Why Beating the Tide Is One of the Best Stock Investing Newsletters in 2025

Discover why Beating the Tide is the best stock newsletter of 2025: Join hundreds of investors who rely on Beating the Tide for deep dives, actionable ideas, and market skepticism that pays.

Why We’re the Best Stock Newsletter

Looking to stay ahead of market trends and uncover high-conviction stock ideas?

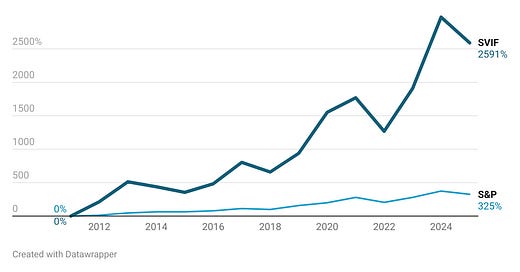

Beating the Tide has outperformed the S&P 500 by over 2,500% since 2011. Trusted by hundreds of investors, our newsletter delivers deep-dive analyses, real-time trade alerts, and data-driven insights straight to your inbox.

👉 Browse the full index of everything I’ve written — deep dives, weekly letters, and investing insights — right here.

Past Stock Picks

Click on the trade for more details on each.

Testimonials

What You’ll Receive as a Free Subscriber

Here’s a breakdown of what you’ll receive in your inbox:

1. The Weekly newsletter

This is sent on Sundays. The Weekly includes the portfolio's performance and my thoughts for the week. The thought can be a stock idea, an opinion on the market, an investment philosophy, personal finance, or anything I believe would be of value to you. Everything is free except for the performance of each stock, which is under a paywall at the bottom of the Weekly.

You can find previous Weeklies here.

Here is a sample Weekly,

2. Occasional stock idea

A piece that would detail why I like or dislike a certain company, including a dissection of their strategy, stock valuation and risks.

You can find previous stock ideas here.

Here is a sample of a stock idea,

Fortrea (FTRE): An Attractive Post-Spin-Off Opportunity From Labcorp (LH)

Important Note: This is not a Trade Alert. FTRE is not currently part of my highest-conviction USA portfolio. This article highlights a company that I find interesting and believe offers upside potential, though not quite enough to join my top-tier selections.

Unlock Premium Alerts & Portfolio Performance

As a Paid Subscriber, you receive everything Free Subscribers get, plus

1. Weekly stock performance

In Sunday Weeklies, I will include the performance of each stock in the portfolio. This will be at the bottom of the Weekly, behind a paywall.

2. Real-time buy/sell alerts in my portfolio

Whenever a position is added or sold in the portfolio, I will post the trade. I tend to send those notes between 10 am and 2 pm. The note will have a rationale behind the thesis. Those positions tend to stay in the portfolio for 6 months to 1.5 years, but I have had some that closed in 2 months and some that have been in my portfolio for 7 years (and are still open).

You can find my historical trade alerts here.

Here is a sample trade alert,

DXP Enterprises (DXPE): A Hidden MRO Powerhouse with Significant Upside

Finally, the deep dive is here. I noticed I went overboard on the details so I summarized with the help of ChatGPT the most useful information. Note that we are closing NTGR and redeploying most of that capital to DXPE.

3. Access to my portfolios

On the right-hand panel in the Home tab, you can find the portfolios under ‘Paid Membership’.

Below is a sample portfolio,

4. One in-depth stock idea per month

Once a month, I will send a detailed investment analysis for a company I am adding to the portfolio.

Here is a sample deep dive that I did for TSMC (7,400 words),

TSMC Stock: Why This Semiconductor Giant is My Highest-Conviction Buy

In Romy and Michele's High School Reunion (1997), there is a scene that was a very common dynamic in high school. Romy excitedly gets invited to prom by a guy, but later, he cancels on her because one of the popular girls becomes available. It’s a classic case of ditching someone for a more desirable option.

🔥 Exclusive New Member Offer! 🔥

As a new subscriber, I’m offering you 25% off the paid plan forever.

Sign up today and start accessing real-time trade alerts, my full portfolio, and in-depth stock ideas.

The paid plan pays for itself. Based on my average annual return, a $10,000 portfolio could cover the subscription cost for the year in just 15 days. If you go for the annual subscription, it gets even better. The subscription would pay itself in just 11 days. Remember that this is just my estimate, as past performance is not indicative of future results.

