DXP Enterprises (DXPE): A Hidden MRO Powerhouse with Significant Upside

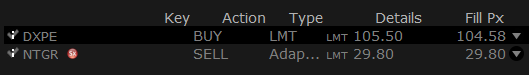

After locking in a 54% return on Netgear (NTGR) in just 123 days, we’re redeploying capital into DXP Enterprises (DXPE) — a high-growth MRO distributor with strong upside potential. Here’s why

Finally, the deep dive is here. I noticed I went overboard on the details so I summarized with the help of ChatGPT the most useful information. Note that we are closing NTGR and redeploying most of that capital to DXPE.

NTGR investment history; 54% gain in 123 days

I am not your financial advisor so do your own research, but for new positions consider buying 2.0% to 2.5% of your portfolio, not more. Also, I wouldn’t recommend buying for less than 1.0% of your portfolio as you would be over-diversifying your portfolio.

Enjoy the read and leave any comments or questions below or drop me a note at hello.svif@gmail.com.

Trade Alert: Buy DXPE and close NTGR in the SVIF USA portfolio.

DXP Enterprises (DXPE), based in Houston, is an MRO distributor established in 1908. Just to give you a sense of how old DXPE is, the first colour photography was introduced in 1907, and in 1908, the Wright Brothers conducted their first-ever passenger flight.

DXPE serves customers across the US and Canada through three main offerings:

Service Centers: supplying MRO products and services for industries like oil & gas, food & beverage, and petrochemicals

Supply Chain Services: helping businesses save money with smarter supply chains

Innovative Pumping Solutions: custom pump packages for water, wastewater, and more

Click the ❤️ button on this post so that more people can discover it on Substack.

DXPE’s Unique Value built around its M&A strategy

DXPE sets itself apart by snapping up other businesses that help it grow and offer more services. Its first acquisition was in 1987 when it acquired Shoreline Supply and then M&A started picking up, according to its website, in total it has acquired 76 companies. These acquisitions allowed DXPE to offer a wide range of MRO products and services for all sorts of industries. By balancing organic growth and smart acquisitions, the company stays nimble and keeps expanding in a fast-moving market.

Click the ❤️ button on this post so that more people can discover it on Substack.

DXP Enterprises vs. The Competition: How It Stacks Up in the Industrial Distribution Market

DXPE operates in a highly competitive sector, facing rivals that vary in scale, specialization, and market reach. Success depends on product breadth, supply chain efficiency, and customer-focused services. Some competitors concentrate solely on industrial MRO supplies, while others specialize in energy distribution or high-margin engineered solutions. DXPE differentiates itself through a diversified product mix, service-driven approach, and mid-sized operational flexibility, enabling it to compete across multiple industries.

DNOW Inc. (DNOW) focuses on energy-sector distribution, providing pipes, valves, fittings, and MRO supplies. Its strength lies in upstream oilfield services, but this concentration makes it vulnerable to oil price volatility. MRC Global Inc. (MRC) is another energy-centric distributor specializing in pipes, valves, and fittings for large-scale projects that has deep industry expertise and global reach.

MSC Industrial Direct Co., Inc. (MSM) has an extensive e-commerce platform and broad product selection. However, DXPE sets itself apart with value-added services such as custom engineering and on-site maintenance, which are crucial in water treatment and manufacturing. Similarly, W.W. Grainger, Inc. (GWW) dominates industrial distribution with vast inventory and strong logistics, but DXPE’s focus on engineered solutions and customer service offers a more tailored approach.

Global Industrial Company (GIC) primarily serves small to mid-sized enterprises through an e-commerce-heavy model. While it overlaps with DXPE in MRO supplies, it lacks the technical services and large-scale industrial solutions DXPE provides. Rush Enterprises, Inc. (RUSHA), focused on commercial vehicle distribution, has limited overlap but competes in supplying heavy industrial equipment.

Transcat, Inc. (TRNS), focusing on calibration and lab services for pharmaceuticals and aerospace, has minimal overlap with DXPE. BlueLinx Holdings Inc. (BXC) specializes in building materials distribution, with some crossover in industrial and specialty products.

