Weekly #15: What Is Wealth, Really? A Hard Look at Money & Freedom

Why Most Investors Never Feel Like They Have Enough: The Real Price of Wealth, Elon Musk's and Bill Gates's Motivations, and Portfolio Returns (15.7% vs. 5.0% for the S&P).

What’s the point of all this investing?

You wake up, check your portfolio, trade a few stocks, read market news, and repeat. But what’s the endgame? Are you building wealth—or chasing something deeper?

This week, the market saw a wild ride (see the Portfolio Return section at the end of this post). Let’s zoom out. Today, I want to explore what wealth really means—beyond numbers. If you’ve ever caught yourself wondering, “How much is enough?” this is for you.

What is wealth?

At first glance, this may seem a stupid question. Most people instinctively answer, 'Of course, we invest to grow wealth, generate passive income through dividends, or beat inflation to maintain the purchasing power of our savings. Some more advanced investors may say they invest for portfolio diversification, speculation, retirement planning, influencing the company (if you have enough shares) or to have liquid investments.”

However, those answers are superficial. Saying you invest to make more money is like saying you buy a Rolex Submariner 16618 just to check the time, a pair of Nikes just to run, or a Lamborghini just to commute.

In my book, The Most Boring Stock Investment Book You’ll Ever Read, I explore the true meaning of wealth. Here’s one of my favourite excerpts:

"Wealth is the ability to fully experience life." - Henry David Thoreau

Wealth means different things to different people. Many people accumulate money to spend, but this is not true wealth. The ultimate goal should be to control your time, but few consider this. Most personal finance advice focuses on accumulating wealth, but knowing what to do with it once you have it is more complex. Money can clarify life priorities, and those without financial independence may make up stories to avoid doing things they don't want. When someone suddenly becomes wealthy, it forces them to reassess their priorities, and their time use becomes more critical. Someone who prioritizes wealth over family after achieving financial independence reveals their actual values. Continuing to work after attaining financial freedom is not wrong, but it becomes a choice rather than a necessity. It's essential to understand what money and wealth can and cannot provide and to recognize that wealth also reveals a person's true desires and character in ways that may not always be welcome. While defining wealth is beneficial for measuring societal progress and addressing income inequality, we should focus on each person's definition of wealth. Individuals can plan and work towards their financial goals better if they define wealth for themselves. For some, wealth might mean having a certain amount of money in savings or being debt-free. In contrast, for others, it might mean owning multiple properties or retiring early. Whatever a person's definition of wealth is, understanding it can help them make better decisions and take actions that will bring them closer to their goals.

As a Shark, you need to define wealth for you.

Click the ❤️ button on this post so that more people can discover it on Substack.

Why is it so important to answer this question before investing? If you don’t know why you invest, you can’t measure whether you're getting closer to your goal or if you've already achieved it. Maybe you achieved it long ago, but since you never defined it, you're still running on the investing treadmill on autopilot.

That is why, you need to know why you invest, so you can measure your progress toward that goal.

When you really reflect on why you invest, you will learn that it is more than just making money. It’s about what money represents—security, freedom, status, or even excitement. People invest to fulfill deeper emotional and psychological needs, not just to grow their wealth.

How Money Provides Security

Many invest out of fear of not having enough. They want to ensure they can handle emergencies or unexpected downturns. This instinct to store resources is deeply rooted in human nature.

This was my first motivation for accumulating money. I didn’t come from wealth and had to figure out how to make money from an early age. But as I built a financial safety net, my reason for investing evolved—toward freedom.

Why Money means freedom

It allows people to choose how they live rather than being stuck in jobs or situations they dislike. Investing gives them control over their financial future, reducing dependence on employers. I performed better at my day job because I knew I had my portfolio and didn’t need to suck up to my boss for a paycheck. I was not afraid to say what was on my mind and not have to play office politics.

This helped me at times. In one instance, the CEO appreciated my frankness and my role as a devil’s advocate for his wild ideas, while the rest of his leadership team were a bunch of yes-men (his words, not mine).

It also made me many enemies, which eventually came back to bite me. Still, that’s the beautiful thing—I didn’t care. I had the freedom money provides. They didn’t—and likely never will—no matter their salary.

