View by Peter Schwartz emphasizes how scenario planning helps organizations navigate uncertainty by focusing on long-term trends. The market has definitely not heard about this book.

When I started my investment career, I remember not understanding when investors would jump into the herd mentality, buying whatever was hot and popular, forgetting that the same company had been bankrupt a couple of years earlier. Or, having not learned from the 2008 debt crisis, bankers go on to do mortage-backed securites (MBS) based on subprime auto loans instead of subprime mortgages, thinking subprime auto loans are safer or a new 'asset class’. John Oliver addressed this issue back in 2016.

I think RAIL is a victim of that short-ism

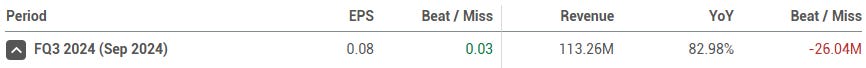

In May, I invested in RAIL at $3.5 per share following its impressive Q1 results. When the stock tripled to $12.50 in October, I revisited the position and posted my analysis in Seeking Alpha. After that, the shares kept climbing up to $15.70 right up to the Q3 2024 earning results in November.

While revenues grew 83% in that quarter, the stock dropped by a third to $10 because it missed revenue consensus, despite beating the EPS consensus.

I took a second look and concluded that the market just overreacted to the revenue miss as I explained in another article.

On January 6th, RAIL paid off all its outstanding preferred shares by taking on a new term loan (check out the press release).

I went through the 8-K filing, and while eliminating the preferred shares simplifies things for common shareholders, I don’t think it will significantly impact the company’s valuation. It could even hold back capex growth in 2025. That’s the short answer. For the long answer, grab a coffee and keep reading.

If you're enjoying this and think others might too, feel free to share and earn rewards!

In this article, I’m diving into the restructuring of RAIL’s capital stack—think of it as a follow-up to the first two articles where I gave a deep dive on RAIL (article 1 and article 2).

Not your plan-vanilla loan

At first, the new loan seemed like a plain vanilla secured loan. It was for $115 million, has a 4-year term, 0.6% of the capital paid quarterly, and the balance due in December 2028. The loan is secured by its assets, and it has an interest rate of SOFR plus 6%.

The 8-K filing also defines SOFR:

“SOFR” means a rate equal to the secured overnight financing rate as administered by the SOFR Administrator.

“SOFR Administrator” means the Federal Reserve Bank of New York (or a successor administrator of the secured overnight financing rate).

But when you check the details on the interest rate, you discover this is not a plain vanilla loan, but a soup of interest rates, margins and benchmark rates - delicious!

The interest rate is actually a bit trickier than what management made it sound like in the press release. Here’s how it’s really calculated:

Term loans outstanding thereunder will bear interest at the Term SOFR rate plus an applicable margin of 6.00% per annum or at a base rate, as selected by Borrower. The Term SOFR rate has a floor of 3.00% per annum. Base rate loans will bear interest at the highest of (a) 4.00% per annum, (b) the federal funds rate plus 0.50%, (c) the prime rate or (d) the Term SOFR rate plus 1.00% per annum plus an applicable margin of 5.00% per annum.

Let’s break down the numbers using today’s rates:

The interest rate on the Term SOFR-Based Loan is 10.27%, which includes a 4.27% SOFR rate plus a 6.00% margin.

The base rate loan interest comes out to 12.50%, with a 5.00% margin added to the highest of the following:

4.00% per year

4.83% (which is the Federal Funds Rate of 4.33% plus a 0.50% margin)

7.50% (the current Prime rate)

5.27% (the term SOFR rate of 4.27% plus a 1.00% margin)

In this case, the loan interest rate is 10.27%, amounting to around $11.8 million in interest to be paid. The Series C preferred shares are earning dividends at a 17.5% annual rate. By the end of 2024, the total balance of preferred shares and accrued dividends was $113,274,739, which would translate to $19.8 million in yearly accrued dividends.

