Weekly #23: Why Ignoring Market Noise Pays Off

Discover how AGX beat earnings estimates, sending shares up 20%, and why ignoring short-term fears like inflation or tariffs is key to success

Happy Sunday, my fellow Sharks!

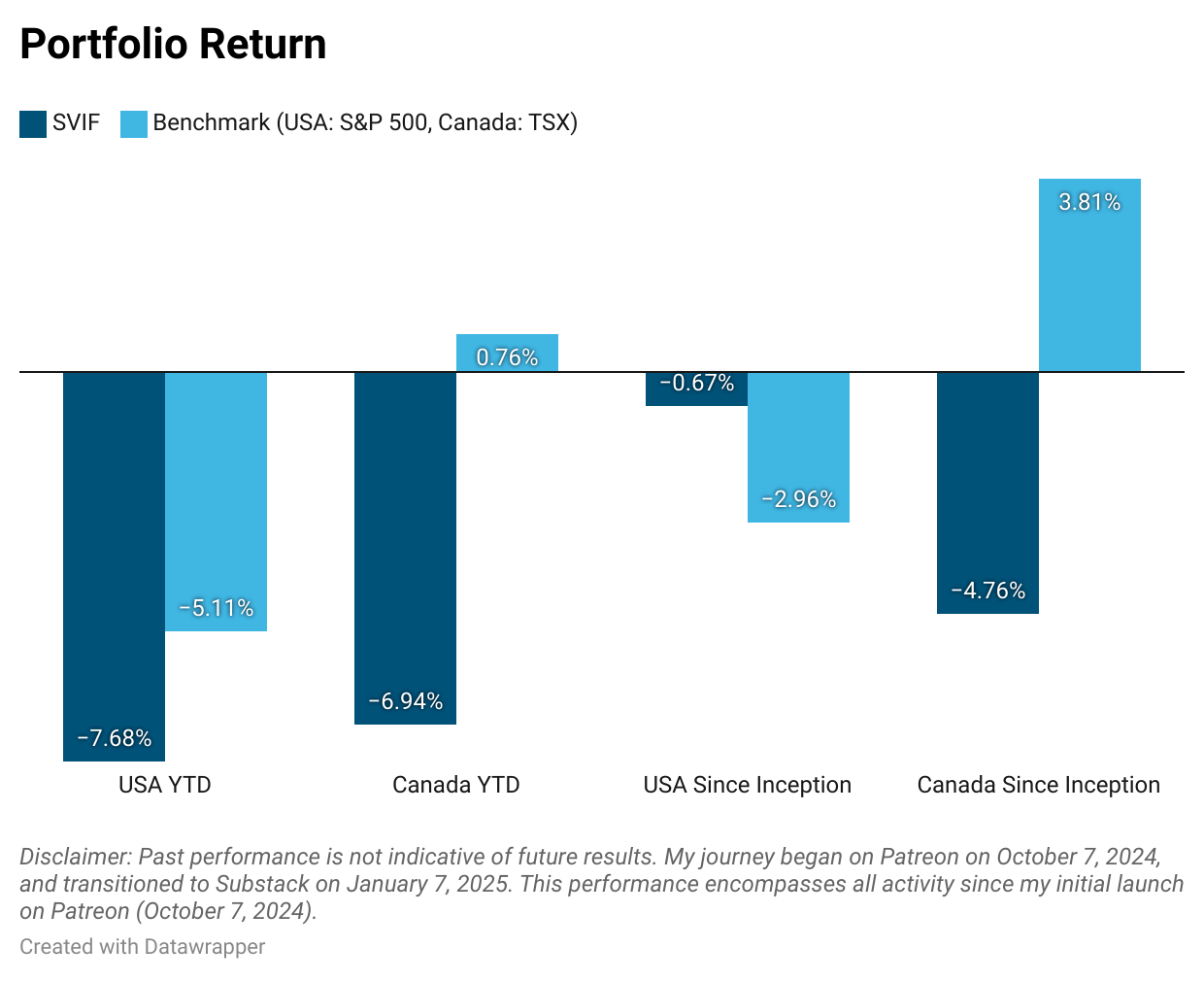

This week, our portfolios continued to decline along with the broader market. Portfolio USA's performance vs. the S&P 500 narrowed from -308 bps to -257 bps YTD. Portfolio Canada's performance worsened against the TSX, widening the gap from -584 bps to -770 bps YTD. However, 217 bps was due to one stock, which I am very confident will outperform. This stock is our highest-conviction position in Portfolio Canada. At one point, the position was up 173%; however, the stock price retraced due to the headwinds we are seeing impacting AI-related companies.

