Fortrea (FTRE): An Attractive Post-Spin-Off Opportunity From Labcorp (LH)

Despite recent earnings volatility, Fortrea's strong backlog, global reach, and growing CRO market present compelling upside—here's why I'm bullish (though cautious).

Important Note: This is not a Trade Alert. FTRE is not currently part of my highest-conviction USA portfolio. This article highlights a company that I find interesting and believe offers upside potential, though not quite enough to join my top-tier selections.

To access my highest-conviction trade ideas and timely alerts, consider upgrading to a paid subscription.

I have a soft spot for spin-offs—many of my multi-baggers have been spin-offs. In a spin-off, shareholders of the larger company receive shares for the spun-off unit. This spun-off unit is smaller, relatively unknown, likely does not have analyst coverage yet, and may not fit the mandate of institutional investors, leading these shareholders to sell the spun-off stock at any price.

Occasionally, large companies may spin off a part of their business for various reasons. These reasons can include lowering leverage or complying with an antitrust issue. Sometimes these spun-off companies are great businesses, but due to their small size, there isn't much interest in them from the market. Another possibility is that the parent company’s stockholders might be compelled to sell shares of the spun-off company, as they fail to meet the size requirements of the funds holding the parent stock.

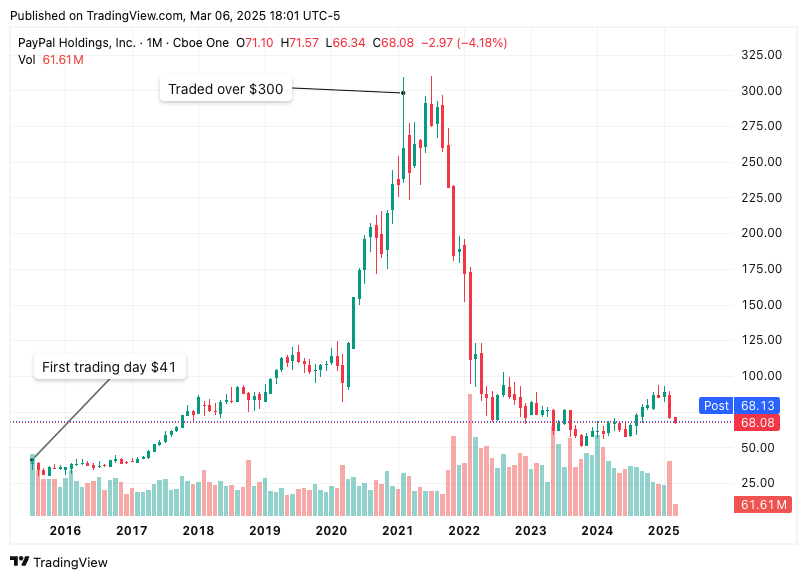

PayPal Holdings Inc. (PYPL) is an example of a spin-off that proved a good investment. Originally a subsidiary of eBay, PayPal became an independent, publicly traded company in 2015 following a spinoff. Since then, the company's stock price has increased from $41.46 on its first trading day to a high of over $300 in February 2021.

Allegion (ALLE) is a prime example of a spin-off that was initially overlooked by the market but proved to be a winning investment. In 2013, the company was spun off from Ingersoll-Rand and emerged as a dominant player in a niche industry of mechanical and electronic security products without direct US competitors. Instead, its main competitors were primarily based in Europe, providing Allegion with a unique economic moat.

Since the separation, Allegion has flourished as a standalone company and has garnered significant attention, especially in its international segments, where margins have improved from negative to positive. This success can be attributed to its status as an orphan spin-off, enabling it to establish a strong foothold in its industry.

In November 2013, Allegion's stock opened at $48 per share, and as of October 2024, it reached a high of $156 per share.

Unfortunately, you won't find these companies using stock screeners. However, some websites maintain a list of future potential spinoffs, such as www.thezenofinvesting.com, www.stockspinoffs.com, and www.insidearbitrage.com. You can also create a Google alert for news, including the words “spinoff".