So for example, if freedom was the reason you invest, when you achieve freedom, you should action your goal. Specifically for me, when my nest egg was big enough, I walked away from the corporate grind and finally did what I wanted. I wrote a book—titled exactly as I liked—despite my friends and editors recommending something more enticing for sales. Self-publishing gave me the freedom to ignore them.

Also, I launched this Substack simply because I enjoy writing about my investments and sharing my thoughts. I would love this newsletter to grow and have 100,000 subscribers. But if I have 10,000 paid subscribers or zero, I don’t care as I am free and don’t depend financially on paid subscribers, so I can write whatever I want even this long grammatically incorrect sentence that has no meaning other than I am forcing you to continue reading this sentence.

But here I have a warning for you: Wealth isn’t freedom if you’re a slave to the pursuit of more. As Seneca put it, 'It is not the man who has too little, but the man who craves more, that is poor.' Epictetus reinforced this idea: 'Wealth consists not in having great possessions, but in having few wants.' If your pursuit of wealth turns into an endless treadmill, you're not free—you’re just a different kind of prisoner.

Can Wealth be a Status Symbol?

Some invest for status. Wealth can be a symbol of intelligence, power, or success. Seeing their portfolio grow makes them feel validated, especially when comparing themselves to others. The person that comes to mind is Elon Musk.

I am always surprised when reporters try to understand Elon’s financial motivation for having bought Twitter for $44 billion and then alienating advertisers. That’s the mistake journalists make—you need an interviewer with a similar IQ to ask the right questions and have a deeper conversation. With all the respect to Andrew Ross, I loved reading his book ‘Too Big To Fail’ and he is a great host. But we needed Noam Chomsky, Christopher Langan or Edward Witten to interview Elon.

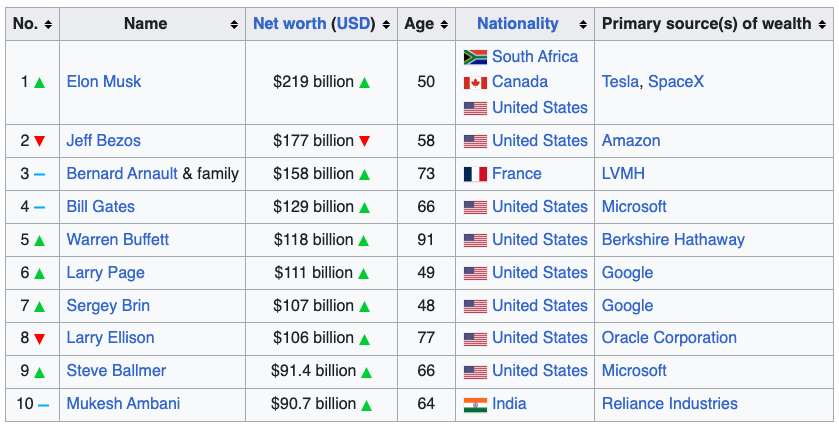

One indication that Elon is on a different wavelength and invests for status is the outcome of the Twitter saga. His $44 billion investment in Twitter is worth less due to the lower advertisement revenues. Financials for Twitter are not public but I bet the business is worth way less than $44 billion. For argument’s sake, let’s say it’s worth zero. In 2022 (the year he acquired Twitter) his net worth was $219 billion.

Approximately two years after acquiring Twitter, his net worth has almost doubled to $421 billion. So does he care if no company advertises on Twitter? No, he is investing because of status. By dumping $44 billion in Twitter (besides $260 million in Trump’s presidential campaign), he is in a position to influence regulations that can impact his companies and his competitors, gets more government contracts and has the ear of the president of the most powerful country in the globe.

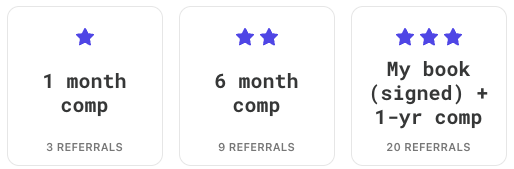

Share the Love! Invite friends to join our community and earn rewards!

The stock market is a game

Certain investors enjoy the challenge of analyzing companies, predicting trends, and outsmarting others. It’s not just about profit—it’s about winning. I know many people who do this, they have no business investing, and they would be better off putting all their money in an ETF and forgetting about it.