I'm currently writing a deep dive on the company, which I'll share next week with both free and paid subscribers. After the deep dive, you will understand why I am not worried about Portfolio Canada.

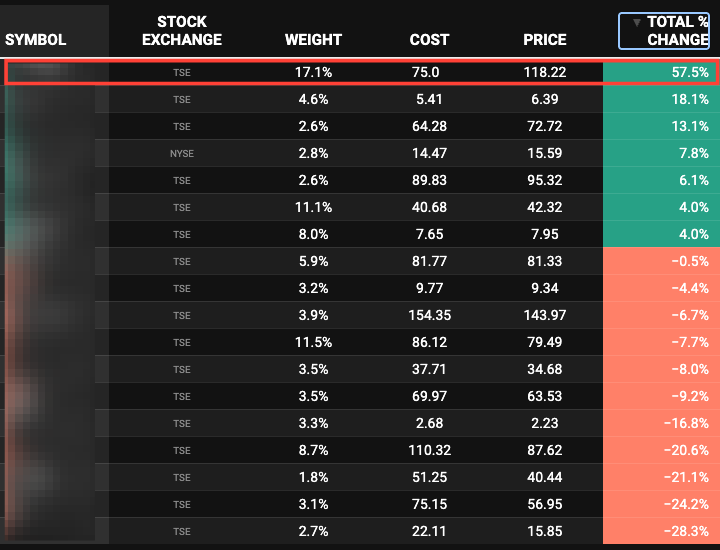

Here is the weekly performance of each stock in our portfolios: Weekly Stock Performance Tracker

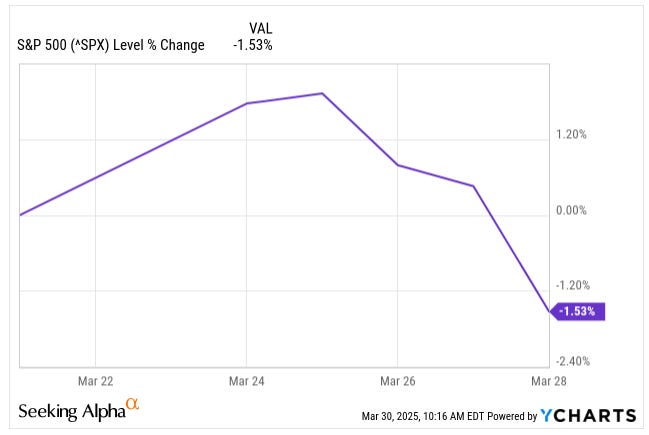

Stocks dropped on Friday after a survey revealed that consumer sentiment was at its lowest point in over a year.

The University of Michigan’s poll found more folks think inflation’s going to get worse. On top of that, about two-thirds believe more job losses are coming—the most since 2009. Inflation climbed further past the Fed’s 2% goal. In February, core PCE—which leaves out food and energy—rose 2.8% over the year. That’s higher than what was expected.

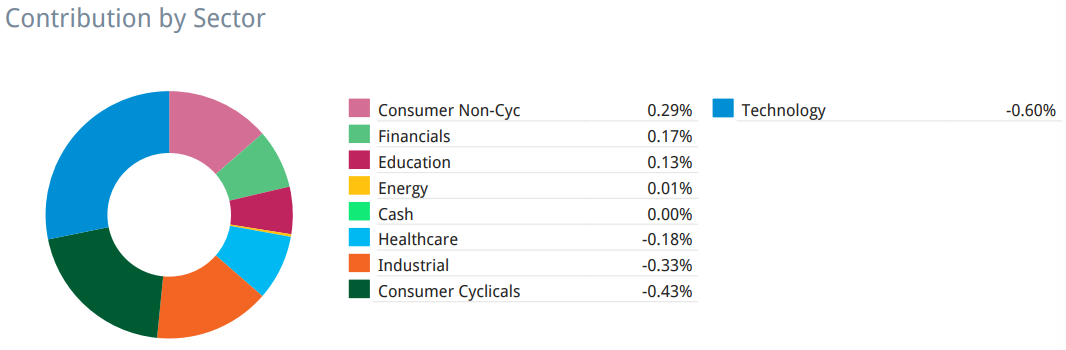

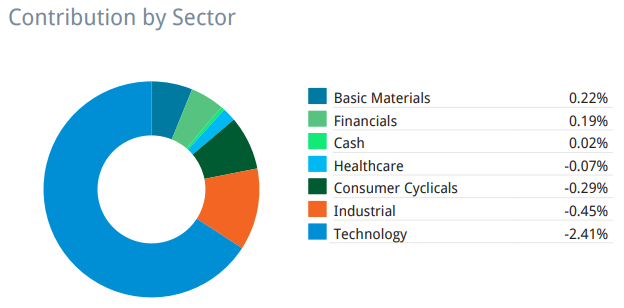

Rising inflation, declining consumer sentiment, and the tariffs set to take effect in early April caused Technology and Industrials to be the worst-performing sectors in both portfolios.

