Weekly #20: DXPE’s Earnings Shine but Trade at an Even Larger Discount—AMPH’s Post-Mortem Reinforces Discipline

Strong DXPE Results Meet Market Skepticism, While AMPH’s Collapse Reminds Us to Stick to Our Investment Process

Fellow Sharks,

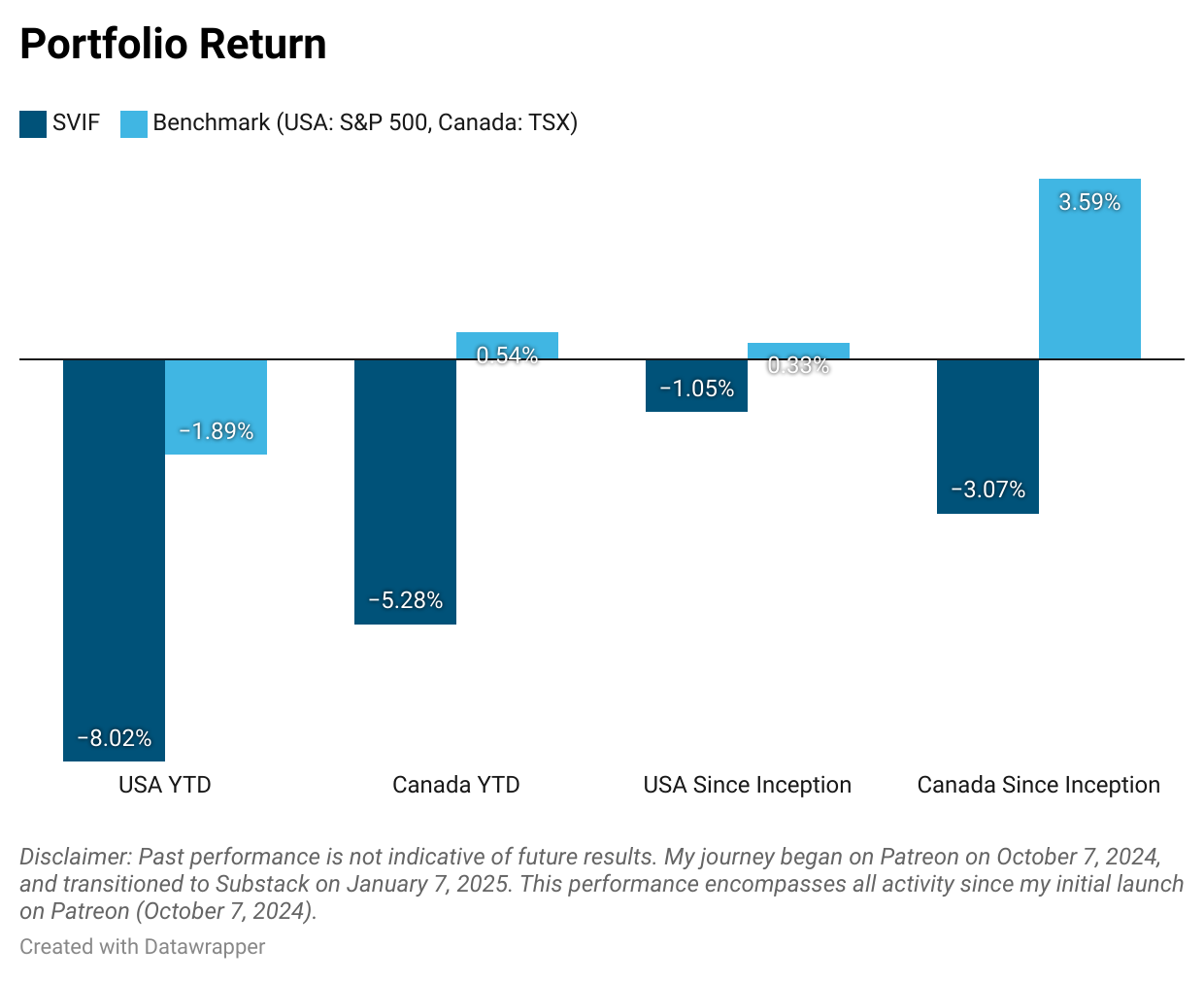

This has been another negative week for our portfolios and the market.

Here is the weekly performance of each stock in our portfolios: Weekly Stock Performance Tracker

This decline has been driven by the tariffs Trump is imposing on Canada, Mexico, and China. He is using these tariffs as a negotiation tool, having already extended them twice, with April 2nd now set as the deadline. But regardless of whether he applies the tariffs or not, he has already disrupted the system, injecting uncertainty—something we will have to navigate until at least 2028 (assuming a presidential election takes place then).