One spin-off that I found interesting is Fortrea (FTRE).

Let’s talk about FTRE.

FTRE is a contract research organization (CRO) specializing in late-stage clinical trials—Phases II, III, and IV. FTRE partners primarily with large pharmaceutical and biotech companies, managing the complexities of running extensive global trials. Established about 30 years ago, FTRE became a standalone company in 2023 following a spin-off from Labcorp (LH).

Latest Earnings

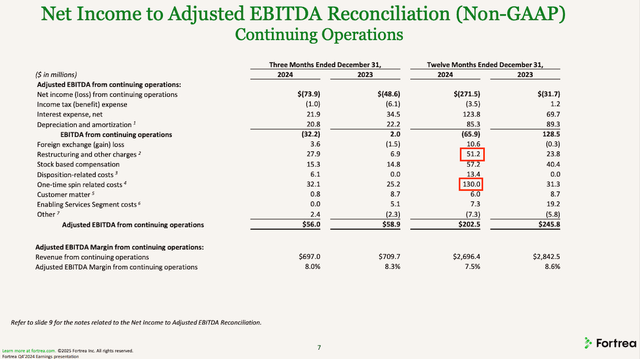

On March 3, FTRE released its Q4 2024 earnings, causing shares to drop from $13.86 to $11.00 due to missed revenue and earnings estimates. Most of the miss resulted from extra spin-off costs and some large projects winding down.

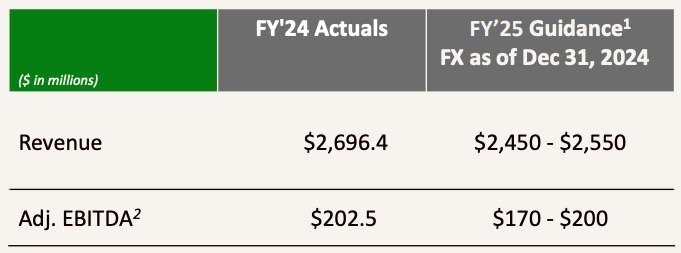

However, FTRE provided a cautiously optimistic 2025 outlook, guiding revenues of $2.45 to $2.55 billion and EBITDA between $170 million and $200 million, slightly lower than their actual 2024 results. Positively, the backlog increased by 4.2% to $7.7 billion.

The Buy Thesis

Strong Growth in the CRO Market

The global CRO market, valued at approximately $60 billion in 2023, is projected to grow 8.1% annually to about $118 billion by 2032, driven by pharma companies outsourcing clinical trials to specialized providers.

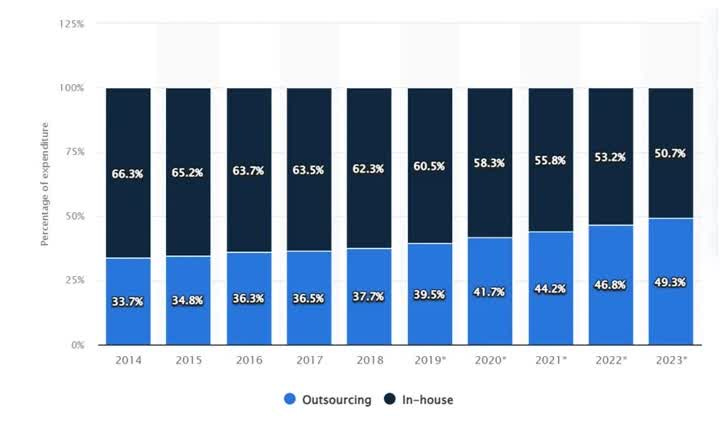

Given the increasing complexity and scale of late-stage trials, more companies are turning to CROs like FTRE to manage these extensive projects, creating long-term demand for their services. More businesses are outsourcing now—rising from 33.7% to 49.3% in the last ten years. It’s a smart move for cutting costs, growing smoothly, and tapping into talent worldwide.

I think more companies, especially those working on new treatments like gene therapies, will turn to outsourcing. The rules are getting tougher and more complicated, so firms like FTRE will likely see more business.

