Weekly #26: What Market Efficiency Really Means—and How Fundamental Investors Can Still Win

TSMC Earnings, Fed Fireworks, and Portfolio Recovery: How Semi-Efficient Markets Still Reward Deep Dive Investors

Table of Contents:

Hello fellow Sharks,

This week, I had a pretty long talk about market efficiency with a very good friend. While I agree that most investors should stick with a passive investment strategy using ETFs, if you want to grow your savings faster by beating the market, you should follow an active strategy, even if markets are semi-efficient.

While humans grasp many concepts well, they often struggle to intuitively understand how compounding works. Many years ago, I read a story about a peasant playing chess with a king. Forgive me if I’ve forgotten some of the details—it’s been a while. But I remember the key takeaway, and so will you. The king enjoyed the game so much that he offered the peasant whatever he desired.

So the peasant asked the king just for rice. He asked him one grain on the 1st square, two grains on the 2nd square and so on, doubling the grains on each square until all 64 squares were filled.

The king agreed.

Do you know how many grains of rice the king owed the peasant?

Instead of making your life easy by giving you the answer, I’ll make you work for it. Just give an approximation—no calculator.

Ready…Go!👇

You can find the answer in the footnote1. I bet you got it wrong, I did and the king obviously did.

Why am I talking about compounding?

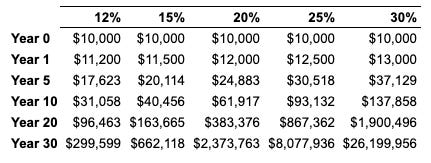

Because the extra work to beat the market pays off. The S&P 500 has averaged 12% since 2012, assuming you find an ETF mirroring the S&P 500 without an expense ratio, obtaining the 12% should be easy. If you contribute just $10,000 and leave it compounding at 12% for 30 years, you’ll end up with nearly $300,000. That’s a 30x return.

Your returns grow the more you contribute—something you should absolutely do. But to keep it simple, let’s assume you just had the $10,000 and never put a dollar more into your investment account.

If you improve your stock portfolio’s performance by 25%, your annual average return would be 15% (12% x 1.25). In that scenario, you more than doubled your money from $300,000 to $660,000 in 30 years.

If you achieve a 30% return, you’d have over $26 million after 30 years.

So, yes, most should avoid the headaches of active investing. Keep your $300k—I’m chasing the $26 million. 🤑

My friend argued that most portfolio managers underperform the index. I agreed, but I argued that if you know what you are doing, you can be the few that outperform the market and extract higher returns.

