On March 11, RERE reported earnings. Results were better than expected, with revenue climbing ~25% y/y for the quarter and full-year. Profitability also advanced reflecting operating margin improvements as the company expanded its 1P direct sales to consumers and multi-category recycling businesses. During the call, management highlighted strong momentum from partnerships with JD.com and rising brand awareness via new media channels.

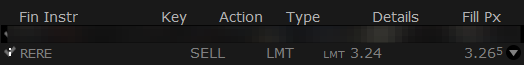

I expect RERE to continue benefiting from ongoing consumer upgrade trends, stronger trade-in demand, and further development of high-margin product categories. As a result, I believe revenue will continue growing. Having said that, I am closing our position looking at a 20% gain or 52% IRR.

I am still bullish on RERE, but as I mentioned in the last Weekly, I am rebalancing from the lowest risk-reward opportunities to the highest. And I found another Asian stock offering a better profile.

This new company is a rapidly growing Asian fintech platform positioned to benefit from the booming online consumer finance market across emerging Asian economies. Trading at an attractive forward P/E of just 7x, this under-the-radar company offers a robust 2.2% dividend yield, alongside projected double-digit EPS growth.

What sets it apart?

The firm leverages advanced big data analytics and proprietary machine learning technology—its secret weapon for superior credit risk management and operational efficiency. Already a market leader domestically, its explosive expansion into international markets like Indonesia and the Philippines is driving impressive borrower growth and higher profitability.

Below is the Trade Alert.