Global Reach

FTRE operates in 90 countries, making it exceptionally capable of running multi-region trials—a critical need for pharma companies aiming for regulatory approvals across the US, Europe, and Asia-Pacific simultaneously. FTRE’s global footprint provides the regulatory knowledge and local operational expertise necessary for the efficient management of large-scale trials.

Strong Backlog

FTRE boasts a substantial backlog of $7.7 billion, equating to approximately three years' worth of revenue at its current scale. Since late-stage clinical trials usually span multiple years, this backlog gives FTRE excellent visibility into future revenue streams, providing financial stability despite potential short-term market or operational disruptions.

Spin-Off Restructuring Benefits

Although the recent spin-off from Labcorp introduced short-term costs and challenges, it strategically positions FTRE to focus exclusively on CRO operations. Over time, this focus should allow for margin improvements due to the elimination of redundant costs and more targeted investment in technology and service enhancements, ultimately leading to better profitability.

Risks

While the prospects look promising, there are meaningful risks to consider:

Regulatory Uncertainty: The most significant risk for FTRE lies in potential regulatory slowdowns, particularly in the US. If the federal government shifts toward an anti-science stance, agencies like the FDA could face staffing cuts, budget reductions, or policy changes that slow down the approval and review process for new drugs. This could lead to delays in clinical trials, extended timelines for regulatory approvals, and increased uncertainty for pharmaceutical companies—factors that could dampen demand for FTRE’s services.

While FTRE’s three-year backlog provides revenue stability in the short term, prolonged regulatory bottlenecks could affect the pipeline of future contracts, leading to slower growth beyond that period. Additionally, if the slowdown is severe enough, some biotech firms could struggle to secure funding, potentially leading to force majeure defaults on existing contracts.

That said, FTRE's global presence helps mitigate this risk. Non-US revenues currently make up approximately 53% of its total revenue, and the demand for clinical trials remains strong in regions outside the US. Even if the FDA becomes less efficient, the European Medicines Agency (EMA) and other global regulators will continue approving new drugs, keeping demand for late-stage clinical trials intact.

While a regulatory shift in the US could create headwinds, it is unlikely to completely derail FTRE’s long-term prospects. However, this uncertainty is a key reason why FTRE is not part of my high-conviction names in my USA portfolio.

Economic Sensitivity: During economic downturns or periods of reduced biotech funding, demand for clinical trials could decline, impacting revenue growth.

Competition: The CRO market is fiercely competitive. Any operational setbacks could lead larger competitors like IQVIA (IQV) and ICON (ICLR) to capture market share from FTRE.

Spin-Off Execution: Although beneficial long-term, the spin-off from Labcorp may involve further unforeseen costs or operational inefficiencies that could temporarily pressure margins and profitability.

Valuation

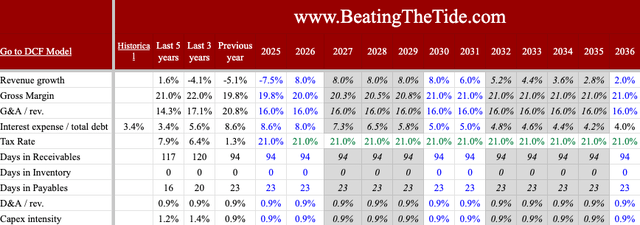

My DCF valuation for FTRE is $21 per share, assuming a WACC of 7.4%, reflecting an industry unlevered beta of 0.82. Revenue forecasts for 2025 closely align with management guidance due to the predictability of their backlog, while medium-term projections reflect overall industry growth trends.

These are my main assumptions:

Conclusion

Although the recent spin-off and earnings miss created short-term uncertainty, Fortrea’s robust backlog, global reach, and favourable industry dynamics offer a compelling risk-reward scenario. I'm bullish on FTRE, though it hasn't quite met the criteria to join my highest-conviction stocks in my USA portfolio. Nonetheless, at current prices, FTRE represents an attractive opportunity for investors willing to navigate near-term volatility.