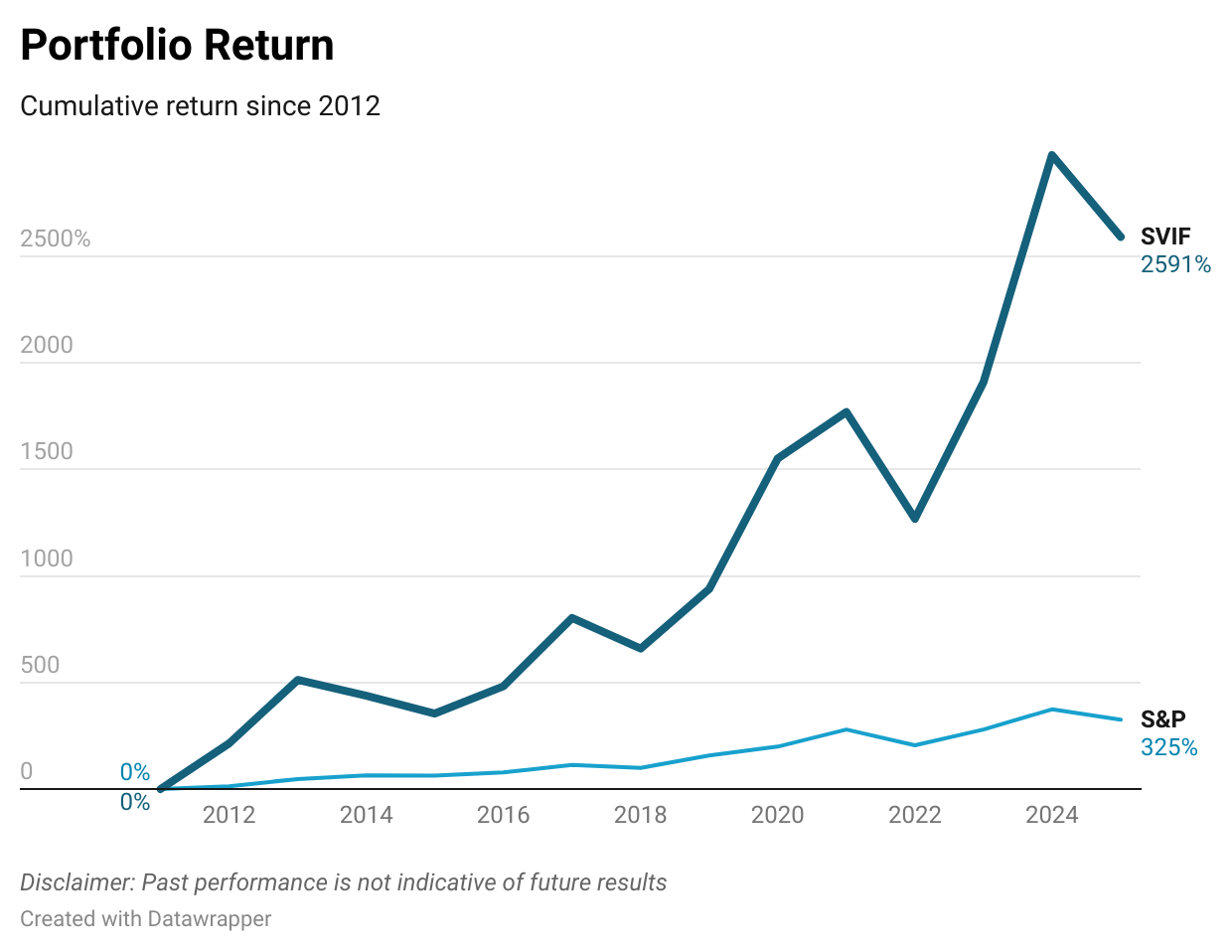

Forget about my +10-year overperformance—I’m just one investor, and maybe I’ve been lucky so far.

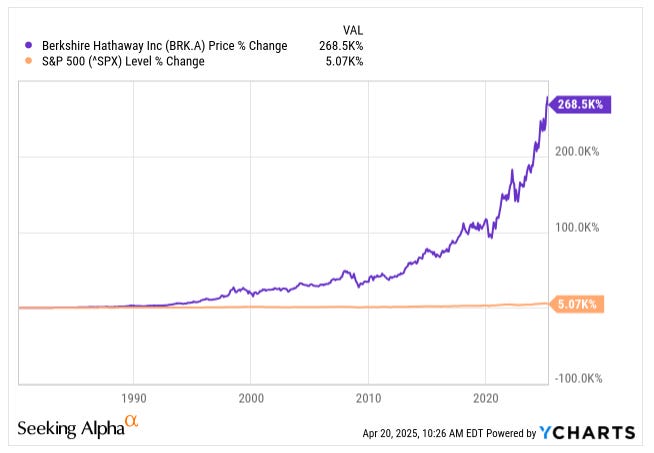

Look at Warren Buffett, do you think that he also got lucky since 1980?

But my friend argued that the market is efficient, so I cannot beat the market in the long term.

And that is the focus of the thought of the week.

Enjoy!

Thought of the Week - What Does It Mean for a Market to Be Efficient? (And Why It Matters for Stock Investing)

Market Efficiency: Not Just Academic Mumbo Jumbo

I bet even before I mentioned it above, you heard the phrase "efficient market" tossed around, especially when someone, like my friend, is trying to convince you it's pointless to try and beat the market.

But what does "market efficiency" actually mean?

Simply put, a stock market is considered efficient when prices fully reflect all publicly available information. Essentially, this means there's no easy, consistent way to outperform because every piece of news, earnings announcement, economic data point, or juicy rumour is already baked into the current share price.

This idea was popularized by economist Eugene Fama back in the 1970s, under what's known as the Efficient Market Hypothesis (EMH).

The Three Flavours of Market Efficiency

Market efficiency isn't just one big monolithic idea—it comes in three different forms:

Weak-form efficiency: Stock prices reflect all past trading data. So, sorry technical analysts, your candlesticks and moving averages won't reliably help you beat the market.

Semi-strong form efficiency: Stock prices include all publicly available information. Financial statements, earnings reports, management commentary—all quickly priced into the shares.

