Week #16: The Fast and Slow Investor: When to Wait, When to Strike, and How to Win

Most investors move at the wrong speed—here’s how to time your actions for maximum returns. YTD return of 8.4% crushing the S&P. Plus, a breakdown of Powell Industries' (POWL) strong earnings.

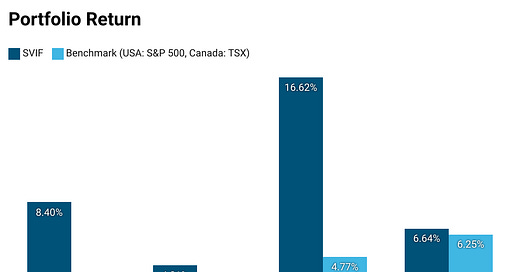

While the S&P’s YTD return decreased from 2.70% to 2.45%, we have increased our YTD return for the USA portfolio from 7.49% to 8.40% widening our outperformance to 3.4x the benchmark. For the Canadian portfolio, we are outperforming the benchmark by 109 bps. Since launching SwS, the USA portfolio performance is 3.5x that of the benchmark.

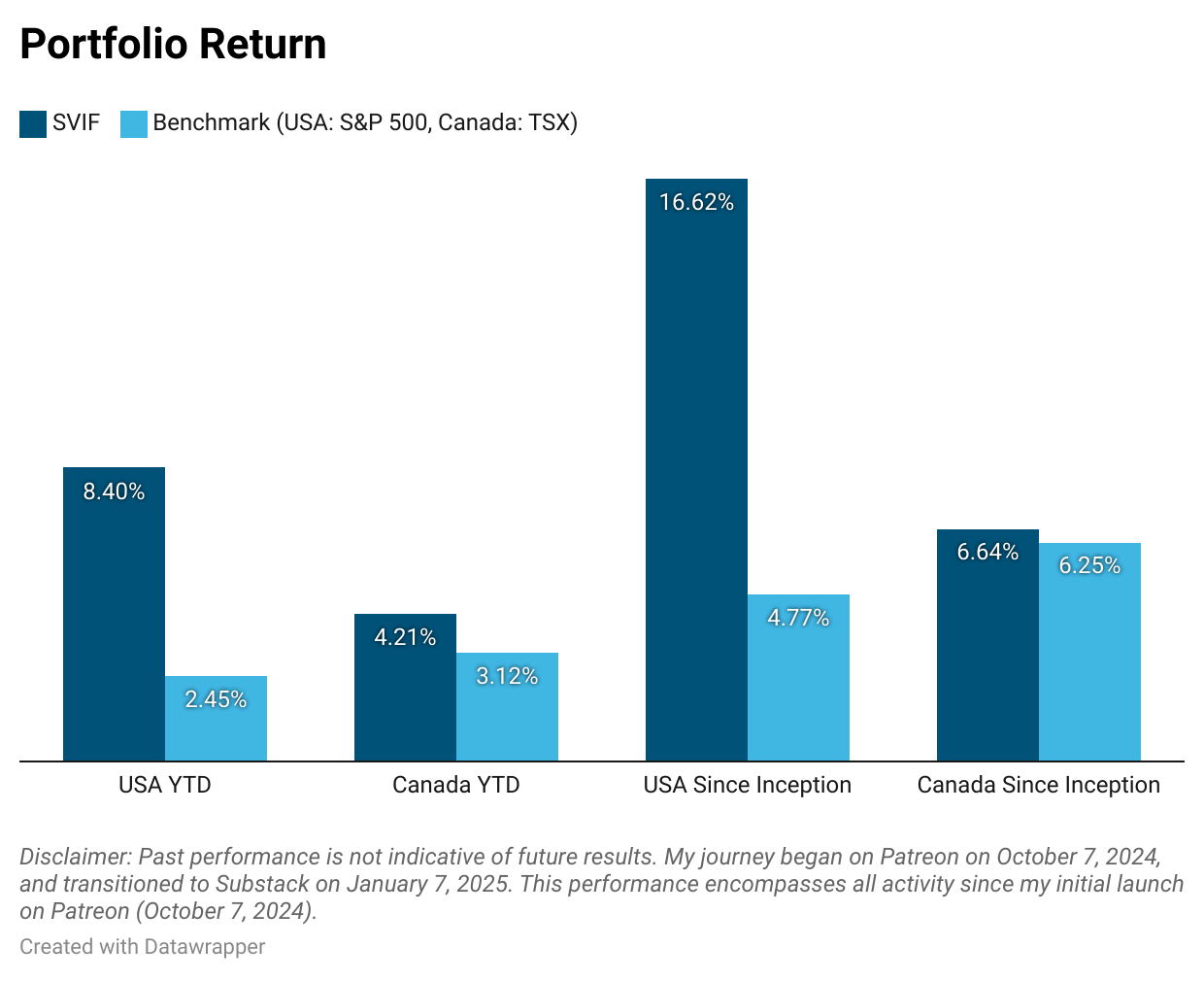

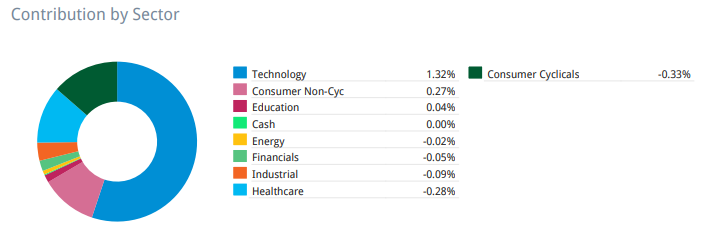

Most of this week’s return came from technology stocks in both portfolios.

Portfolio USA

Portfolio Canada

Here is the weekly performance of each stock in our portfolios: Weekly Stock Performance Tracker

19 Earnings Reports In—Here’s How Our Companies Performed

So far, 19 portfolio companies have reported earnings—only four missed revenue estimates, and four missed EPS expectations.

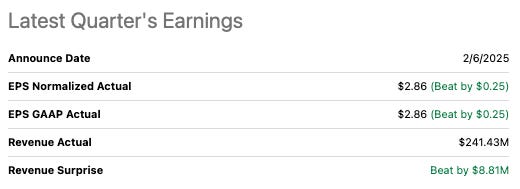

Powell Industries (POWL) Earnings: Strong Quarter, Weak Market Reaction

Powell Industries (POWL) had a solid first quarter in fiscal 2025, with revenue climbing 24% to $241 million, net income up 44% to $34.8 million and new orders up 36% from last year. The oil and gas sector grew by 14%, while electric utilities and other industries posted even stronger gains. A major win—a $75 million contract for an LNG project—helped fuel this momentum. CEO Brett Cope emphasized the strength of the company’s $1.3 billion backlog, which ensures revenue visibility into 2027, with utilities making up a third of it. The company is also expanding capacity, including new manufacturing space from land acquired in mid-2024 and an ongoing factory expansion in Houston.

