Trade Alert: This Cat’s Got Claws (and Cash Flow)

A quiet, tariff-proof compounder with big returns hidden in plain sight

Fellow Sharks,

I just picked up shares for this quality. It's an exceptionally boring business (it involves cats), but don't let that fool you—this company is quietly printing cash!

Here’s a quick snapshot:

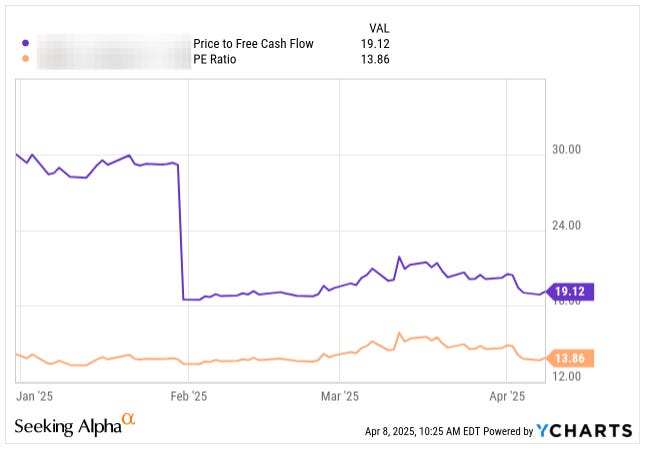

Very low valuation: trading at a P/E and Price-to-Free-Cash-Flow.

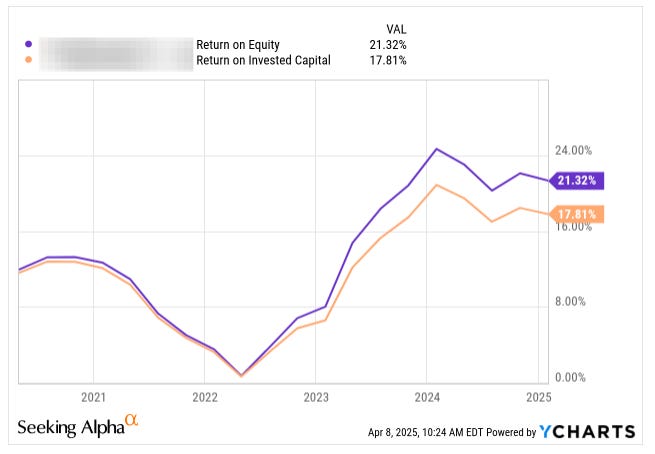

Strong profitability: double-digit ROE and ROIC

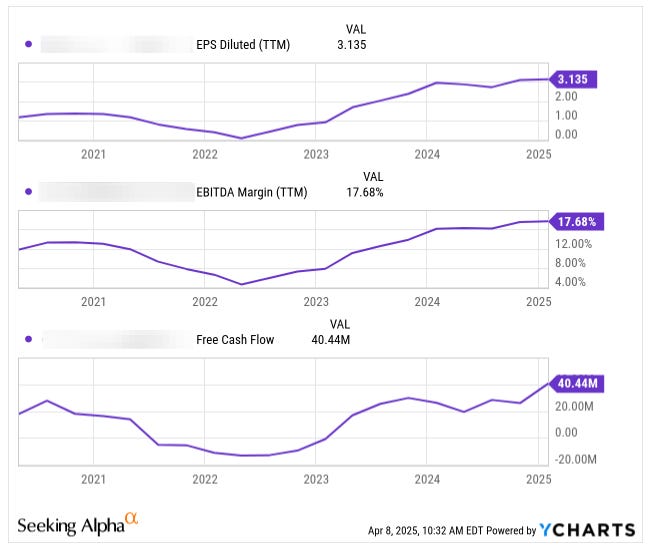

Solid balance sheet: $58 million in debt, $22 million in cash, $83 million EBITDA and stable dividend yield of 3.2%.

Excellent fundamentals: High margins, steady EPS growth, and reliable free cash flow

Protected business model: Shielded from tariffs with long-term secured raw materials and minimal foreign competition.

This is a classic "boring but beautiful" investment, and I see a considerable upside from current prices.

I'll follow up soon with a detailed deep dive to explore the entire investment thesis and numbers behind this trade.

Happy Tuesday, Sharks!