Strong-form efficiency: Even insider information is priced into stocks. In theory, not even company insiders can profit consistently from non-public info. (Good luck with that one!)

Most real-world markets, including major stock markets like the NYSE, fall into the semi-strong category. Information travels fast, but there are still occasional hiccups.

Why Should You Care About Market Efficiency?

Here's the kicker: If markets are truly efficient, trying to outperform them consistently should be nearly impossible, right?

That's the theory—and it's exactly why passive investing and indexing have become wildly popular. Why try to beat the market when you can just own it cheaply?

But, and it's a big but, the market isn't always perfectly rational.

Why I Believe You Can Beat the Tide

I didn't name my newsletter Beating The Tide just because it sounds cool (even though, let's face it, it does). Passive investing is just surfing on the tides, but the tides control you; if they go up, you go up, if they go down, you go down. But active investors should aim to outperform regardless of which way the tide moves. That’s where the name comes from: while we may over- or underperform the tide in the short term, we aim to beat it over the long term as we are focused on the signal and ignore the noise.

How?

Here's my secret sauce: markets are semi-efficient. This means that while most news and public information gets rapidly reflected in prices, the market often misinterprets information, especially in the short term. The real skill—and the source of long-term alpha—is in spotting trends before they're obvious and correctly interpreting available data when others get it wrong.

Take Daqo New Energy (DQ), for example. Back in 2017, I identified DQ as a deep value stock in the polysilicon space, positioned to dominate as the lowest-cost producer, thanks to its strategic location with lower electricity costs and efficient production processes (here is my initial thesis that I posted on Seeking Alpha). While the market saw falling polysilicon prices as negative, I saw it as an opportunity for low-cost producers like Daqo to consolidate and capture market share.

Was the market efficient?

Yes, it was, but the market focused on the noise (declining polysilicon prices) rather than on the signal (the lowest cost producer and solar panels were booming).

Noise vs. Signal: Ignore the Breaking News Headlines

Financial news channels like Bloomberg or Yahoo Finance bombard you with real-time alerts. Sure, it feels crucial, but most of this news is just noise. Markets react immediately, and that reaction is usually priced in within minutes.

Yet, not every piece of breaking news is meaningful for a company’s long-term fundamentals. For instance, a temporary supply chain hiccup reported in real-time might cause a company's stock to dip momentarily. Investors glued to the news might panic-sell. But if you zoom out and realize that the company's long-term fundamentals remain intact, these moments often represent buying opportunities.

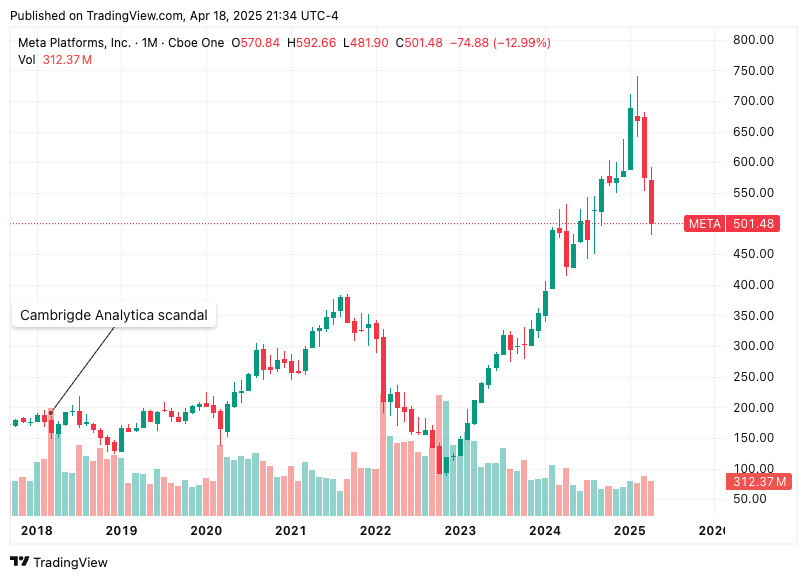

Consider Meta in early 2018. The Cambridge Analytica scandal led to massive headlines, public outrage, and a sharp sell-off in the stock, dropping ~15% from $176 to $150. But long-term fundamental investors focused on Meta’s core advertising engine, user moat, and strong margins, understood that the platform’s underlying strength hadn't changed. Fast-forward a few years, and Meta rebounded stronger than ever, demonstrating the power of staying focused on fundamentals.