Gross margins dipped slightly from last quarter due to seasonal factors, but cash flow remained strong. During the earnings call, analysts were cautiously optimistic, noting POWL’s solid backlog and market position but raising concerns about LNG permitting delays and margin pressures. Management is confident, citing steady demand in oil, gas, and utilities, as well as new opportunities in data centers.

Just days before the call, shares were trading above $250. But as the earnings date approached, the stock slid to $221. Since then, it has recovered to $229. I think the market overreacted to the outlook and LNG concerns. However, I don’t believe the drop was justified, and I saw it as a buying opportunity. Below is the latest note on POWL if you need a refresher on why I love this company.

Thought of the Week: Thinking, Fast and Slow

I tend to focus on the long term and not place too much weight on short-term results, so I don’t worry about quarterly earnings. However, good quarterly results reinforce that I am buying quality companies, which continue to deliver positive surprises. This ties directly into my Fast vs. Slow Investing approach—knowing when to be patient and when to act quickly.

Click the ❤️ button on this post so that more people can discover it on Substack.

Books such as Thinking, Fast and Slow and Mindset: The New Psychology of Success have shown me that the best strategy is an adaptive one.

Fast vs. Slow Investing: When to Wait and When to Strike

Investing isn’t about constant action. The best investors don’t just buy and sell all the time—they wait, they study, and then, when the right moment arrives, they strike fast. This approach isn’t new. It’s how elite predators hunt. A great white shark doesn’t chase everything in the ocean; it moves slowly, almost lazily, until the perfect opportunity presents itself. Then, in an instant, it explodes into action, securing its prey before the victim even knows what happened.