By the way, BXC was one of my best picks back in Seeking Alpha. I issued a strong buy in March 2019 when it was trading around $27, I reiterated my buy in November 2019 when the shares dropped to $16 and one more time in January 2020 when it was trading around $13 a share. I closed my position in February 2023 when the shares were close to $90.

My adventures with BXC

Back to DXPE…

Industrial Growth Tailwinds

When we look at industry, DXPE should benefit from the trends in industrial automation, infrastructure spending and energy transition.

Increasing Industrial Automation

While tariffs might hurt DXPE (more on that below in the Risk section), I think Trump’s policy of bringing manufacturing back to US would push for further automation as we cannot compete with China or Mexico on labor cost, so manufacturing should rely more on automation. This will fuel demand for advanced MRO products and custom solutions. DXPE’s focus on high-value, service-intensive offerings, such as Innovative Pumping Solutions (IPS), positions it well to capitalize on this trend. For example, custom pump solutions that integrate advanced monitoring systems are becoming increasingly critical in automated manufacturing processes, where uptime and efficiency are paramount.

Infrastructure Spending

The US Infrastructure Investment and Jobs Act (IIJA), which allocates billions toward roads, bridges, water systems, and energy infrastructure, directly aligns with DXPE’s product portfolio. The IIJA authorized $1.2 trillion for transportation and infrastructure spending, dedicating $105 billion to modernize transit systems and improve accessibility, $110 billion to repair roads and bridges, $73 billion to overhaul the nation's power infrastructure, $65 billion in broadband development, $21 billion for environmental projects and $50 billion for water storage.

Energy Transition Investments

As the world transitions toward cleaner energy, sectors like renewable energy, hydrogen, and carbon capture are creating new demand for specialized industrial equipment. DXPE is a natural partner for companies building out renewable energy projects or upgrading legacy oil & gas systems to support sustainability initiatives.

Sector-Specific Growth

DXPE’s diversified exposure to high-growth industries positions it to capture sector-specific opportunities.

Oil & Gas

While the industry remains cyclical, recent stabilization in oil prices and increased capex from energy producers are driving demand for DXPE’s MRO and custom pumping solutions. The company’s ability to service upstream, midstream, and downstream operations ensures a steady revenue stream across various stages of the energy value chain. Additionally, as oil companies invest in efficiency and emission reduction technologies, DXP’s custom solutions, which integrate efficiency monitoring, are highly relevant.

Water Management

Rising concerns over water scarcity and the need for efficient wastewater treatment are accelerating investment in water management infrastructure. DXPE’s IPS segment is well-positioned to benefit, particularly through its ability to design and deliver custom pumping solutions for water treatment facilities. With governments and private entities prioritizing sustainable water use, this segment offers significant growth potential.

Food & Beverage

The increasing focus on hygiene, automation, and efficiency in food processing is driving demand for specialized equipment and MRO solutions. DXPE’s expertise in supplying and servicing industrial equipment tailored to this sector allows it to capitalize on these trends. For example, the company’s ability to provide clean-in-place (CIP) systems for food-grade applications aligns well with the industry’s strict regulatory requirements and need for efficiency.