Exploiting the Semi-Efficient Market

Interestingly, the market’s semi-efficiency itself creates opportunities for savvy investors. Because many believe markets are efficient, they invest passively through ETFs that blindly track indexes. This means investors automatically buy stocks like Apple, Netflix, and Microsoft at a set proportion regardless of their valuation or fundamentals.

This passive investing approach can cause stocks to become mispriced—overvalued or undervalued—due to blind ETF inflows, distorting price and fundamental value. Active investors, who carefully analyze valuations and fundamentals, can capitalize on these distortions by identifying overvalued or undervalued stocks created by this indiscriminate buying.

Think about it: If a stock rises significantly just because ETFs need to buy it to mirror the index, rather than because of real, fundamental improvements, this represents an excellent selling opportunity for active investors who understand the true value of that stock.

Bringing It All Back to Market Efficiency

So, back to our main question: "What does it mean for a market to be efficient?"

It means that in the short term, most publicly available news is rapidly absorbed into stock prices. But it doesn't mean prices are always correct or rational.

The market can—and frequently does—misinterpret information, creating opportunities for those willing to do deeper research, understand long-term trends before they're obvious, and avoid being distracted by short-term noise.

That's exactly what I do in Beating The Tide. By interpreting public information more accurately than the market does and focusing on trends before they become mainstream, investors can beat the semi-efficient market.

In the coming weeks, I will post a deep dive on a company that has returned a ~75% gain for paid subscribers. Two of their rivals were exiting the market, and we noticed ahead of the crowd. I still see upside, as I will detail in the deep dive. It will be a deep dive for free and paid subscribers, so stay tuned.

Market efficiency doesn’t mean stocks are always fairly valued. It just means you need to be smarter, more patient, and sometimes contrarian enough to swim against the tide.

Beating the Tide delivers deep, fundamentally backed stock picks that have outperformed the S&P 500 since 2012. It’s $130/year (or $15/month) to join the $26 million journey—because $300k just doesn’t cut it.

Forget the Noise—Here’s What Mattered This Week

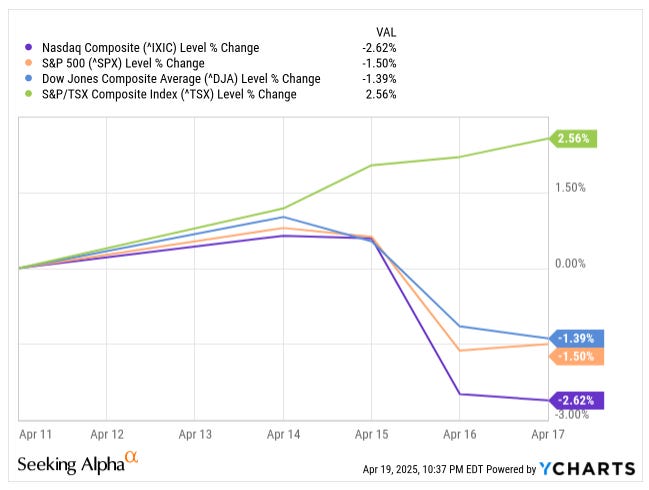

While our portfolios outperformed the market this week, most US investors did not enjoy the same recovery as the US market stumbled. Canada held its breath, and global headlines didn’t exactly help calm anyone’s nerves. So what happened?

Let’s unpack it.

The Numbers First

S&P 500: Down 1.5% for the week

Nasdaq: Dropped 2.6%

Dow Jones: Fell about 1.4%

TSX: Up 2.6%

Chips, Tariffs, and the Return of Trump-o-nomics

The semiconductor industry got sucker-punched this week. The US government slapped licensing restrictions on Nvidia’s AI chips destined for China. Nvidia immediately wrote off $5.5 billion. AMD took an $800 million hit. ASML joined the party by missing bookings due to weakened demand. Their CEO basically threw up his hands and said, "Who knows where this is going?"

Welcome to investing in 2025.

But not all chip news was bad.

TSMC crushed earnings, and the market noticed. Shares jumped 5% on Thursday. First-quarter revenue came in at $25.53 billion, up 35.3% in USD terms and 41.6% in New Taiwan dollars compared to last year. That’s a massive year-over-year jump, even though it declined 5.1% from the previous quarter.