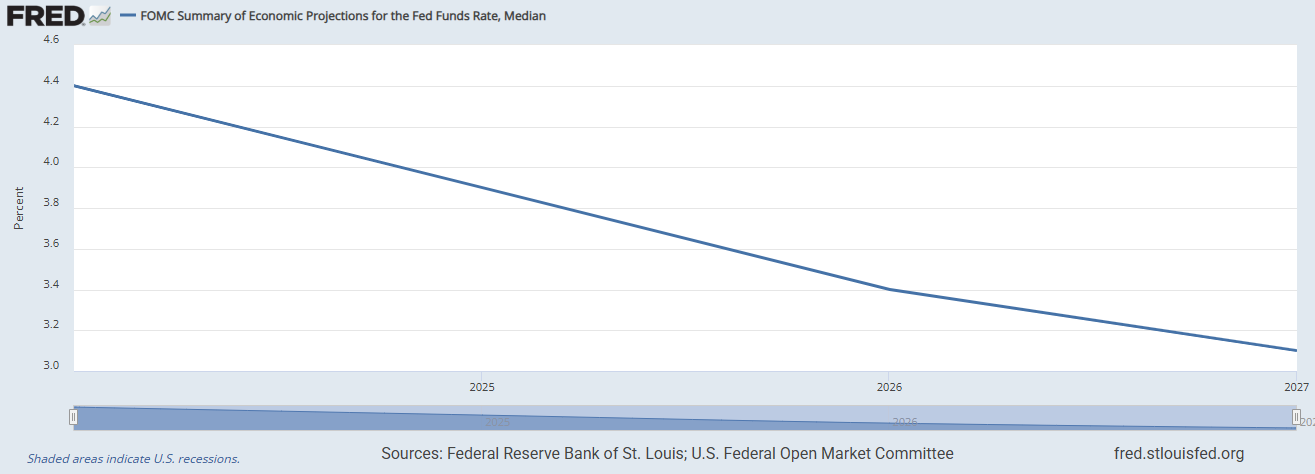

This results in savings of $8.0 million, which is lower than the $9.2 million the company mentioned in the press release. I reached out to the company to clarify the difference but haven’t received a response yet. It’s probably because I’m using current rates, and the Fed is expected to cut rates by 50bps in 2025, 50bps in 2026, and 25bps in 2027. So, the savings might end up being a bit higher in the future.

This deal will likely hurt cash flow

This deal isn't ideal for cash flow. The preferred shares accrued the dividends and there was no cash outflow. But the loan means RAIL will need to pay out $14.6 million in 2025 — $11.8 million for interest and $2.8 million for capital.

It looks like RAIL will have to keep capex at $12 million in 2025, which is $4 million less than I was originally expecting. No increase in capex means slower revenue growth in the short term, but things should pick up in 2026 when there’s enough cash to start ramping up capex again, based on my estimates.

Valuation would be marginally impacted

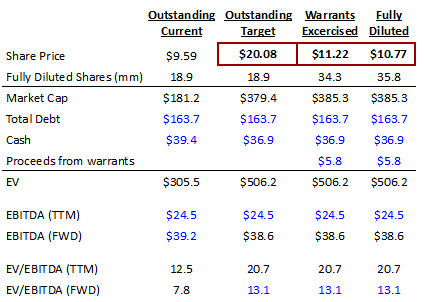

The bigger question here is about valuation. Since interest is less than EBITDA, it won’t mess with the EBITDA figure itself. Instead, it should push up the EV/EBITDA multiple because this restructuring lowers the cost of capital (WACC). I’m not going to dive into the details of how WACC affects the EV/EBITDA multiple—you can work it out with some simple algebra.

If you’re on board with the idea that “Enterprise Value = the total of future discounted cash flows,” then the next equation will make sense too.

EV / EBITDA = [ (EBITDA Margin – Capex Margin) x (1 – tax rate) / (WACC – growth rate)] / EBITDA margin

If you want the complete proof, take a look at Chapter 14, page 136 of my book.

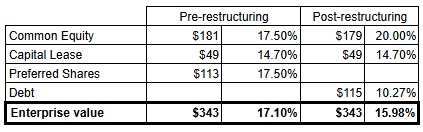

The current WACC decreases 112 bps post-restructuring.

Keep in mind, that this is the current cost of capital, not the long-term cost you'd use in a DCF. The cost of common equity and preferred shares both happen to land at 17.5%—just a coincidence. The cost of equity is calculated using a 6% equity premium, a 4% risk-free rate, and a levered beta of 2.2. After the restructuring, though, the cost of equity jumps to 20%, thanks to the levered beta climbing to 2.7.

That 112 bps drop in the WACC would increase the target EV/EBITDA multiple from 12.5x in my initial article by 0.6x to 13.1x. Boosting the enterprise value by about $23.2 million (0.6x on EV/EBITDA, with EBITDA at $38.6 million).

So, the fully diluted target share price basically stays the same. This restructuring isn’t going to make a big difference in RAIL’s valuation.

And that is the long answer.

Why the Shares Aren’t in My Portfolio

Having said so, while bullish on RAIL, I divested my shares on December 17th (post). As you might know by now, I have a self-imposed cap of 50 stocks in the portfolio. I needed to replace one portfolio stock to make room for a new position that had a great valuation, profitability and risk-reward profile. RAIL was the loser in that scenario and had to let it go for now, but RAIL is happily idling in my 300-stock watchlist for now.