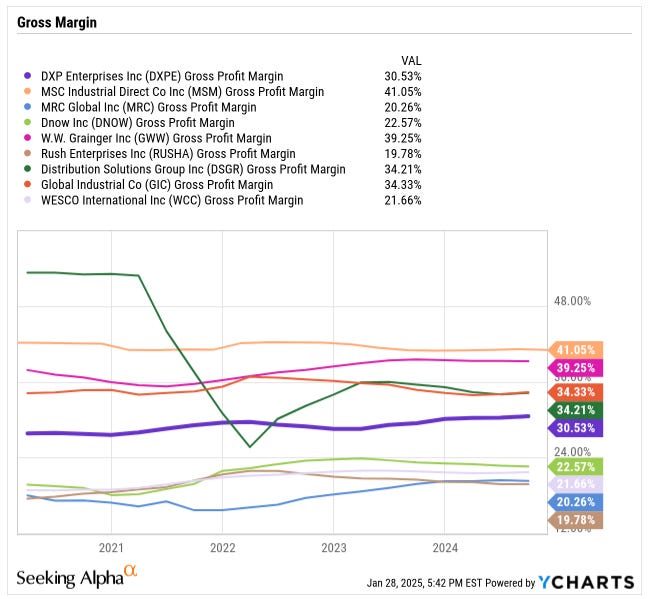

Profitability Trends

DXPE's gross margin consistently sits in the middle of the competitive spectrum due to its diversified business model and broad industry exposure. Unlike high-margin peers such as MSM and GWW, which benefit from scale efficiencies and a focus on niche, high-margin products, DXPE operates across a wide array of sectors. While this diversification provides stability, certain industries, particularly oil & gas, naturally yield lower gross margins. Moreover, DXPE’s product portfolio, which balances standard MRO supplies with more specialized and custom solutions, helps maintain margin consistency but prevents it from reaching the profitability levels of niche-focused players.

Another key factor influencing DXPE’s margins is its acquisition-driven growth strategy. Acquisitions often come with integration costs and varying levels of profitability, which can dilute gross margins in the short term. While these acquisitions enhance top-line growth and market presence, they require time to unlock their full value and synergies. Ultimately, DXPE’s positioning reflects a balance between stability and growth, with opportunities to expand gross margins through operational efficiencies, scaling high-margin segments, and leveraging acquired assets more effectively.

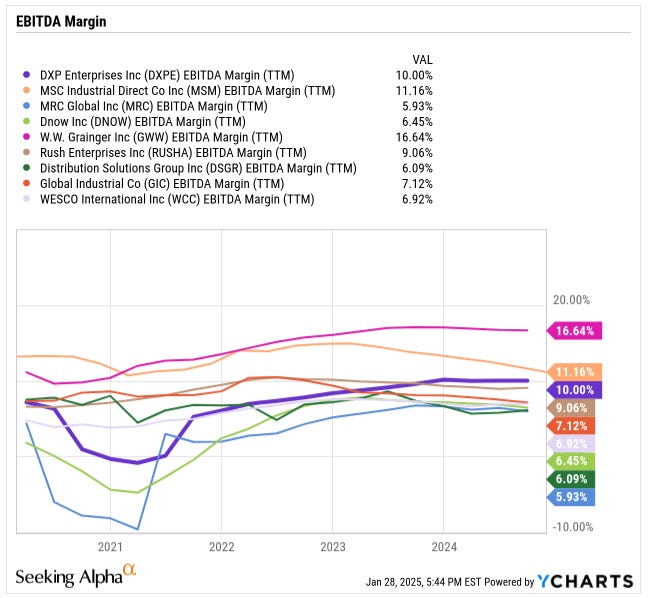

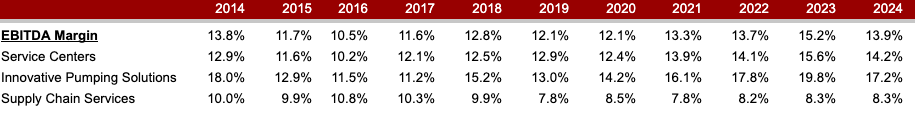

DXPE's EBITDA margin, positioned slightly higher than most of its competitors, reflects its focus on operational efficiency and a balanced product-service mix. The company’s margin profile benefits from its integration of high-value service offerings, such as IPS and supply chain management, which enhance profitability compared to pure product distribution models. These segments typically generate higher operating leverage, contributing to a better EBITDA margin relative to competitors that may rely more heavily on lower-margin product sales.

Moreover, DXPE’s consistent focus on acquisitions has enabled it to expand into higher-margin businesses, capturing synergies that enhance operational efficiency. Unlike some competitors, such as MRC and DNOW, which operate in commodity-driven markets like oil and gas, DXPE serves a diversified customer base across industries such as water treatment, manufacturing, and food and beverage. This diversification shields it from the margin pressures faced by peers heavily reliant on cyclical or low-margin industries.

DXPE’s mid-sized operational scale allows it to avoid some of the inefficiencies that larger competitors like GWW may face while still benefiting from economies of scale in procurement and distribution. While DXPE’s EBITDA margin does not match industry leaders, its ability to optimize its mix of products and services while managing costs effectively places it ahead of most of its peer group in terms of profitability.