I look forward to sharing my insights with you. You can email me anytime at george@beatingthetide.com. I read all the emails and aim to reply within 24 hours.

~ George

Disclaimer

Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. I am not a licensed securities dealer, broker, US/Canadian investment adviser or investment bank. I am not licensed or certified by any institute or regulatory body.

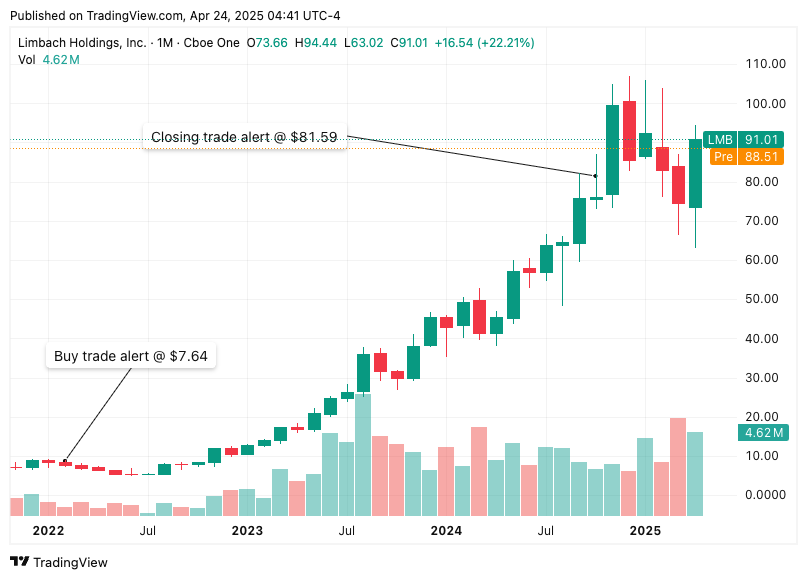

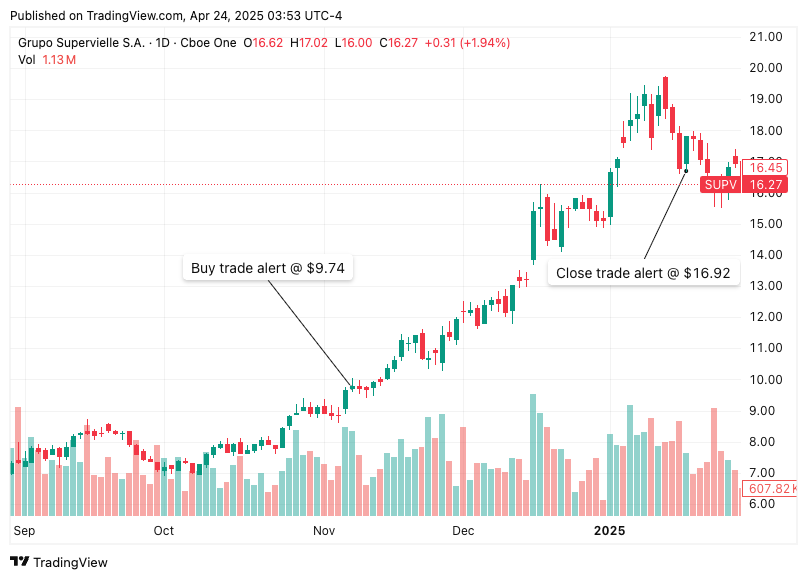

Details on past stock picks

Trade details and sources on the caption of each image.

Bought ⬆️ DQ: +1,726%

Bought ⬆️ LMB: +968%

Bought ⬆️ TGLS: +340%

Bought ⬆️ CPS: +273%

Bought ⬆️ BXC: +220%

Bought ⬆️ GLGI: +164%

Bought ⬆️ AVGO: +154%

Bought ⬆️ NGL: +132%

Bought ⬆️ UBER: +121%

Bought ⬆️ NXXYF: +115%

Trade alert at $0.86 and was acquired within 2 months for $1.85.

Bought ⬆️ TEN: +99%

Sent a buy trade alert in January 2022 at $10.40 and was acquired in 31 days by Apollo for $20.

Short ⬇️ BYND: +97%