Even if Trump gets what he wants, he risks alienating one of the U.S.'s closest allies—Canada. Additionally, these tariffs are likely to be a net negative for the US in the long term, as I detailed in mid-February in the article below:

Anyway, I prefer to look at the bright side. While the current storm may seem daunting, zooming out reveals a great opportunity to increase our investments in high-quality companies at a discount. Looking at the portfolio, you’ll see that the companies remain solid and continue to report strong results—as I will later illustrate with DXPE, which just released earnings.

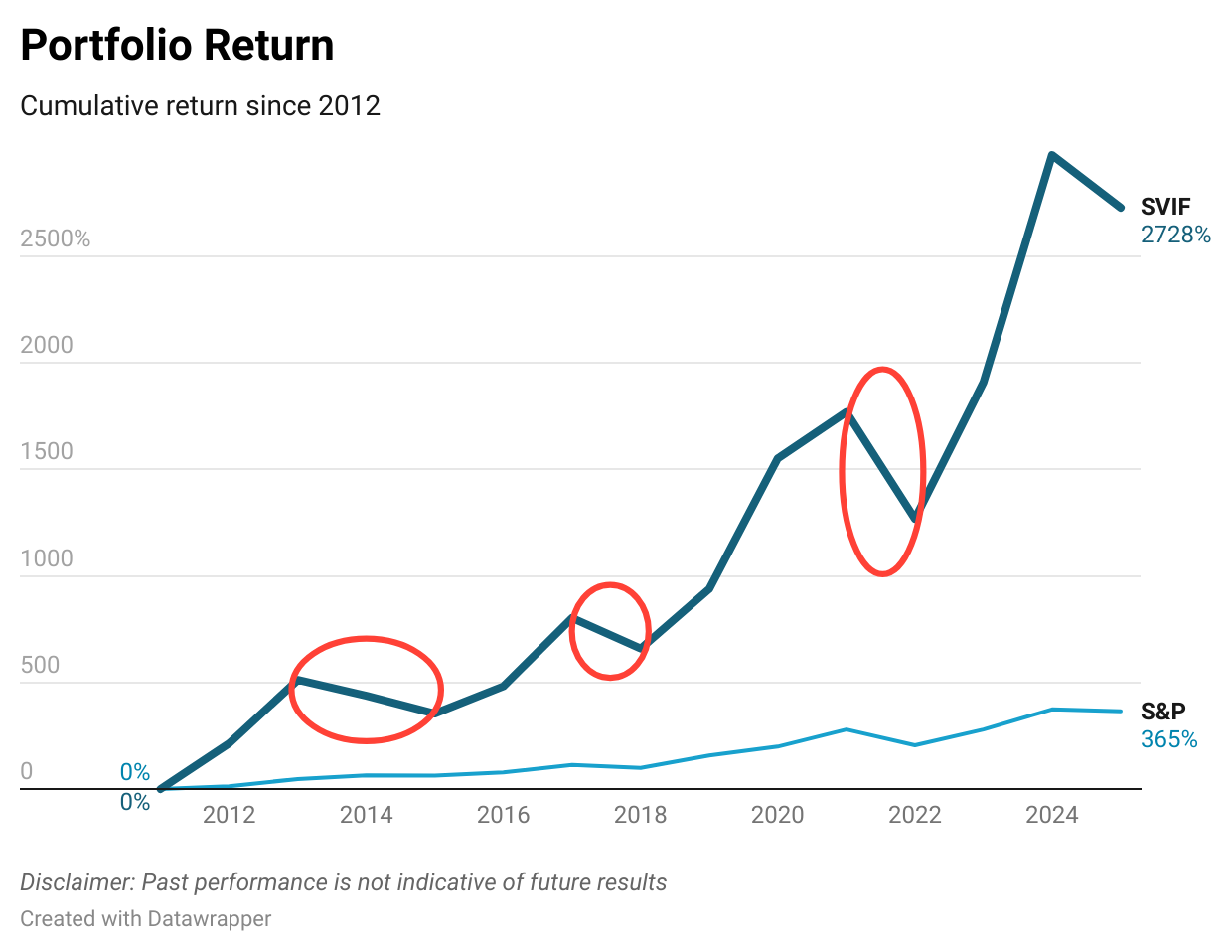

In times like these, I like to reflect on the graph below. The red circles highlight periods where the portfolio experienced losses, but ultimately, we emerged stronger as I used these downturns as opportunities to double down on quality companies.