Additionally, DXPE’s disciplined acquisition strategy plays a crucial role in driving its EBITDA performance. While acquisitions can temporarily dilute margins due to integration costs, they often lead to significant operating efficiencies and synergies over time, which enhance EBITDA margins. In contrast, some peers with lower gross margins, like DNOW or WCC, lack the same operational leverage or cost controls to achieve similar EBITDA performance. By effectively balancing a diversified revenue mix with cost discipline, DXPE is able to maintain a stronger EBITDA margin, despite not dominating the gross margin leaderboard.

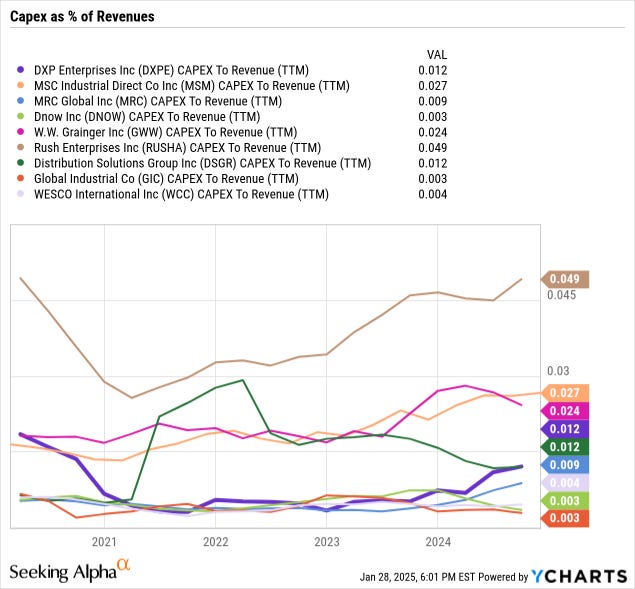

DXPE’s lower capex intensity compared to many of its competitors can be attributed to its business model. Unlike companies such as RUSHA or MSM, which may require higher capex for maintaining large physical assets like fleets, warehouses, or manufacturing facilities, DXPE operates a more service-driven and asset-light model. Its focus on distributing MRO products and providing custom solutions, rather than owning and managing significant infrastructure, allows it to maintain a lower capex intensity.

This acquisition-driven strategy enables the company to expand its footprint, customer base, and capabilities without the need for substantial upfront capex. By acquiring existing businesses and integrating them into its operations, DXP minimizes the need for large investments in property, equipment, or new facilities.

Furthermore, DXPE’s diversified product and service offerings often emphasize operational efficiency and scalability rather than heavy investments in physical assets. For example, its supply chain and IPS leverage existing infrastructure and technology, which require less incremental capital investment. This contrasts with companies like GWW or RUSHA, which may have ongoing capex demands to expand or modernize their facilities or fleets to maintain competitive positioning.

Share the Love! Invite friends to join our community and earn rewards!

Capital Allocation Strategy of DXP Enterprises

Balancing Acquisitions with Organic Growth Investments:

DXPE strategically allocates the majority of its capital toward acquisitions, which have been the cornerstone of its expansion strategy. For example, its acquisitions in the Innovative Pumping Solutions (IPS) segment have allowed it to penetrate higher-margin markets like water treatment and petrochemicals. These acquisitions are deliberately chosen to align with DXPE’s focus on high-value and service-driven solutions.

At the same time, DXPE maintains targeted investments in organic growth, particularly in digital transformation and operational efficiency. The company has invested in modernizing its e-commerce platform and inventory management systems, which enhance customer experience and streamline internal processes. These investments are relatively low-cost compared to acquisitions but yield high returns by improving scalability and driving operational efficiencies.

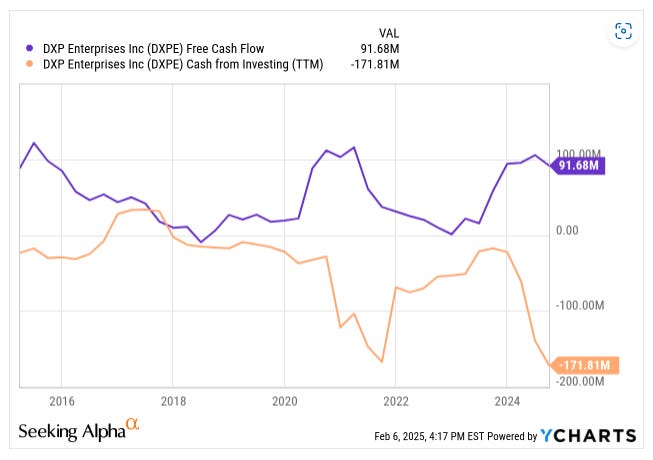

Free Cash Flow Generation and Funding Growth

DXPE generates strong FCF, driven by its stable gross margins and operational efficiency. It has consistently used this cash flow to finance acquisitions while minimizing reliance on external debt. This disciplined approach reduces leverage risk and funds expansion.

