Argentina: Choppy Waters, Big Catches

From Sovereign Defaults to Strategic Investments in argentine banks and YPF – A Shark’s Approach to Risk and Reward.

I vividly remember Argentina losing the 1990 World Cup final to West Germany, 1-0. Back then, Argentina was seen as a developed country, envied by the rest of South America. I didn’t think about Argentina again until 2011.

In 2011, I joined an asset manager in Chile and travelled across Latin America, including Argentina. Most trips were for work, meeting companies with public shares or junk bonds, my focus at the time.

I also travelled for leisure. This photo is from almost 13 years ago in Buenos Aires, Argentina.

How time flies…

Time flies indeed, the Argentine government tends to have a very short memory, forgetting the mistakes of the past and repeating them. Since its start, Argentina experienced nine sovereign debt defaults, making it one of the countries with the most recurring debt crises. These "bankruptcies" or defaults occurred in 1827, 1890, 1951, 1956, 1982, 1989, 2001, 2014 and 2020.

Investing in Argentina is tough, actually, the first time I had to deal with a bankruptcy was in 2014 with an Argentine power firm. That ruined my zero-bankrupcies streak. After I moved on to brighter pastures, I read the company went bankrupt again in 2021 and the state had to intervene — and the drama continues up to today.

This hasn’t stopped me from investing in Argentina, but it made me aware of the Argentine default cycle and to invest around it, ready to get out before the winds change.

Over the years, my Argentine investments have focused on YPF, the Argentine oil & gas company and Argentine banks. I tend to buy when sentiment is low and exit when sentiment is at its peak.

This is the path of the Shark. This is the Way.

Case in point, when YPF shares dropped from $30 to $16 in 2016, I picked up shares based on the rationale in this article I published in Seeking Alpha. Then sold them at $25 in early 2017. I bought YPF shares again in mid-2023 at $14, only to sell them in mid-2024 at $21, missing the run-up to above $40.

My Adventures with YPF

Why invest in Argentine Banks?

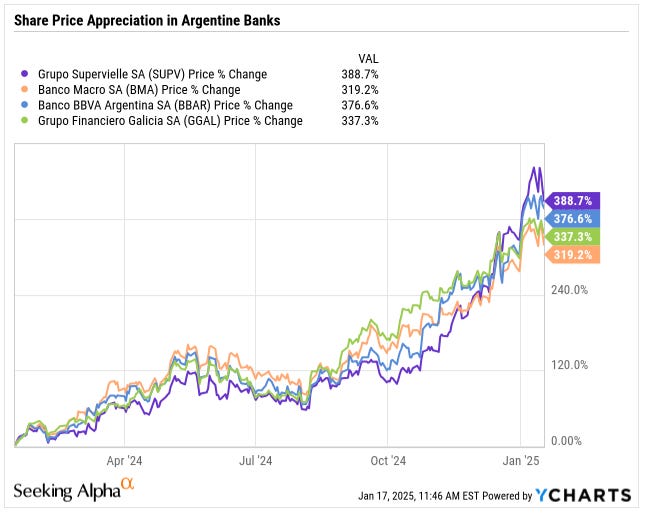

If you had invested in any of the Argentine banks below, your shares would have increased in price by anywhere from 320% to 390%.

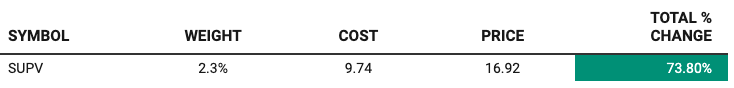

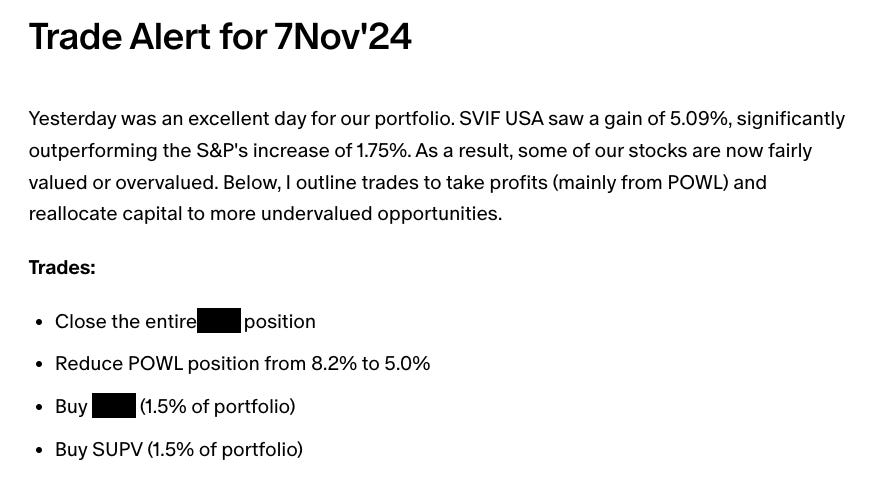

Among the banks, I picked SUPV as deserving of a spot in the portfolio. On November 7, 2024, I sent a trading alert to paid subscribers recommending buying SUPV.

The shares are up almost 78%. (As of today, the shares are $17.30.)

So which Argentine bank did I invest in?