Basic materials was the best sector in Portfolio Canada due to the increase in gold's price. Gold’s price went up for the fourth straight week, adding to a strong rally this year. It even broke past $3,100 an ounce for the first time. By Friday afternoon, it was hovering around $3,116—up roughly 17% since the start of the year.

Portfolio USA

Portfolio Canada

Last week, AGX, a core position in Portfolio USA, released great earnings, and the stock was up 20% in the day. This company is my top pick for 2015 (you can read the thesis here)1. The stock price increased from $140 to $184 by mid-January. However, the stock has been dropping with the market and reached a low of $104 per share.

The company surprised the market:

EPS of $2.22, beats consensus by $1.07

Revenue of $232MM, beats consensus by $35MM

I’m not sharing this to brag—the portfolio is still underperforming its benchmark so far in 2025—but rather to emphasize a fundamental investing principle: invest in companies, not stocks.

I have said this a couple of times before, but I want to repeat it: Investing is easy. It is people that make it complex:

Instead of betting on one variable (stock price going up or down), people prefer to guess 9 variables by using options, as I discuss in Weekly #21.

They speculate in risky stocks rather than invest in stable, reliable companies.

They look for short-term quick games instead of almost guaranteed returns in the long term.

Let me emphasize the last point clearly: Investors often trade away a nearly guaranteed long-term positive return in exchange for quick, speculative gains. Besides death, there is nothing guaranteed in life. I know Benjamin Franklin said, “In this world, nothing is certain except death and taxes,” but as the billionaires in the world have shown us, the latter can be avoided.

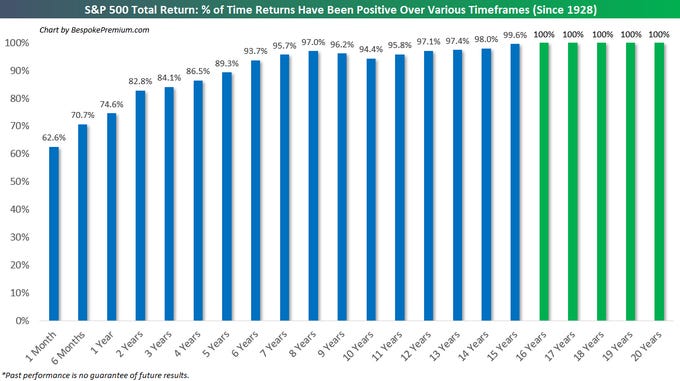

I have borrowed the chart below from

, who borrowed it from Bespoke. It is such a great chart; no wonder we are all sharing it.If you invest for just one month, the odds of it being a positive month is 62%, close to two thirds, and it makes sense as the stock market is positively skewed. But the longer you stay invested, the higher the probability that the period will return a positive return. There is no 16-year period since 1928 that returned a negative return.

However, keep in mind this is based on roughly 100 years of historical data, giving us a 99.6% confidence level—but still not an absolute guarantee.