Additionally, DXPE’s low capex-to-revenue ratio (around 1.2%) reflects its asset-light business model, allowing it to reinvest the majority of its cash flow into growth initiatives rather than fixed assets. This is a notable distinction from peers like MSM or GWW, which allocate more toward physical infrastructure and expansion.

Managing Shareholder Returns

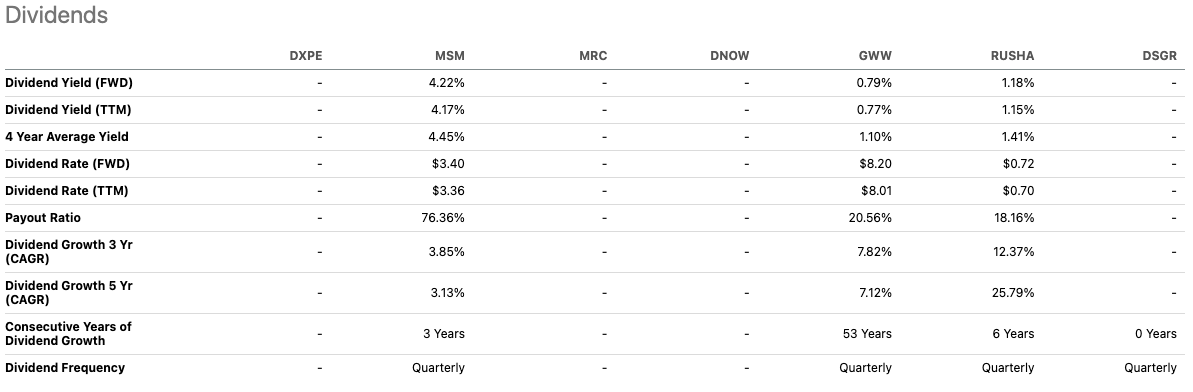

DXPE has historically been conservative in direct shareholder returns, such as dividends or buybacks. For example, while some competitors like MSM, GWW and RUSHA regularly pay dividends and repurchase shares, DXPE has focused its resources on reinvestment into acquisitions. The company initiated a share repurchase program in 2022, demonstrating its willingness to return capital when excess cash flow is available. However, shareholder returns remain secondary to its core growth strategy, emphasizing long-term value creation over immediate payouts.

Valuation

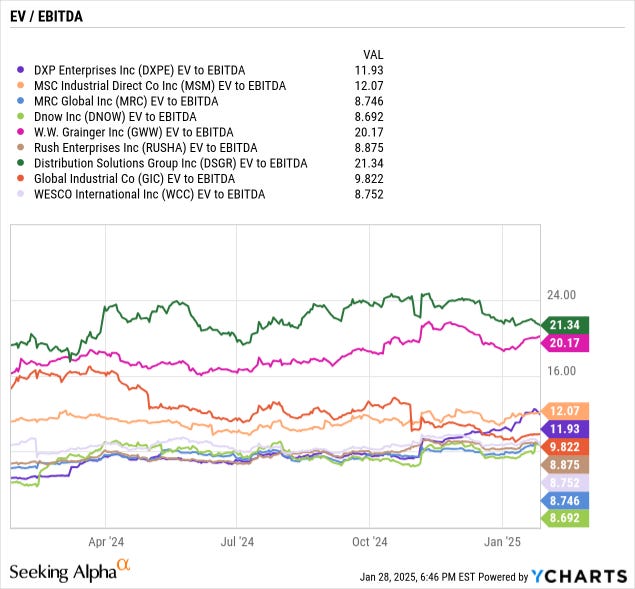

On a relative basis, the stock appears fairly priced.

