Weekly #17: The Tariff Trap: How Short-Term Gains Could Cost the US its Competitive Edge

Are tariffs a ticking time bomb for US competitiveness? They may lift stocks short-term, but history warns of stagnation. Where should investors turn? Let’s break it down.

Wow—500 subscribers! We hit this milestone faster than expected, and it’s all thanks to you.

Let’s keep the momentum going! Next stop: 1K, then 5K, 10K… maybe even 1 million? If you’ve been enjoying these insights, share this with a friend—let’s grow together!

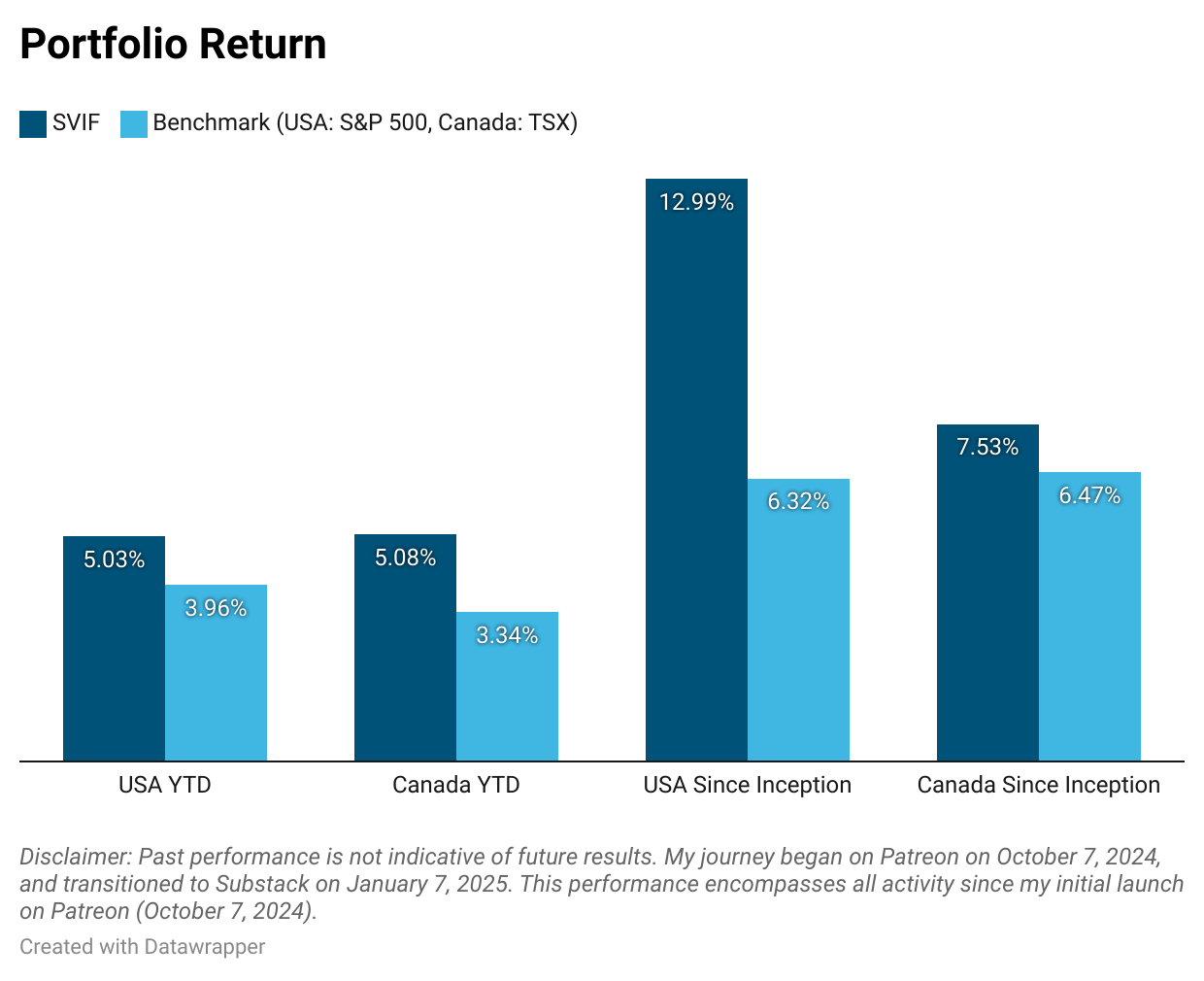

Portfolio Performance

This week, our lead over the S&P 500 shrank, with our YTD return dropping from 8.40% to 5.03%, while the S&P climbed from 2.45% to 3.96%. The pullback was driven by five stocks, which accounted for 80% of the decline—details for paid subscribers at the end of this email. Despite this dip, our total return since launch is still more than double the S&P 500’s.

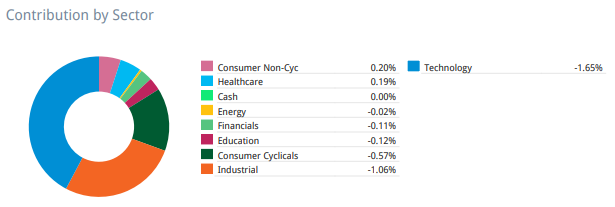

Portfolio USA

Contrary to last week, technology was the main dragger for the USA portfolio.

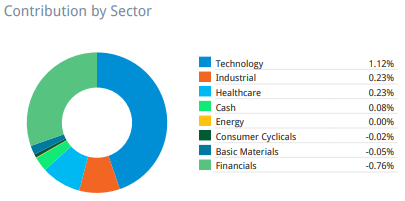

Portfolio Canada

As per Canada, technology continued to be the main contributor to the positive gains.

Here is the weekly performance of each stock in our portfolios: Weekly Stock Performance Tracker

Thought of the Week - The Hidden Cost of Tariffs

Recently, financial news—including many Substack newsletters—has centred on the impact of tariffs on the US, Canada, Mexico, and China. While these discussions make valid points, they’re often too simplistic, focusing only on tariffs’ immediate effects while ignoring their long-term consequences.

Trump’s tariff threats may be a bargaining tactic, but ignoring their long-term consequences, if implemented, would be a mistake. Short-term, tariffs could fuel inflation, disrupt supply chains, and strengthen the US dollar. In the long term, they could reshape global trade, erode US export competitiveness, and push countries toward alternative trade alliances—weakening U.S. influence. However, I don’t want to discuss the above as the media and many economists have well covered it. I want to talk about how US tariffs would guarantee the fall of the US as a superpower and it is not for any of the above mentioned. If you are curious keep reading.

Necessity is the mother of invention

Tariffs shield US companies for now, but they force other nations to innovate—cutting costs, boosting efficiency, and leapfrogging the US in key technologies.

Two clear examples of this are the US tariffs on solar panels and the ban on Huawei’s access to American semiconductors.

Click the ❤️ button on this post so that more people can discover it on Substack.