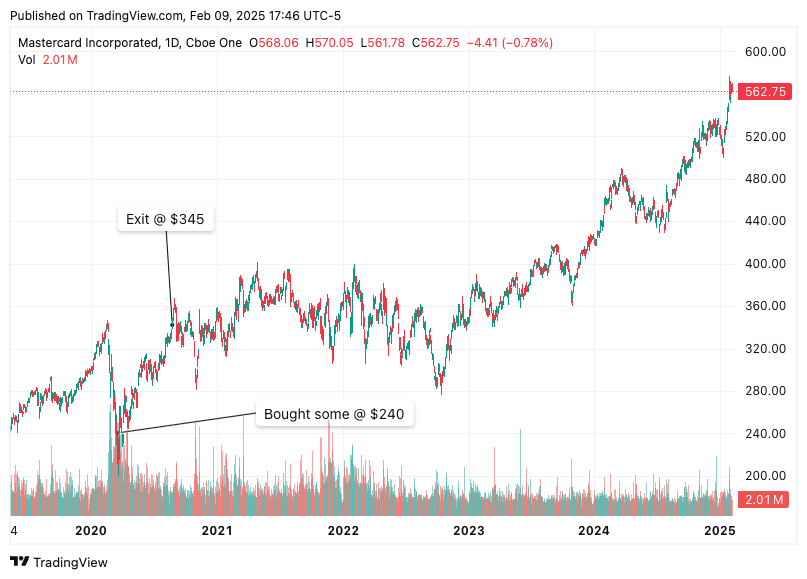

I’ve realized over the years that investing should work the same way. Most of the time, you should be slow. But when the stars align, you need to move fast. That’s how I approached my Mastercard buy in 2020—waiting years, then pouncing when the price finally made sense.

Investing isn't a game of constant trades. It’s a game of positioning. The slow phase is where most of the real work happens—reading financial reports, studying industries, understanding business models, and tracking valuation levels. It’s the time to watch how a company executes over multiple quarters, identify patterns, and wait for the right entry point.

When to Act Fast in the Market—and When Not To

When the right opportunity appears, hesitation is costly. If a stock you’ve researched drops to an irrational level or a temporary panic sweeps the market, you move quickly. This isn’t the time for endless second-guessing.

Take Warren Buffett during the 2008 financial crisis. He wasn’t scrambling to understand banks when Lehman collapsed—he already knew what he wanted. He had spent years analyzing bank balance sheets, so when Goldman Sachs needed capital, he didn’t hesitate. He secured an incredible deal while the rest of the market panicked.

I’ve had my own moments like this. In March 2020, when COVID fear crushed the markets, I had a list of high-quality companies I wanted to own but thought were too expensive. Suddenly, they weren’t. But that window didn’t last long—if you didn’t act fast, you missed it.

For example, I always wanted to own Mastercard (MA), but the valuation was too high—it almost always is. When the market crashed, I bought shares at $240 and sold them at $345 just four months later. That’s a 44% gain in four months, or an annualized return of 197% (not 132%, due to compounding).

My Mastercard adventure during COVID

The Biggest Timing Mistakes Investors Make (And How to Avoid Them)

Many investors make the mistake of being fast when they should be slow and being slow when they should be fast. They chase hype stocks without doing the research. They hesitate when a great company is trading at a discount. They get emotional over short-term moves instead of sticking to their process.

I’ve made these mistakes too. Early in my investing career, I held onto bad stocks for too long because I was too focused on the long term. I ignored clear warning signs, thinking time would fix everything. It didn’t. On the other hand, I’ve also hesitated on great opportunities, overanalyzing instead of just buying when I knew I should.

Investing Is About Timing—But Not the Way Most Think

People often say “You can’t time the market.” That’s true in the sense that predicting exact tops and bottoms is impossible. But you can time your actions—when to be patient and when to strike.

The best investors don’t rush into trades out of boredom or FOMO. They wait, sometimes for years, for the perfect setup. And when that moment comes, they don’t hesitate. They move fast, with conviction.

So the real question isn’t whether now is a good time to buy or sell. The real question is: Is this the time to be slow or the time to be fast?

Share the Love! Invite friends to join our community and earn rewards!

I was stuck in the Slow-verse.

Reviewing my past investments, my biggest opportunity for improvement was incorporating new information into my thesis. I used to spend months developing an investment thesis, becoming so confident in it that I ignored any new information that didn’t align with my original view. My investment criteria focused entirely on the long term and failed to account for the value of time.

Before, I used to hold all my positions for a very long time. And as I was fully invested, I wouldn't be actively seeking new opportunities. My criteria ignored the value of time and they were:

The company had a moat and good operational metrics

The market price was +50% below the fair value

However, as I explain in my book, I have refined my approach by adding two more criteria:

The risk-reward profile has to at least be 1:2

Find a catalyst and expected timeframe

Focusing on risk-reward ensured my portfolio was positioned for asymmetric gains. Identifying catalysts helped enhance IRR—after all, a 50% return over five years is far less attractive than 50% in a single year.

Over the years, I have built a Google Sheet that tracks all those metrics for the companies I follow and I review it weekly. I only buy the top companies. In the past, I only bought the top 12 companies, but I wasn’t comfortable with the drawdowns. Also, over the past 10+ years, I’ve added more companies to the database and now track around 400. So I have expanded to buying the top 50. Currently, we have 48 holdings as those are the only companies that match the four criteria above.

What’s one stock you wish you had bought during a market dip but didn’t?