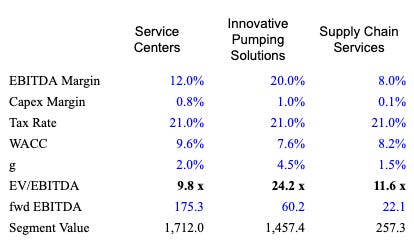

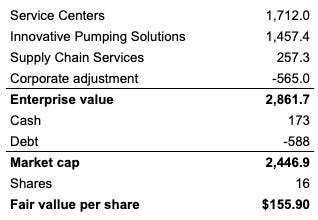

However, when we value each segment separately, the fair value of DPXE’s shares is almost $156 per share. The weighted cost of capital is 9.0% based on an unlevered beta of 1.15 and an optimal debt-to-capital ratio of 55%. Note that I adjusted the cost of capital per segment to take into account the risk of the cash flows, however, the average is the same at 9.0%.

Risks

Weakness in the Supply Chain Services (SCS) Segment

This risk is not as significant as this segment represents around 15% of DXPE’s revenues. This weakness stems from fluctuating demand in key industries and potential inefficiencies in managing supply chain operations.

To address these challenges, DXPE is reportedly optimizing its supply chain processes by leveraging technology to improve visibility and efficiency. Their SmartSolutions® programs, such as SmartVMI®, utilize advanced software and equipment to optimize inventory management, ensuring critical products are always available and reducing waste. Additionally, SmartCMMS® offers a user-friendly, web-based platform for electronic requisitions and comprehensive maintenance management, further streamlining operations.

Additionally, the company is exploring supplier diversification to mitigate risks associated with over-reliance on specific vendors or regions, particularly in a volatile macroeconomic environment.

DXPE has been actively diversifying its supplier base to reduce dependence on specific vendors or regions, especially given the unpredictable global economy. A notable example is their acquisition of Total Equipment Company, APO Pumps & Compressors, and Pumping Solutions, Inc. in December 2020. These strategic moves expanded DXPE's presence in the water and wastewater sectors, thereby broadening their market reach and supplier network.

Furthermore, in November 2024, DXPE acquired Burt Gurney & Associates and MaxVac Inc., enhancing their footprint in the municipal water treatment and vacuum pump markets. These acquisitions not only diversified their supplier relationships but also mitigated risks associated with over-reliance on specific vendors or regions.

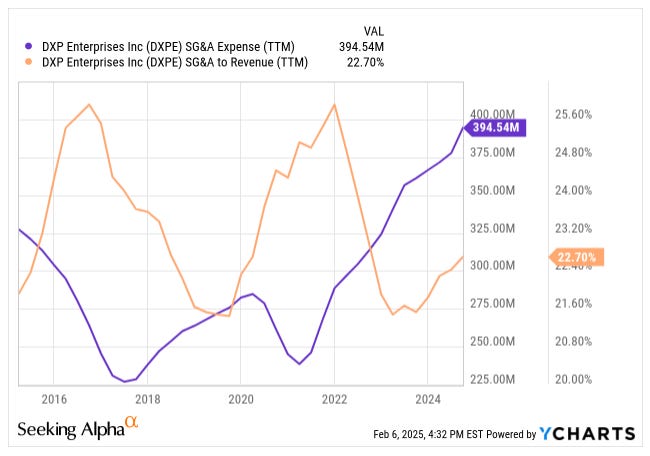

Increased SG&A Expenses

Rising SG&A costs have partially offset the gains from high-margin segments like IPS. This upward pressure on expenses could erode profitability if not managed effectively.

DXPE has initiated cost-control measures such as streamlining admin processes and investing in automation to offset rising SG&A. The company is also leveraging technology to enhance operational efficiency and reduce manual overhead, which could stabilize SG&A costs over time.