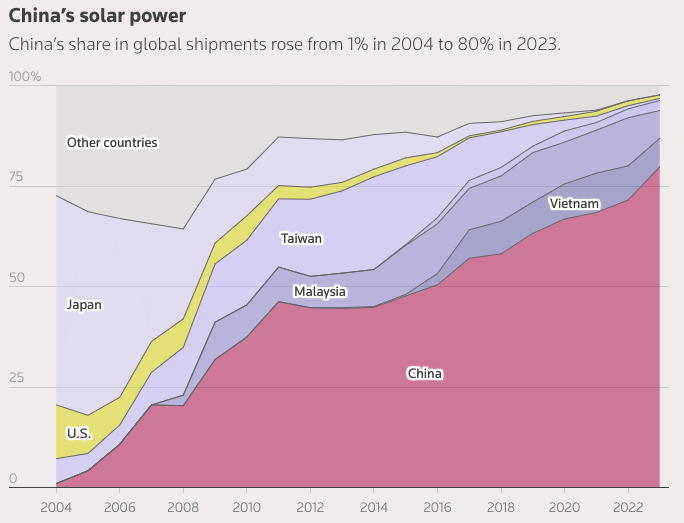

Even after years of US tariffs and restrictions across three administrations, Chinese companies continue to dominate the global solar market. They've managed to stay ahead by shifting production to Southeast Asian countries like Malaysia, Vietnam, and Thailand, sidestepping tariffs and keeping their prices competitive in the US. As a result, China now controls 80% of the world's solar supply, with another 17% coming from these Southeast Asian hubs. Their ability to produce solar gear cheaply and adapt to trade rules has cemented their lead in the industry.

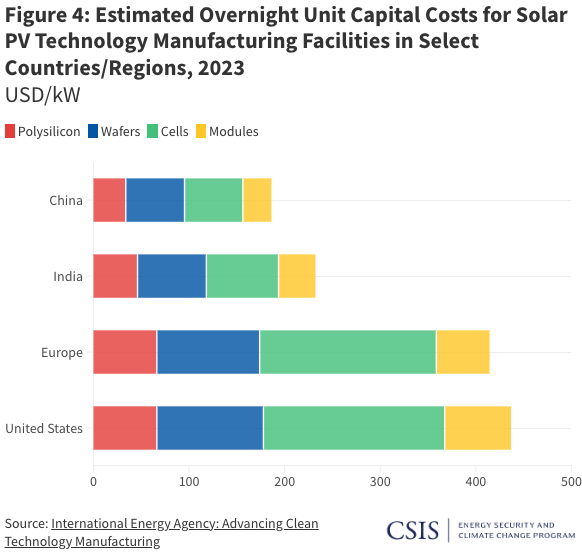

On top of that, in 2023, Chinese solar panel prices dropped by 42%, making them 44% cheaper than those made in the US. This massive price cut comes down to a mix of government support, real innovation, and sheer overproduction in China’s solar sector.

Did solar tariffs help the US? No—they killed the domestic industry. Meanwhile, China surged ahead.

In 2020, the US hit Huawei with sanctions, blocking its access to key American tech like semiconductors and the Android OS for its phones. At first, Huawei took a big hit. By 2021, its revenue had plunged nearly 30% from the previous year. Its main telecom gear business was hurting, and Apple’s iPhone was stealing its share of the smartphone market. Following the sanctions, Huawei has significantly increased its investment in domestic semiconductor R&D.

In August 2023, Huawei unveiled the Mate 60 Pro smartphone, featuring the Kirin 9000s chip manufactured domestically by Semiconductor Manufacturing International Corporation (SMIC) using advanced 7-nanometer technology. This milestone demonstrates China's progress in developing its semiconductor capabilities despite facing international trade restrictions. Additionally, Huawei has announced plans to commence mass production of its advanced AI chip, the Ascend 910C, in early 2025.

Did US sanctions weaken Huawei, or did they ultimately make it stronger?

Reduced competition leads to complacency

Tariffs protect US companies from foreign competition, but less competition often leads to complacency. I’ve seen this firsthand at Anheuser-Busch (AB) and Entel.

In the early 2000s, AB had a dominant market share above 50% in the US. AB made several missteps, including dismissing craft beers as a niche and sticking to light lagers.

But its biggest failure?

Underestimating international competition.

AB failed on two fronts—it ignored growing global competition at home and never expanded internationally like its rivals. So when 2008 came, and AB struggled domestically, it had no international operation to offset the struggling US operation. This opened the window for Inbev, to come in and acquire AB.

Entel, Chile’s largest telecom company, focused on shareholder dividends rather than innovation. When a more agile competitor entered the market, Entel was unprepared, triggering a price war that forced it to sell off key assets. That is one of the reasons that Chile has among the cheapest mobile plans in the world.

Not convinced yet? here is a third example.

