Closing WGS and CLOV Positions – Locking in Gains Before Market Volatility

Selling WGS After a 29.5% Gain in 71 Days & CLOV After a 17.8% Gain – Why I'm Taking Profits Now

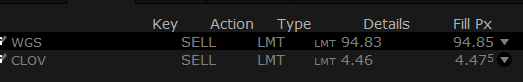

Trade Alert: We are closing WGS and CLOV in the Portfolio USA.

Closing WGS after only holding the shares for 71 days

On December 9, 2024, I recommended buying WGS. Even though I hold positions for longer than a couple of months, the run-up and gap opening cause me to close my position for now and reassess once the market calms down.

The return on this trade is 29.5% over 71 days, which equates to an annualized return of 277%. Some may say that I am leaving money on the table, but the risk-reward profile is unfavourable right now.

Summary of WGS earning results

Earlier today, WGS released earnings. The company reported strong Q4 2024 results, which caused the shares to gap on today’s opening. Revenue reached $95.3 million, up 64% year-over-year. Adjusted gross margin expanded to 70%, while adjusted net income came in at $16.8 million. Full-year 2024 revenue grew 56% to $302.3 million, driven by a 51% increase in exome and genome testing volume. The company maintains a solid cash position of $142.2 million.

For 2025, GeneDx projects revenue between $350 million and $360 million, with at least 30% growth in exome/genome volume and revenue. The company continues expanding its genomic testing footprint, particularly in pediatric and NICU settings and recently launched ultraRapid Whole Genome Sequencing.

Closing CLOV: Managing Risk Ahead of Q4 Earnings

I am closing my position in Clover Health due to the increased risk of a post-earnings selloff, similar to what occurred after Q3 results. I initially bought shares on October 7 at $3.80, and with the stock now up just 17.8% over 134 days (an annualized return of 56%), I see limited upside in holding through potential short-term volatility. While the company has delivered strong Medicare Advantage growth and macro tailwinds, such as higher reimbursement rates and regulatory changes, the 40% year-to-date rally and 60% retail ownership make profit-taking a real concern.

If the stock rallies post-earnings, I’ll consider re-entering with greater conviction; however, if we see another panic-driven dip like in Q3, I’ll wait for clear signs of a reversal before buying back in. For now, I’d rather lock in gains and avoid unnecessary downside risk.