DXPE Q4 2024: Pumping Solutions Fuel Record-Breaking Growth

During the earnings call, DXPE had a lot to say about its performance, and it's worth noting that the company increased revenues, maintained solid margins, and secured a few interesting deals. While Trump boasts about making deals, DXPE is actually delivering on them!

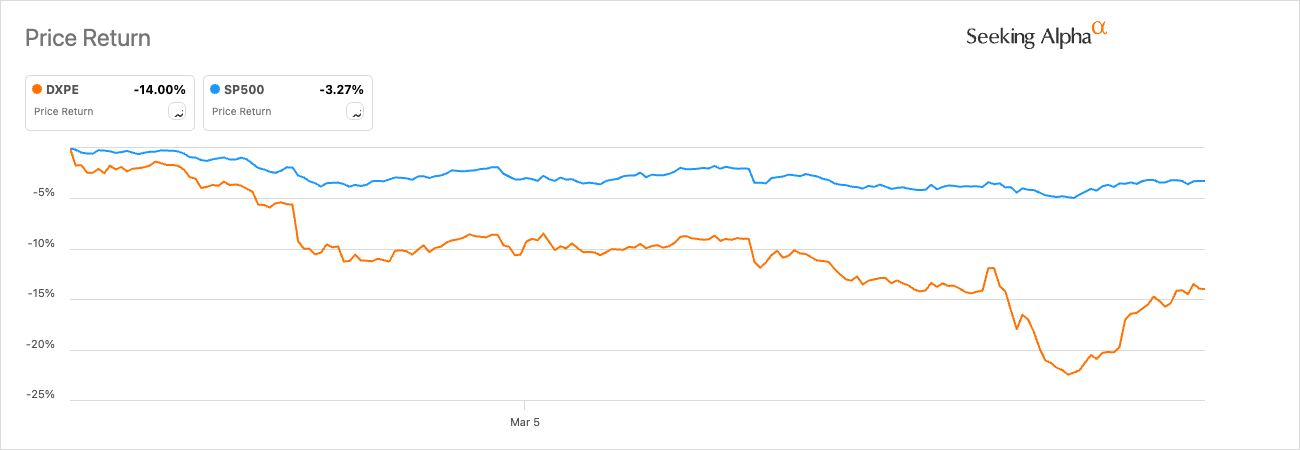

As you will see, the results were very strong supporting the strong fundamentals of our buy thesis, but the shares have been sliding from $100 when I first wrote about DXPE to $71 right before the earning call.

If you need a refresher on why I like DXPE, read my deep dive below.

Since the call on March 7, DXPE has recovered slightly to $78. However, as you can see below, its stock price has been reacting more to macroeconomic factors than its fundamentals—presenting a compelling opportunity to acquire a strong company at an even greater discount.

Let’s unpack the main points:

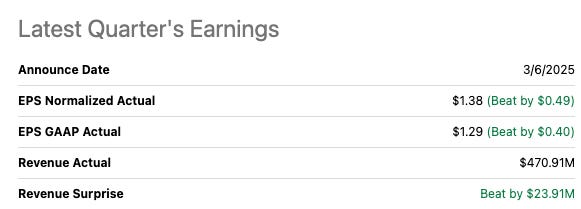

First off, DXPE ended the year on a high note. For Q4, total sales shot up to $470.9 million, marking a healthy jump of about 15%-plus y/y. On top of that, their EPS came in nicely above expectations at $1.38, beating estimates by $0.49. If you’re wondering, yes, management was quick to pat themselves on the back—but given the growth, it’s pretty understandable.

Segment Rundown

Service Centers: The segment remains the largest contributor, pulling in $1.2 billion for the full year (a slight 1.9% increase y/y). Management described the service side as consistent, with stable MRO activity and a good spread across different geographies.