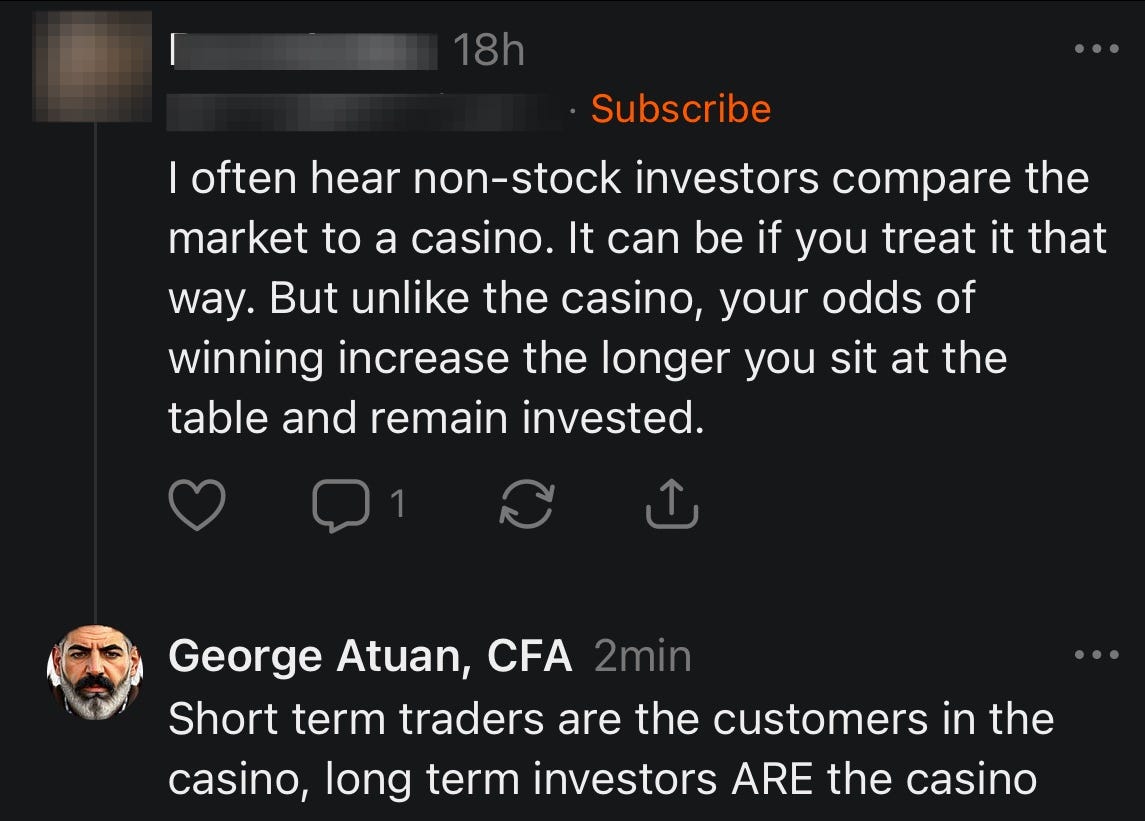

Last week, I saw this post on Notes, and I just had to reply.

If you are a short-term trader, the tides are against you:

Day traders would pay trading fees and commission 500 times in the same period that a long-term investor would pay twice those fees (entry and closing the position).

In most countries, short-term trades pay higher tax rates on capital gains.

As a short-term trader, the odds of buying high and selling low increase. Short-term trading increases exposure to market noise and volatility, leading traders to overreact to temporary market fluctuations rather than focusing on underlying fundamentals. Frequent trading amplifies emotional decision-making, leading to impulsive trades driven by fear or greed.

Short-term trading requires constant monitoring and time compared to long-term investing.

There are other points as to why long-term investing is better, but I think these four make the point.

Back to AGX, if I listened to the TV talking heads, the tariff news or the inflation, I would have sold close to the bottom at $104 a share and likely would have re-entered at the post-earing spike of $152. So effectively, I would have sold low at $104 and bought high at $152; we want the opposite: buy low and sell high.

The key to success is ignoring market noise—don’t think of your holdings as stocks you can easily trade but rather as businesses you’ve committed to owning long-term.

This mindset helped me stay invested in AGX because I was confident that short-term volatility would eventually fade. I can guarantee you that AGX stock prices will decrease in the future again, be it a new inflation read, Trump imposing a 500% tariff to Canada or a war. But it is just noise in the long term.

Since 2008, we have had the following events:

2008: Global financial crisis

2009: 140 US banks failed

2010: Eurozone debt fears

2011: US Credit Rating downgraded

2012: European bank crisis

2013: Emerging markets crisis

2014: Russia invades Crimea

2015: Oil price collapse

2016: Brexit

2017: Tech bubble concern

2018: Trade war

2019: Yield curve inverses (classic recession signal)

2020: COVID

2021: Inflation fears

2022: Russia- Ukraine war

2023: Banking crisis (SVB and Credit Suisse)

2024: War in the Middle East intensifies

2025: Tariffs…

With all that, the S&P 500 is up 280%.

Help Shape the Future of "Beating The Tide" by taking a quick survey!

As our community grows, I'd greatly appreciate hearing what first drew you to this newsletter, which content resonates most with you, and what you'd like to see less often.

Please take a moment to fill out this brief survey—it's quick, anonymous, and will greatly help me make this newsletter even more valuable for you.

That is it, fellow Sharks!

I posted the idea on Patreon and Linkedin before I created this newsletter.