Why the excitement? Because the results confirmed that TSMC isn’t just riding the AI wave—it’s surfing it with a turbocharged board.

AI-related demand continued to pick up speed. HPC accounted for 59% of net revenue, up from 46% last year. Smartphone-related revenue, meanwhile, fell from 38% to 28%, which management attributed to seasonality.

Revenue from 3nm technology more than doubled y/y, now making up 22% of total wafer revenue. That's up from just 9% in Q1 2024. Yes, there was a slight dip from 26% in Q4, but that’s expected after a blockbuster holiday quarter. TSMC also reaffirmed that 2025 revenue should grow in the mid-20s percent in USD terms. Oh, and they’re expecting AI accelerator revenue to double this year.

As if that weren’t enough, CoWoS is on track to double capacity in 2025. The CEO even cited DeepSeek as evidence that lower-cost AI solutions will open the floodgates to more demand. This is in line with my discussion about low-cost AI solutions in my TSMC deep dive.

And then there’s the US investment.

TSM reiterated its commitment to spend $100 billion more in the US over the coming years. That includes three new wafer fabs, two packaging plants, and an R&D hub—bringing total US investment to $165 billion. Importantly, the CEO shot down rumours of any JV with Intel.

As I mentioned in the TSMC earnings preview, while we already knew about the revenue growth, the call would be important to assess whether clients front-loaded revenues due to the tariffs and would see if there is any slowdown in capex. The call and outlook reaffirmed that revenues will continue the strong momentum that was also supported by the reiterated full-year capex guidance of $38–$42 billion.

But then Friday brought a reality check. TSMC shares gave back all their post-earnings gains. The reason? Trump slapped new export restrictions on Nvidia’s H20 chips, effectively banning them from sale to China. What’s wild is that the H20 wasn’t even Nvidia’s top-tier chip—it was a dialled-down version, designed specifically to skirt export restrictions of US export rules. But this version still had enough performance, especially with higher memory bandwidth.

Nvidia had already seen this movie play out. First it was the H100, then the H800, and now the H20. Each time, they trimmed specs to stay within the rules. Each time, the US closed the loophole.

That brought fears that even TSMC’s bullish AI outlook could face regulatory headwinds down the road. So the market rewarded strong execution on Thursday and punished macro uncertainty on Friday.

I think this is all noise, and our TSMC investment thesis is untouched. The company’s fundamentals remain strong. While the new export restrictions on Nvidia’s H20 chips may indeed accelerate China’s push to develop a self-reliant chip industry—as I discussed here—that’s a multi-decade challenge, not a 2025 threat.

TSMC isn’t just a contract manufacturer. It’s the only foundry in the world with consistent volume-scale production of 3nm and soon 2nm nodes, and its lead in packaging technologies like CoWoS is unmatched. Even if China throws unlimited capital at its domestic champions like SMIC, it still lacks access to the most critical piece of the puzzle: ASML’s EUV lithography machines. ASML is a Dutch company, subject to Western export controls, and has already restricted shipments of advanced tools to Chinese firms. Without those tools, China simply cannot catch up—no matter how many engineers or subsidies it throws at the problem.

What About the Fed?

You’d think with inflation cooling and the Fed signalling patience, this section would be quiet this week.

Nope.

Trump cranked the noise right back up.

On Thursday, he told reporters that Fed Chair Jerome Powell’s “termination cannot come fast enough.” And while that may sound like standard Trump hyperbole, this time it’s backed by a real effort. His economic team, led by National Economic Council Director Kevin Hassett, is actively studying ways to remove Powell, even though the Fed is legally independent and Powell’s term runs through mid-2026.

Technically, the President can’t fire the Fed Chair just because he disagrees with rate policy. Legally, removal requires cause, and Powell hasn’t violated any laws. But Trump is testing that boundary (as always). His administration is reportedly considering ways to challenge or reinterpret the 1935 Supreme Court precedent (Humphrey’s Executor) that protects independent agencies like the Fed.

This matters because markets hate uncertainty. The threat of politicizing the Fed could spike bond yields and rattle investor confidence, especially if Trump replaces Powell with a more compliant figure like Kevin Warsh, a former Fed governor.

Here’s the kicker.

In a twisted way, part of me wants Trump to go ahead and try to fire Powell. