Weekly #18: The Future Is Nuclear—But It’s Not Time to Invest in NuScale (SMR) Just Yet

While small modular reactors look poised to power tomorrow’s clean energy boom, NuScale’s cash burn, limited revenue, and upcoming dilution suggest caution for investors right now.

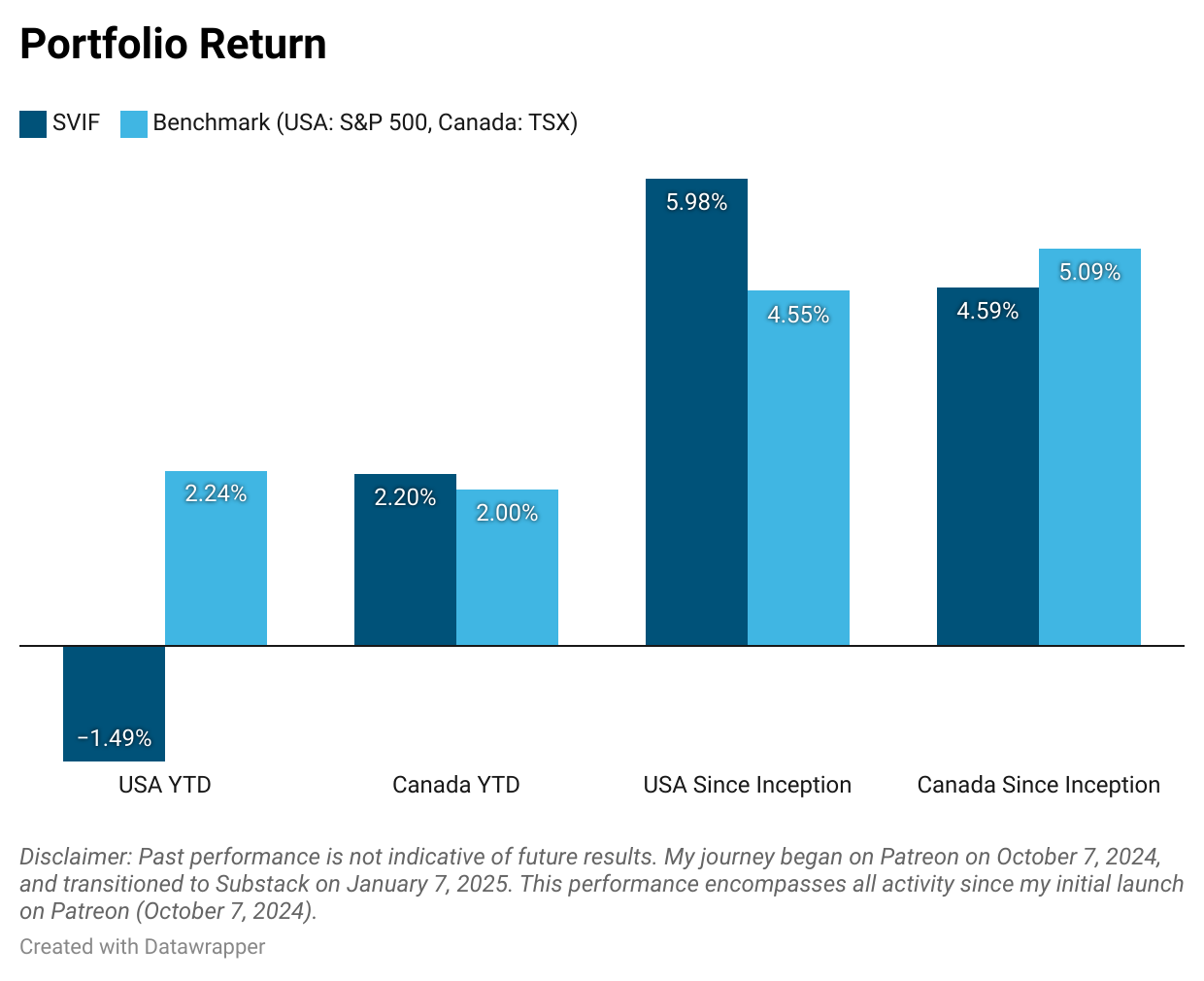

Ouch. What can I say? It’s been a bit of a bruiser. Our portfolios took a decent hit this week, with the USA side even dipping into the red. All relevant indices except the Nasdaq declined this week (Dow -2.2%, S&P500 -1.7%, TSX -1.3% and Nasdaq +0.2%). The Canadian portfolio is hanging in there, performing right around its benchmark, but overall this is the kind of week that tests our commitment and discipline. I’d love to pretend it’s all peachy, but that’d be like sticking our heads in the sand. Still, we’re not about to run for the exits. Despite this short-term slugfest, since launching Beating The Tide, we’ve continued to outperform the S&P. If you want a deeper dive into this week’s market moves, see the end of this email.

Here is the weekly performance of each stock in our portfolios: Weekly Stock Performance Tracker

Thought of the Week - The Future is Nuclear

As a kid, I remember watching cartoons for hours. Watching The Jetsons opened my intrigue into science and how to create a hovering car. Eventually, that interest steered me toward mechanical engineering.

Now, decades later, many kids like me have become engineers and made their childhood dreams a reality with mobile phones, video calls and EVs. However, I think we focused too much on big computing but we stayed behind on developing the energy to feed those devices, we have reached a critical point in our evolution. We have reached a point where we need to satisfy our energy appetite—AI, data centers, EVs and streaming services—and to do it in a way that doesn’t make climate change worse. We have made progress in renewable energies in the past decades but solar and wind cannot satisfy our needs as I explain below. That is why I think to achieve our evolution we need our energy future to be nuclear.

Click the ❤️ button on this post so that more people can discover it on Substack.

The Kardashev Scale ranks civilizations by how much energy they can use, from just a single planet’s worth (Type I) to siphoning an entire galaxy (Type III) and beyond. We’re typically pegged around Type 0.7. We still rely on a medley of fossil fuels, some renewables, and a pinch of nuclear here and there, so we’re not exactly capturing every last drop of Earth’s energy. It’s like we’ve got a few puzzle pieces of the grand planetary-energy jigsaw, but we haven’t pieced them all together yet. Climbing this ladder matters because a species that’s mastered vast energy resources can innovate faster, address global problems like famine or disease, and maybe even keep itself from going extinct. Nuclear power—fission now and maybe fusion down the line—acts like a power-up on our path toward Type I status: it’s a dense, reliable energy source that doesn’t cough up carbon all day long. In other words, if we want to move from scratching around with basic fossil fuels to harnessing near-unlimited planetary (and eventually stellar) energy, nuclear could be the key stepping stone we need.

Nuclear power has always been the misunderstood kid in the energy classroom. One moment, everyone’s thrilled by its potential to save the planet. The next, folks are ready to stick it in the corner with a dunce cap because they’re terrified of meltdowns and radioactive backyards. Lately, though, it’s making a comeback—especially as we scramble for more electricity to feed energy-hungry data centers, AI, and all our devices.

First, let’s break down the nuclear basics. Traditional nuclear plants use fission, which is splitting a big heavy atom (uranium or plutonium) into smaller parts. It’s simply about harnessing the insane energy stored in the nucleus. Meanwhile, fusion is a big dream: smooshing two light atoms (like hydrogen isotopes) into a heavier one. Fusion is the star of, well, stars—literally, it powers the Sun—so we all get excited about the idea of plugging a star’s power into the grid. But we’re not there yet. Fission is the proven technology, while fusion still has some kinks to work out, like trying to keep that reactive plasma stable long enough to produce meaningful net energy.

Fusion research is heating up—literally. In December 2022, the National Ignition Facility made headlines by crossing the “scientific breakeven” threshold, producing more energy from a fusion reaction than was pumped in by its powerful lasers. Meanwhile, Chinese scientists at the EAST reactor hit a jaw-dropping milestone in January 2025, sustaining plasma above 100 million degrees Celsius for 1,066 seconds—a huge leap toward continuous fusion. Not to be outdone, startups like New Zealand’s OpenStar are testing unconventional reactor designs, including a levitating superconducting magnet that held plasma at 300,000 degrees Celsius for 20 seconds. All of this has inspired greater investment, such as the $46 million the US Department of Energy poured into eight companies in 2024 under its Milestone-Based Fusion Development Program. From government labs to private firms, these breakthroughs signal that scalable, clean fusion energy may be closer than we think.

But for now, we only have fission. Critics often wave around the spectres of Chernobyl, Three Mile Island, and Fukushima. But nuclear scientists counter with a great statistic: if you look at the number of deaths per terawatt-hour (a fancy way to compare accidents across all energy sources), nuclear emerges with one of the lowest fatality tallies. That’s right—compared to coal (with its risky mining and respiratory-hazard emissions), or even the occasional rooftop solar worker who’s been known to take a nasty tumble, nuclear’s record, on balance, is a lot cleaner (and safer). Of course, that doesn’t mean we shrug off safety concerns. The emphasis on strong containment structures, plus multiple layers of security (imagine thick steel walls you could ram a plane into—apparently they’ve literally tested this idea), helps keep people safe and meltdown fears in check.

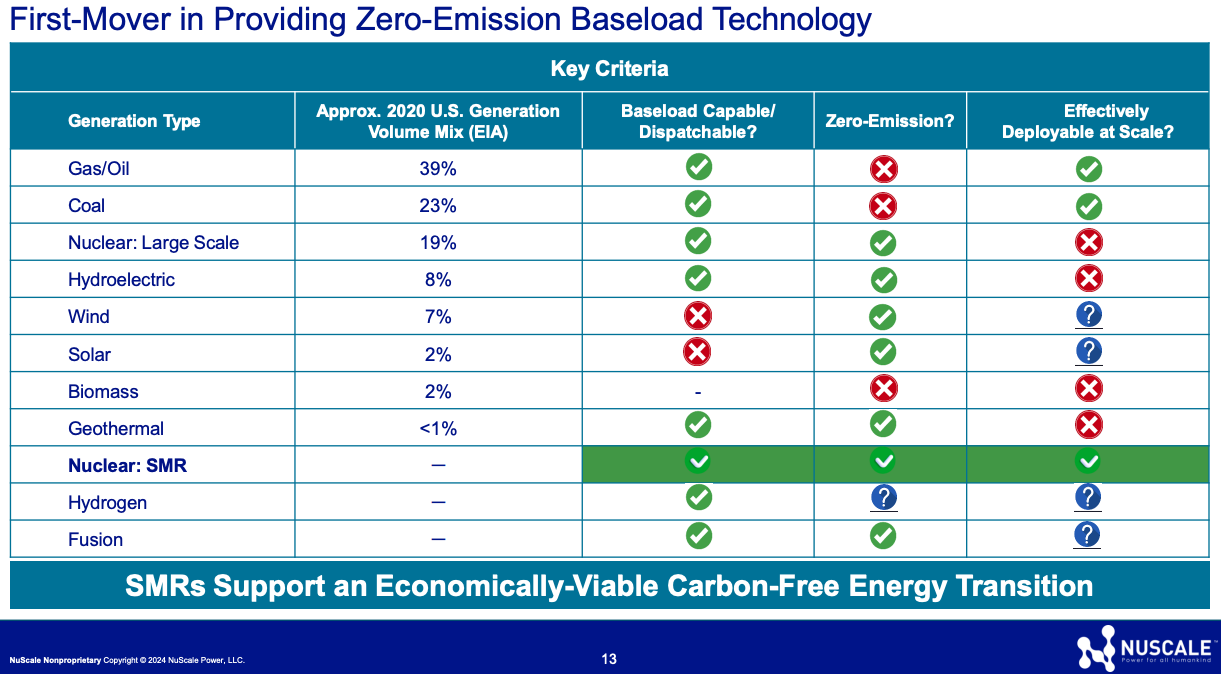

Now, let’s talk demand. We’re living in a future that might’ve seemed unimaginable a few decades ago. Instead of unlimited energy (like old sci-fi magazines loved to promise us in the 1950s), we got unlimited computing. So we do everything on digital platforms—streaming, AI, data analytics, quantum computing (that’s the new kid on the block), machine learning, the endless scroll of social media, and all those servers chewing up insane amounts of power in data centers. Because of these rapid advancements in computing, we’ve hit a wall with traditional energy sources. We’re seeing a renewed interest in nuclear precisely because wind and solar alone can’t comfortably guarantee that constant flow of 24/7 energy these power-hungry data hubs demand. If you’re running a data center worth billions, you don’t want it stuck at 2% capacity just because the breeze took the day off.

Enter small modular reactors—SMRs for short. These are the “fun-sized” versions of nuclear reactors that companies like NuScale (NYSE: SMR) and Westinghouse are developing. Instead of one gargantuan megaproject that takes a decade (or two) to build and billions of dollars you’ll never see again, you create a more manageable, smaller plant. These smaller plants can be built faster, may need less up-front investment, and you can cluster multiple modules if you need more juice. Imagine building one, learning the ropes, then building another more cheaply, and so on.

Also in the pipeline are even more “futuristic” advanced reactor designs. Some use molten salt; others use sodium as a coolant. The idea is to crank the operational temperatures way up (hundreds of degrees Celsius hotter than conventional reactors) so the energy conversion process gets more efficient or can even deliver super hot steam or direct heat to factories. That’s a huge win if you’re trying to make carbon-free steel or other industrial products that currently rely on gas or coal-fired furnaces. One design that keeps popping up is the sodium-cooled fast reactor. Sure, liquefied sodium bursts into flames if it touches water, but with the right containment, it’s surprisingly stable for nuclear applications and can help recycle spent fuel, effectively munching up the leftover isotopes that keep you awake at night worried about waste.

Yes, I have to mention the “W” word—waste. Turns out the total volume of spent nuclear fuel in the US after decades of running nuclear plants (providing a solid 20% of national power, by the way) could fit inside a single football field if stacked a few meters high. Not exactly the unimaginable ocean of toxic green sludge we see in dystopian cartoons. It’s mostly in the form of ceramic pellets or metal rods, carefully stored and shielded. Admittedly, that doesn’t make it less radioactive, but it’s more contained than you’d guess, and many countries are also developing final repositories or recycling capabilities. Finland is leading the way with a final deep geological repository. Meanwhile, France recycles its spent fuel, reusing some of those valuable isotopes. If the US hopped on the recycling train, we’d reduce the volume of high-level waste we have to bury.

So is nuclear about to become the shining star of the energy world? If you ask our data-hungry tech giants, the answer’s creeping toward a “yes.” Microsoft wants to resurrect the Three Mile Island unit; Amazon’s investing in X Energy. We’re seeing big money flow to these advanced reactor projects because tech companies need guaranteed reliable power around the clock. Let’s face it, having your multi-billion-dollar data center power down because clouds blocked the sun isn’t exactly a stellar business plan. Not to mention the planet’s climate crisis is pointing a judgmental finger: we need clean, zero-carbon electricity, and we need it yesterday. Nuclear, while not a perfect angel, is looking better and better in that conversation.

Of course, nuclear power on every street corner might still be a leap. For one, we’re rightly cautious about who gets their hands on fissile material. Another hitch is the not-in-my-backyard crowd. You can bet that if a new reactor is scheduled to go up nearby, somebody will panic about its “inevitable meltdown.” But we also know about the thousands of jobs created, the massive property tax influx for local communities, and the real possibility that advanced designs could be even safer. For decades, nuclear was stuck in the “tomorrow’s technology” category, overshadowed by cheap fossil fuel. But that’s changing.

I find it oddly exciting. It’s like we’ve circled back to those mid-century dreams of a high-powered world, except we’re making strides with safer, more efficient nukes. Maybe I won’t get that personal pocket reactor to run my microwave and maybe that’s a good thing. But if advanced nuclear can satisfy our ballooning energy appetites—AI, data centers, EVs, your ten streaming services—and do it without making climate change worse, that feels like a step in the right direction.

Is NuScale Power (SMR) a good investment?

Whereas I sang the praises of nuclear’s bright future, NuScale’s near-term situation is more nuanced. They’re knee-deep in R&D for small modular reactors (SMRs), the only US-approved modular light water design that can ostensibly be scaled up—or down—depending on what you need. Sounds fantastic, but the company’s financials and project timeline suggest you might want to cool your jets before jumping on board.

First off, NuScale’s technology itself is impressive. With design approval in hand, they can at least say they’re not vaporware; they hold the distinction of being the first to cross the finish line with the NRC for a certified SMR. On paper, these mini-nuclear reactors have everything going for them:

Baseload-capable and emission-free—great news if you’re worried about the planet frying.

Potentially easier to build and cluster than those old-school, gigawatt-scale reactors of yore.

Given how big players (Amazon, Microsoft, Google) are racing to lock down nuclear for their data center expansions. Microsoft entered into an agreement with Constellation Energy to purchase power from the Three Mile Island Unit 1 nuclear facility. This facility was shut down in 2019 and is expected to reopen in 2028. Amazon partnered with Talen Energy to obtain energy from the Susquehanna plant for its data centers. Google signed an agreement with Kairos Power to utilize small nuclear reactors to produce energy for its data centers. The story all but writes itself: “SMR is the next big thing.” And yet, the market doesn’t operate on inspirational buzz alone.

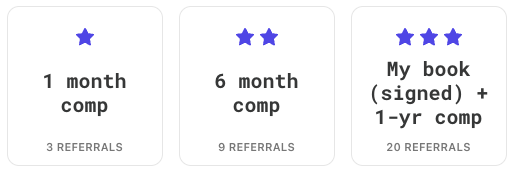

Share the Love! Invite friends to join our community and earn rewards!

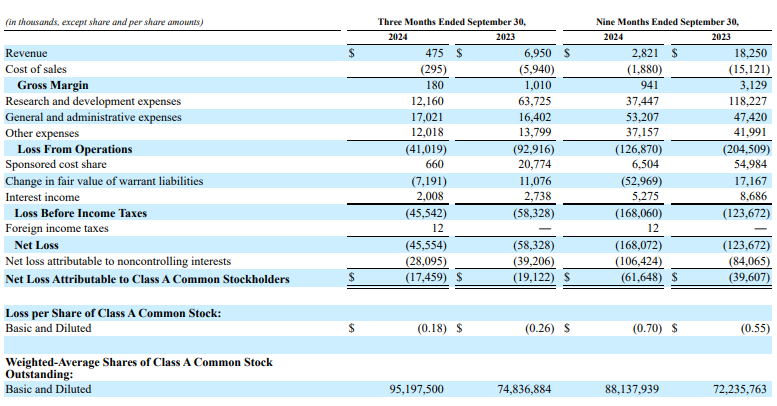

When you pop open NuScale’s latest Form 10-Q, a few caution lights flash:

Vanishing Revenue: As of Q3 2024, revenues were $475,000 for the quarter, down from $6.9 million in the same period last year. A big chunk vanished after they parted ways with the CFPP (Carbon Free Power Project) contract due to rising costs.

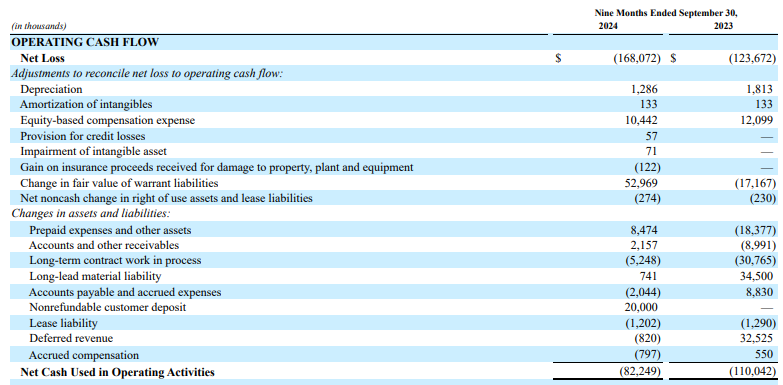

Burn Rate: In nine months, they already plowed through $82.2 million in operating activities. That annualizes somewhere north of $100 million—arguably high for a firm without firm contracts.

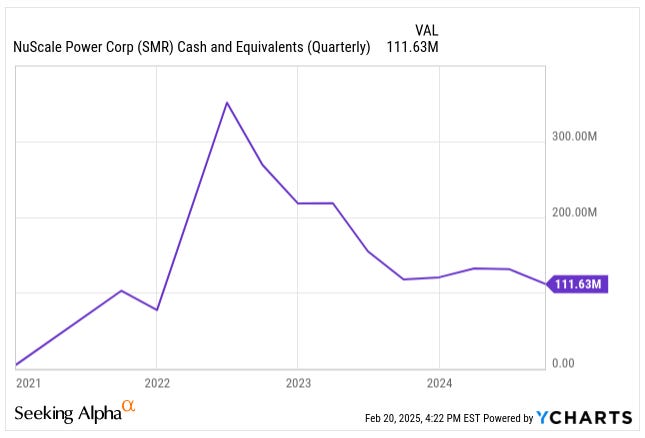

Not sufficient cash on hand: They have about $111.6 million in cash plus $45 million in short-term investments, but that’s not an infinite runway. Even though they are transitioning from an R&D company to a commercialization company, I believe the burn rate will still be over $75 million annually in the best-case scenario giving them two years of runway.

Pre-Revenue, Capital-Intensive: They are still in a “pre-commercialization” phase, not expecting meaningful earnings until at least one project is well underway. Meanwhile, the constant R&D, regulatory hurdles, and market-building efforts keep the meter running.

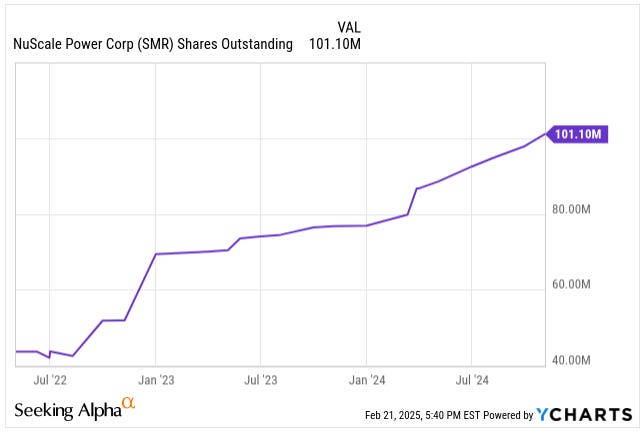

Dilution Risk: NuScale has been leaning heavily on the equity markets. Their “ATM Program” (At-The-Market offering) raised around $103.8 million for the nine months ended September 30, 2024, and they just tacked on another $31.6 million after the quarter ended. If they have to keep going back to the well, existing shareholders could get diluted further.

Then there’s the question of project timing. NuScale spent years developing that first CFPP deal, only to part ways after costs ballooned. They’re talking with folks in Canada, Poland, and other geographies, but nuclear plants don’t pop up overnight. Even once a contract is inked, the build-out is a multi-year saga. In other words, don’t expect a massive revenue ramp to materialize next quarter just because SMRs are “the future.”

You might love the promise (who doesn’t want safe, carbon-free power?), but the financial path looks rocky. Despite some big headlines, NuScale’s stock appears “way ahead” of actual results. They’re burning a lot of cash, haven’t locked in enough real pipelines (the CFPP exit hurt), and will likely keep tapping the capital markets. That means more potential share dilution for current investors. Until we see real, binding contracts that deliver revenue, it’s all about “what could be,” not “what is.”

The idea is golden—small nuclear reactors that can feed AI data centers or next-gen grids. But if you’re evaluating from an investment standpoint, there’s a fair chance this stock underperforms before it outperforms. Until NuScale makes up a pipeline and shows a credible path to positive cash flow, I’d call it a Hold. Don’t get me wrong, I’m rooting for them. But unless your time horizon is basically “wait a couple of years and hope for the best,” slow and steady might be the wiser move. After all, in nuclear land, nothing’s quite as speedy as the marketing deck makes it sound.

What happened this week in the market?

So, what’s driving all the red ink? The market turned grumpy on Friday after fresh US economic data poured a bucket of cold water on the “everything-is-awesome” narrative. Investors got spooked about slowing growth and stubborn inflation. The Dow Jones Industrial Average plunged over 800 points, while the S&P 500 and Nasdaq took a beating of their own—1.6% and 2% drops, respectively. United Health led the Dow’s tumble after reports of a Justice Department investigation. Worst day since March 2020?

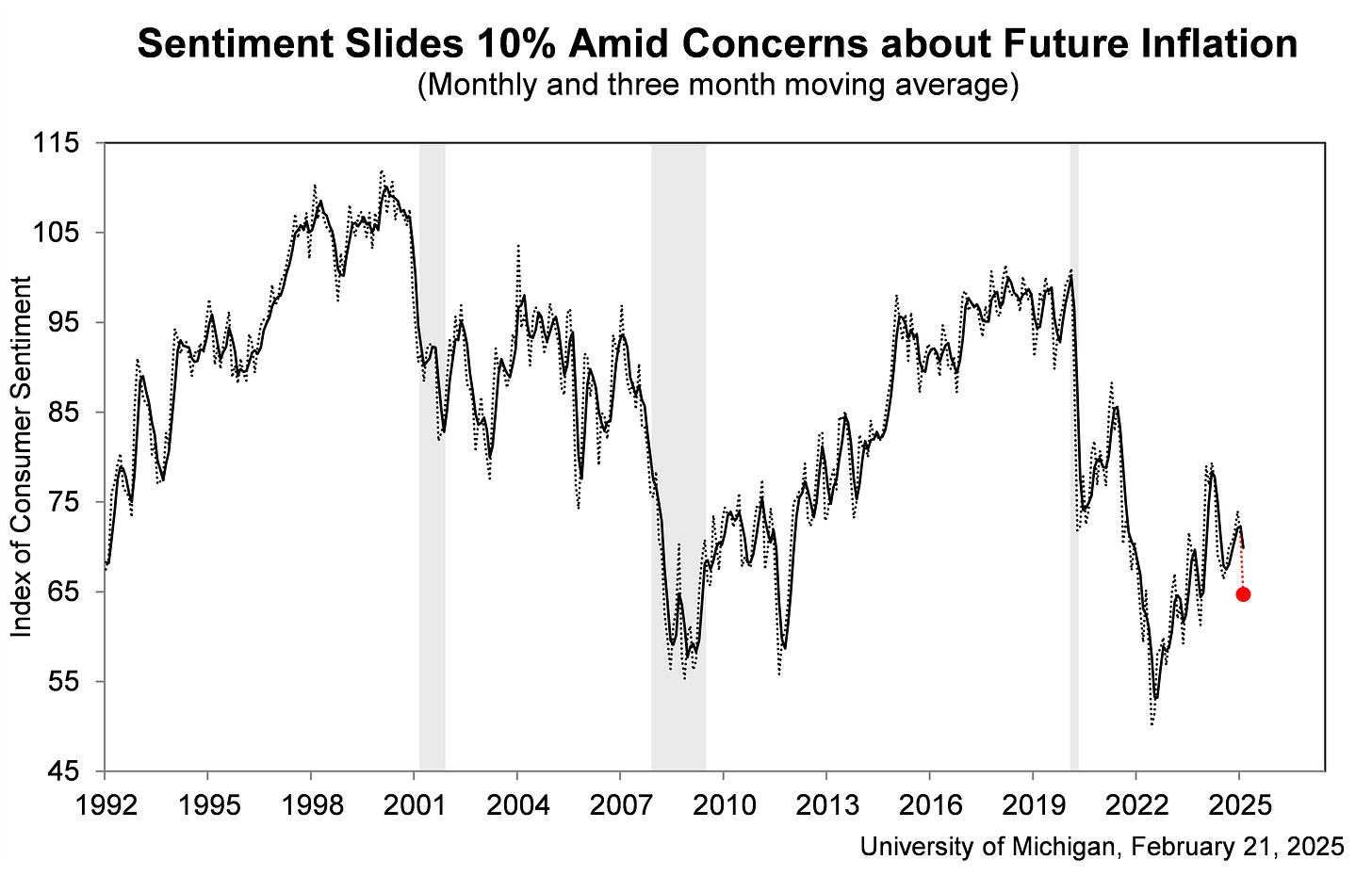

Beyond that, the University of Michigan’s consumer sentiment index declined from 71.7 in January to 64.7 in February …

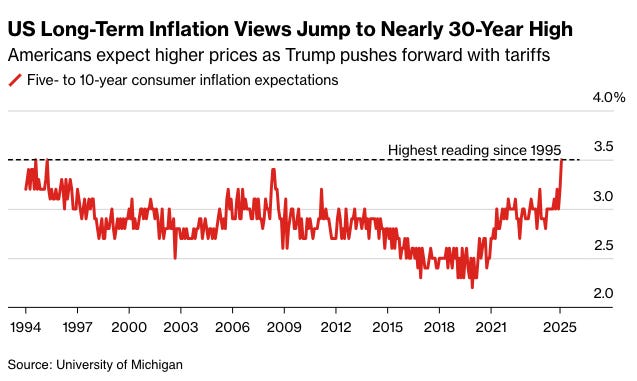

… while the 5-year inflation outlook popped up to 3.5%, its highest since 1995.