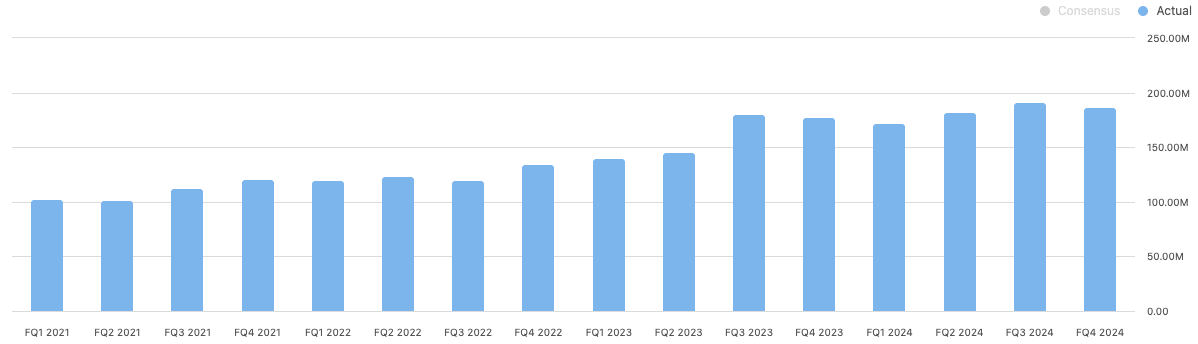

Innovative Pumping Solutions (IPS): This is where the fireworks were. IPS revenue soared 47.7% y/y to about $323 million. That big leap mainly reflects DXPE’s continued push into water and wastewater applications, plus lingering demand for oil and gas projects. Management’s particularly excited about expanding the “DXP Water” platform—that backlog is on a tear, and they see big things for 2025 in municipal and industrial water projects.

Supply Chain Services: Sales dipped 1.5% y/y to $256.4 million, but leadership chalked it up to facility closures at certain customer sites and pockets of softer demand. On the plus side, they see a bunch of new marketing initiatives and remote technology offerings boosting future traction. The emphasis is on hooking more industrial accounts with streamlined supply-chain management tech.

Acquisitions & Investments

DXPE kept up their usual M&A hunt during the year, completing seven acquisitions in 2024 by spending $98.5 million. These primarily added muscle to their IPS business (especially the water/wastewater side) and boosted margins. Leadership sounded confident that they could keep spotting and folding in targets without losing focus on day-to-day business.

The company has demonstrated strong integration capabilities, which reassures me that seven acquisitions within a year are something DXPE could integrate seamlessly. Regardless, I will be keeping a closer watch. Having done M&A and post-M&A integration myself, I understand the difficulties and complexities of such an endeavour.

Current Market Dynamics

On the call, management laid out how each end market is performing. Oil and gas is still a nice tailwind, although not quite the frenzy it’s been in past cycles. Meanwhile, water infrastructure projects are hitting that sweet spot of public investment and industrial demand, giving DXPE a diversified buffer if one sector cools. Essentially, if oil has a modest slowdown, water and wastewater could compensate, and so on. That spread is sort of their ace in the hole.

Also, as supply chains get more complicated—or just downright wacky (thank you Trump)—DXPE expects more customers to seek out integrated solutions. By providing custom pumping systems, distribution, and supply chain management all under one roof, they’re positioning themselves as the go-to fix-it shop for midsize and large industrial clients.

Profitability & Cash Flow

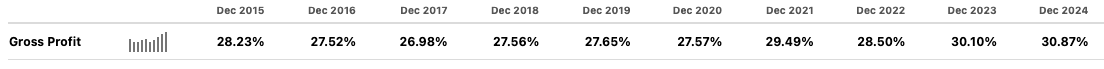

Gross margin improved to its highest since 2015. And in Q4 2024 it was 31.5%. Management was proud of holding or even hiking margins in most segments.

Adjusted EBITDA for 2024 ended around $191 million, or roughly a 10.6% EBITDA margin. Leadership made sure to highlight the second year in a row of double-digit EBITDA margins. And free cash flow hovered around $77 million for the year—down from the prior year but still strong enough to fund acquisitions, shareholder returns, and working capital.

Outlook for 2025

DXPE is optimistic about 2025. They’re carrying a nice backlog in both energy projects and water/wastewater. Plus, the CFO noted that “end markets remain constructive,” meaning nobody’s panicking over a major slowdown. Management expects more synergy out of those 2024 acquisitions and believes they’ve diversified themselves enough that even a shaky macro-environment might not trip them up too badly.

They’re essentially saying: “Even if oil sees price headwinds, water or manufacturing can pick up the slack.” There’s also been talk of continuing share repurchases “opportunistically,” suggesting the board sees the stock as cheap relative to the company’s momentum.

What Went Wrong with AMPH? Key Lessons from My 50% Loss

An important part of my investment process is doing a post-mortem on my investments once I close them, winners and losers. Actually, I have gained more insights from the post-mortem on my losers. Here is my post-mortem on Amphastar Pharmaceuticals (AMPH).

Enjoy!