During the 1970s and 1980s, Japanese carmakers steadily gained ground against US automakers. The 1973 Oil Crisis pushed fuel efficiency to the forefront, catching American manufacturers off guard as they had long relied on selling large, gas-hungry cars. In contrast, Japanese companies excelled by producing smaller, fuel-efficient, and reliable vehicles through lean production and strict quality control.

Rather than innovating, Detroit lobbied for trade restrictions, resulting in the 1981 Voluntary Export Restraints on Japanese cars.

The move backfired.

Japanese automakers responded by moving upmarket with Lexus, Acura, and Infiniti while building US factories to sidestep tariffs. The Big Three failed to modernize, and once the restrictions were lifted, Toyota overtook GM as America’s top-selling brand.

By relying on protectionism instead of innovation, Detroit set itself up for long-term decline—culminating in GM’s 2009 bankruptcy—while Japanese automakers took the lead globally.

Here are just three examples but there are many out there.

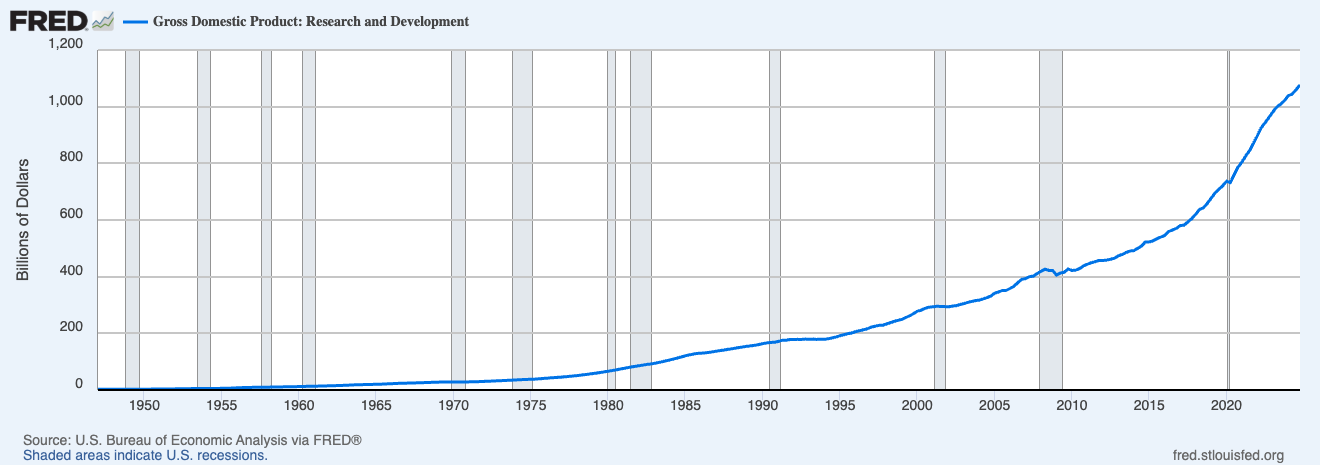

By September 2024, the 500 largest US companies returned $1.075 trillion to shareholders1, in the meantime, the entire US spent $1.060 trillion on R&D. That number covers all R&D in the US, from universities to both private and public companies.

If tariffs are implemented, the stock for US companies likely will show gains in the short term as those companies would likely focus on accelerating share buybacks and dividends while reducing R&D investments.

From a short-sighted investor this makes total sense, why would you invest in innovation if you have no competition?

Without significant R&D investment, it is a matter of time before China and others to out-innovate the US and develop better products cheaper. This will destroy entire industries. It could be argued that the US lost its dominance in steel, consumer electronics and manufacturing due to protectionism instead of innovation.

Is there a way that tariffs are good

While writing this, I noted I may come off as pessimistic, however, I don’t think any significant tariffs will be implemented. Outing my Nate Silver hat, I give only a 20% chance that Trump will enforce any meaningful tariffs. Even the steel tariff enters into effect on March 12, so let’s see what happens.