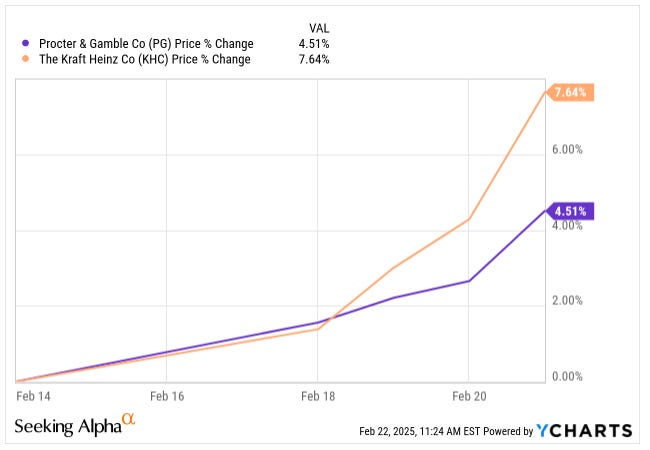

Add in weaker-than-expected housing data, with existing home sales sliding, and a services PMI tipping into contraction territory, and you can see why the markets took a sour turn. Defensive plays—things like bonds and stable consumer goods stocks—were apparent on Friday in response. The 10-year Treasury yield dropped 8 basis points, while Procter & Gamble and other consumer staples perked up as everyone raced to safety.

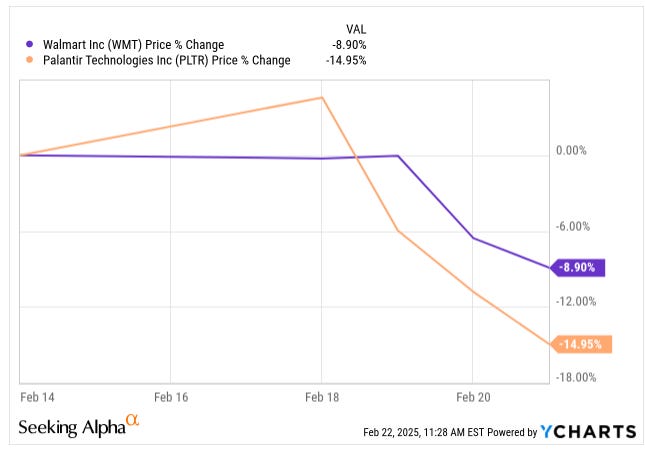

Walmart’s revenue rose 4.2% last quarter and profits climbed 10%, exceeding Wall Street’s estimates thanks to a 20% surge in online sales and strong results at Sam’s Club. However, the retailer’s cautious guidance for the current quarter and fiscal 2026 fell short of lofty expectations, triggering a 9% drop in the stock and weighing on other retailers. A stronger dollar weighed on international results, though adjusting for currency showed a 5.7% increase overseas. Management warned of potential headwinds from tariffs and a softer consumer but remains confident in Walmart’s value-oriented appeal, which continues to resonate with shoppers facing inflationary pressures. Palantir tumbled around 15% this week following news of a memo from Defense Secretary Pete Hegseth that hinted at an 8% reduction in the US defence budget each year for the next five years.

Now, this all sounds pretty ominous, but let’s take a deep breath. You know what’s more painful than seeing these short-term drops? Panicking and selling great assets at bargain-basement prices. I spent some time reviewing all my positions, and fundamentally they’re still on track. Sure, some of our holdings might feel some pain if the economic slowdown or inflation keeps on chugging, but the underlying reasons we invested in them haven’t vanished into thin air. Our approach is about playing the long game, not flinching every time the market sneezes.

Anyway, that’s the lowdown for this week. I’m not burying my head in the sand, but I’m also not going to let the short-term noise knock me off a carefully chosen path. What’s your take on the current roller coaster? Are you hunkering down, or spotting opportunities among the rubble?

Let’s keep talking—and keep our eyes on the horizon. That is the Shark way. This is the way.