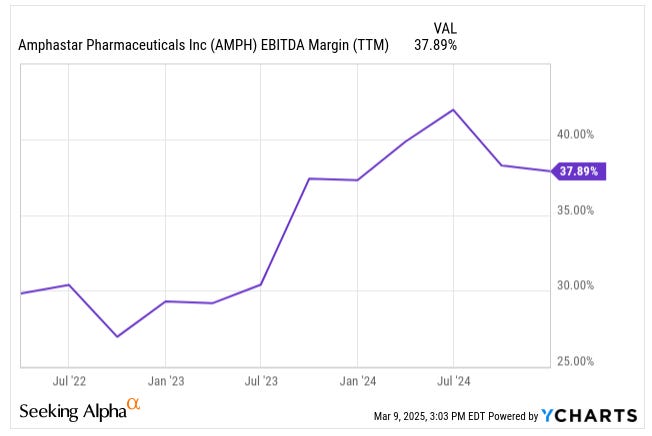

Back in June 2023, I decided to invest in AMPH at $56 per share. At the time, my investment thesis was straightforward and appeared solid. AMPH was growing impressively, with robust revenues driven primarily by their proprietary and niche generic products such as BAQSIMI, a unique nasal glucagon treatment for severe hypoglycemia, and Primatene MIST, an over-the-counter inhaler for mild asthma symptoms. Both products appeared to dominate niche markets with minimal immediate competition, suggesting a defensible market position and consistent revenue streams.

Additionally, AMPH had recently acquired BAQSIMI from Eli Lilly, a move I interpreted as strategic and synergistic, capable of boosting long-term profitability. Financial indicators were appealing as well; AMPH had a solid balance sheet with a net CASH position of $91 million as of March 2023 and consistently high margins.

On top of that, it was trading well below its intrinsic value of $125 based on my DCF valuation.

However, things did not unfold as expected. Over the following months, AMPH’s stock price steadily declined. Usually, I take advantage of price declines and pick up some more stocks at a discount, but this time as it seemed my thesis was not holding and there were structural changes, I just kept my original position and tracked the company. Ultimately, on March 7, I closed my position at $28—a painful 50% loss (keep in mind that it was just ~1.2% of the portfolio, so portfolio-wise, the impact was minimal).

Reflecting on this investment, several key issues became clear:

Firstly, my initial analysis underestimated the impact of competitive pressures and temporary market dynamics. For instance, AMPH’s glucagon business had significantly benefited from temporary shortages at competitors like Fresenius. Once Fresenius resolved its supply issues, AMPH faced immediate market share loss. Additionally, the entry of new competitors, notably Viatris (source) and Lupin (source), further eroded AMPH's position in this key segment.

Secondly, the competitive pressures extended beyond glucagon. AMPH's epinephrine and other generic products faced similar threats. Pfizer’s recovery from earlier disruptions (a tornado damaging a key facility) and the emergence of additional competition sharply reduced Amphastar’s advantage. This illustrated a critical oversight: reliance on temporary competitive advantages rather than sustainable market positions.

Thirdly, the reliance on proprietary products like Primatene MIST proved precarious. Although initially highly profitable, the imminent expiration of its core patent (January 2026) loomed large. Investors, myself included, underestimated how quickly the market would price in this upcoming competitive threat, leading to multiple contractions and a sharp drop in stock value.

Moreover, the expensive acquisition of BAQSIMI, which initially seemed strategically sound, had hidden caveats. The deal with Eli Lilly involved substantial milestone payments, significantly limiting the near-term profitability of the product. This unexpected drain on earnings further weakened Amphastar’s financial profile.

Lastly, Amphastar’s pipeline and potential growth drivers were repeatedly delayed or faced regulatory setbacks, such as multiple FDA rejections for their new products. Products initially expected to compensate for competitive losses failed to materialize or underperformed significantly.

The post-mortem on my AMPH investment yields several critical lessons:

Thoroughly Assess Competitive Advantages: Short-term market conditions or disruptions are not reliable indicators of sustainable competitive moats.

Scrutinize Acquisitions Deeply: Terms of deals, particularly milestone payments and contingent liabilities, require deeper analysis to avoid being blindsided.

Monitor Patent Expirations: Proprietary products with looming patent expirations can see sharp declines long before actual expiry due to market anticipation.

Diversify and De-Risk: Reliance on a small number of high-margin products significantly increases investment vulnerability.

Interestingly, these four points are already on my investment checklist. Yet this time, I did not properly assess them or give them the appropriate weight. This highlights how critical discipline is, especially after more than a decade of investing. I'd argue that the longer you've been investing, the more cautious you need to be about maintaining discipline, as overconfidence naturally tends to grow, potentially causing you to ignore or underweight critical factors.

That is it for this week.

Fellow Sharks, stay sharp and disciplined during these choppy waters!