But nah, they rather invest in some popular company so they have something to talk about in that cocktail. I tried that a couple of times—mentioning my top investments to sound interesting at cocktail parties—but no one cared because they weren’t interested in ‘obscure’ companies that Jim Cramer doesn’t discuss. I spoke about companies such as Daqo New Energy (20x my money in less than 2 years), BlueLinx (4x my money in 2.5 years), and Limbach (12x my money in 2.5 years).

I admit that while the main reason that I invest is for freedom, a part of me does it because I love being right. I see it as an intellectual challenge. When I predicted OGX would go bankrupt before anyone else sensed trouble, I got immense satisfaction when it happened a year later. That adrenaline hooked me and that is the reason I write this newsletter 😊

Leaving a legacy

People invest to secure their family's future, ensuring their children and loved ones have better opportunities. It’s a way of passing down financial stability. This is a popular reason, especially for individuals closer to retirement.

But also the legacy may not be for your direct descendants but a more grandiose legacy for humanity. An example is Bill Gates. In his early career, he did controversial things but he didn’t care as his goal was creating wealth to obtain status. Steve Jobs accused Bill of stealing Apple’s GUI, Bill pursued monopolistic behaviour (such as bundling Internet Explorer for free with Windows, effectively killing Netscape) and Bill even tried to reduce the stake of his co-founder at Microsoft, Paul Allen, while Paul was battling cancer!

Watch Pirates of Silicon Valley, a great movie about the rivalry between Steve Jobs and Bill Gates.

But after achieving the status he desired, he shifted his focus to leaving a legacy. In the early 2000s, he left Microsoft and focused on the Bill & Melinda Gates Foundation to fight diseases, reduce poverty, and improve education—donating over $50 billion.

Psychologically, investing helps avoid regret

Seeing others succeed creates a FOMO. Many invest simply to avoid feeling like they missed an opportunity. I haven’t done the research but bet most losing investors invest because of FOMO.

The GameStop (GME) short squeeze of 2021 is a classic example of FOMO. While early Reddit traders made a killing, many late buyers lost money when the hype faded. Whenever you see a steep drop, the last investor at the peak likely bought in due to FOMO. Think of the tulip mania in 1630, the market crash in 1929, or the financial crash in 2008.

GameStop short-squeeze of 2021

Investing with purpose

Some invest with purpose. They support businesses they believe in, whether through impact investing or ESG funds that align with their values. Their investments go beyond personal gain. Rather than spending time explaining why I think ESG investing makes no sense, I leave a video where Professor Aswath Damodaran explains it beautifully.

How Much Money Do You Really Need?

Once you understand why you invest, everything becomes clearer. For example, if your goal is freedom, how much money do you need annually to achieve it? To do what you want and buy the things you desire? Is it $100,000, $1 million, or $10 billion? There’s no right answer—it’s personal. My number will be different from yours. You may like cars, I don’t like cars, you want a mansion in the South of France, a 4-bedroom in the Beaches1 is fine for me. You may want a yacht as a toy, but I prefer my Rolex Submariner.

For argument's sake, let’s say your annual number is $500,000 post-tax, you need to make $625,000 pre-tax2. If you follow the common financial advisor guidance you should only take out 4%, so you need a portfolio worth $15.6 million. But if you use a more aggressive assumption and invest in an ETF replicating the S&P 500, you can make 10% a year which means you need a portfolio of $6.2 million. If you invest replicating SwS, you should expect 30% a year which means you need $2.1 million.

Using the same logic, you can quantify your goal if it is for security, freedom, legacy even for status. Yes, even if you want status you can quantify it. Sam Bankman-Fried, the FTX guy, was involved in the Effective Altruism movement. His goal was to earn enough to donate $1 billion per year.

If you invest because you see it as a game, have FOMO or want to invest with purpose, those are all -EV moves (read my Weekly #13 if you are not familiar with what is an -EV move). You can do it but I would suggest that you treat it as if you were going to the casino to have fun, set aside money you are willing to lose and only play with that. For the rest invest it in an ETF or follow the advice of someone you trust.

What’s your freedom number? How much wealth is enough for you to step off the treadmill? Let me know in the comments—I read every response and love hearing your stories. Don’t forget to share this post with friends who need clarity on their financial goals!