Also, if the US used most of the tariff proceeds to invest in R&D and develop industries, the tariffs could be positive. For example, China leads the solar panel industry thanks to strong government backing, smart investments, and long-term policies. The China Development Bank poured billions into solar companies, while the government introduced subsidies and incentives like the "Top Runner" program to push innovation. Local governments chipped in, too, boosting production capacity and making it easier for solar businesses to thrive. Solar energy was a key focus in China’s Five-Year Plans, guaranteeing steady support and rapid expansion. Huge investments in R&D helped improve efficiency and cut costs, making Chinese solar panels more competitive worldwide. As a result, China now dominates the market, driving down global prices and speeding up the shift to renewable energy.

One of my best picks on Seeking Alpha was Daqo Energy (DQ), a Chinese manufacturer of polysilicon photovoltaic products. I first published my thesis and buy recommendation in September 2017 @ $5.23 per share, re-iterated the buy in November 2018 @ $4.71 per share, one more buy in February 2020 @ $15.18 per share and finally closed my position in February 2021 @ $95.25.

My adventures investing in Daqo Energy

However, I would be surprised if the US ends up using the tariff money to develop industries. Likely, Trump would use the money for some political moves such as reducing the tax rate for the rich.

Share the Love! Invite friends to join our community and earn rewards!

Smart Portfolio Moves to Profit from Tariffs

If tariffs hit, expect quick gains for US companies that replace imports or see a demand boost—but beware of long-term risks. Steel and aluminum producers like Nucor (NUE), Steel Dynamics (STLD), and Alcoa (AA) will gain pricing power as tariffs make foreign metals more expensive. US automakers like Ford (F) and General Motors (GM) may see a temporary boost as tariffs raise the cost of imported vehicles, making American-made cars more attractive. Defence contractors such as Lockheed Martin (LMT) and Boeing (BA) could also benefit from a push toward domestic production in military spending. Similarly, US agriculture and food producers like Archer-Daniels-Midland (ADM) and Tyson Foods (TSN) will see gains if tariffs limit imports of meats and grains.

Infrastructure and energy sectors will also see short-term advantages. Construction materials companies such as Caterpillar (CAT) and Vulcan Materials (VMC) stand to benefit from both higher demand for US-sourced materials and potential infrastructure spending. In energy, US oil producers like ExxonMobil (XOM) and Chevron (CVX) could gain if tariffs make foreign oil imports more expensive, boosting domestic production. Meanwhile, solar manufacturers like First Solar (FSLR) could see a surge in demand if tariffs make Chinese solar panels less competitive.

As tariffs unfold, the smart move is a gradual shift toward global innovators—eventually making them the core of the portfolio. The best portfolio strategy would be to favour global innovators and hedge against US inefficiencies. The key move is to overweight non-US tech and industrial leaders, particularly in China, Taiwan, South Korea, and Europe, as these regions are likely to develop cheaper, more advanced products in response to tariffs. Companies like Taiwan Semiconductor (TSMC), Tencent (0700.HK), ASML (ASML), and LVMH (MC.PA) are well-positioned to thrive. Meanwhile, US industries reliant on cheap imports, such as automakers, retailers, and industrials, may face rising costs and competitive stagnation, making companies like Ford (F), General Motors (GM), and Walmart (WMT) vulnerable in the long run.

AI and semiconductor leaders should remain strong, as China is likely to accelerate self-sufficiency in chip production—favoring TSMC and Samsung Electronics. With tariffs acting as a hidden tax, inflation could re-emerge, making commodities and gold effective hedges. Lastly, China’s domestic market may offer a safe haven as the country shifts focus from exports to internal consumption and industrial policy, making stocks like PDD Holdings (PDD) and BYD (1211.HK) attractive.

As of now, I have kept the portfolio as is as I don’t believe that there will be any significant tariffs. But one name that we already own is TSM. On Weekly #8, I go into detail why I like TSM.

That’s it for this week.

Stay sharp, swim smart, and I’ll see you next week in the ocean of opportunities.