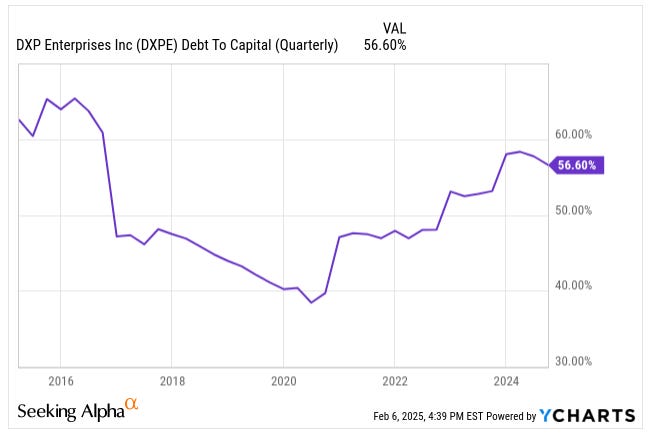

High Leverage and Financial Risks

DXPE’s elevated leverage ratio and growing interest expenses present financial risks, especially in a rising interest rate environment. These factors could strain cash flow and negatively impact the company’s bottom line if not managed carefully.

However, DXPE has taken steps to address these challenges by pursuing refinancing initiatives. For example, recent debt restructuring has extended maturities and reduced the average cost of borrowing by 100 basis points, providing the company with greater financial flexibility. Continued focus on deleveraging through free cash flow generation and prudent capital allocation will be critical to mitigating these risks.

Risk of tariffs

Tariffs on imported industrial components and raw materials could directly impact DXPE’s cost structure, pricing power, and supply chain efficiency. Given DXPE’s reliance on international suppliers for pumps, valves, bearings, and other MRO products, higher import duties would increase the company’s COGS. If these costs cannot be fully passed on to customers, its gross margins could come under pressure, particularly in industries where pricing sensitivity is high, such as oil & gas and general manufacturing. Competitors with stronger pricing power, such as GWW and MSM, may have more flexibility in absorbing cost increases due to their scale, putting DXPE at a disadvantage in maintaining competitive pricing.

On the supply chain front, tariffs could force DXPE to reevaluate its sourcing strategy. The company may need to shift procurement from tariffed regions like China to lower-cost markets or domestic suppliers. While this could help mitigate tariff-related expenses, it may also result in higher lead times, increased working capital requirements, and potential supply chain disruptions. If DXPE accelerates inventory purchases ahead of tariff hikes, it could tie up cash flow, reducing liquidity for other strategic initiatives like acquisitions or debt reduction. Furthermore, supplier diversification efforts may take time, increasing short-term operational risks as the company builds new relationships with alternative manufacturers.

In terms of competitive positioning, DXPE may face increased pressure from domestic distributors who source locally and are less exposed to tariffs. Customers in industrial and energy sectors often operate on tight budgets and fixed contracts, making it challenging to fully pass on tariff-related cost increases. If DXPE raises prices, it risks losing market share to competitors with stronger domestic supply chains or those willing to accept lower margins to maintain volume. Additionally, smaller regional distributors with lower overhead costs could undercut DXPE on pricing, particularly in highly competitive segments like MRO consumables.

However, tariffs may present an opportunity if the US government expands “Buy American” policies favoring domestic industrial suppliers. DXPE could leverage its custom engineering and supply chain management capabilities to position itself as a value-added partner rather than just a distributor of industrial parts. This strategy may help the company retain customers who prioritize service quality over pricing, partially offsetting tariff-related cost pressures.

Investment Case & Final Thoughts

Despite DXPE’s strong margin expansion and proven M&A strategy, shares remain undervalued based on a $156 per share sum-of-the-parts valuation, offering meaningful upside. Its diversified business model shields it from volatility in any single industry, while its service-oriented differentiation allows it to compete against larger players.

At the current valuation, DXPE appears undervalued. A sum-of-the-parts valuation suggests a fair value of $156 per share, implying meaningful upside from current levels. With an estimated 9.0% WACC, DXPE's risk-adjusted return profile remains attractive, particularly given its ability to generate free cash flow and reinvest in high-margin segments.

Catalysts include:

Further margin expansion through high-growth segments like IPS, which is growing 53% YoY.

Continued M&A execution, with two additional deals expected in Q1 FY25 to further strengthen its market presence.

Operating leverage gains, as acquisitions scale and SG&A expenses normalize.

Potential multiple re-rating, as DXPE proves it can sustain mid-to-high EBITDA margins above peers.

While risks such as tariffs, supply chain volatility, and rising interest expenses exist, DXPE's ability to balance organic growth with acquisitions, optimize costs, and leverage its diversified revenue base makes it a compelling investment at current prices.