Portfolio Returns

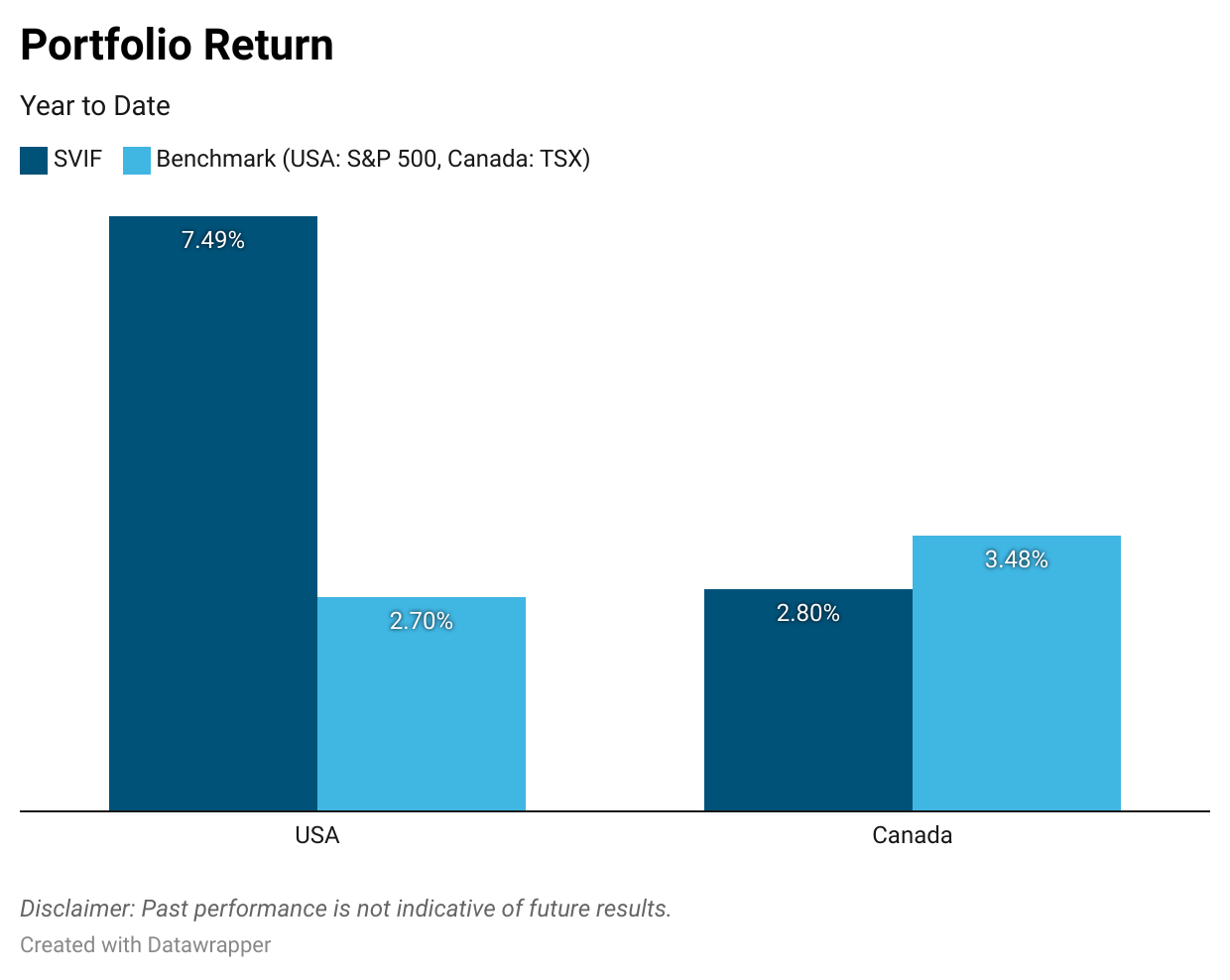

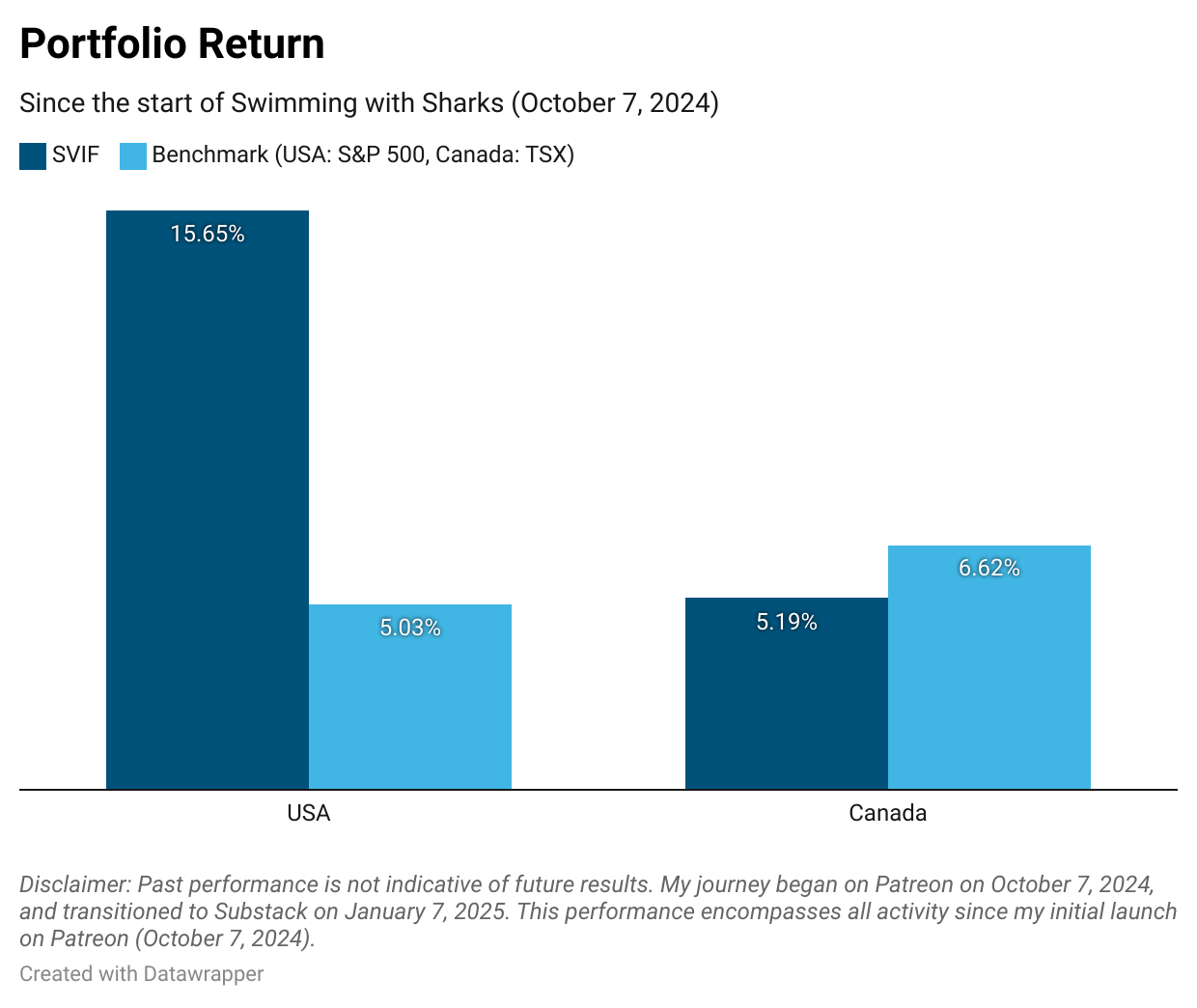

On Monday the market reacted to the DeepSeek news that I mentioned in last week’s newsletter. By Friday, the market recovered most of the losses. Our portfolio’s outperformance expanded compared to the S&P, the portfolio has returned 15.7%, three times the benchmark return since inception and 7.5% so far in 2025.

This week will be a busy one, I will be sending tomorrow a trade alert for a great opportunity and I am preparing a deep-dive for a company I have been following for a couple of years. It has taken longer than I expected but it should be published soon 🙂

The Beaches is a very nice area in Toronto close to the lake.

Assuming that you live in the US and that your investments lye under the Long-Term Capital Gain tax, if it lies under the Short-Term Capital gain tax then you need around $793,000.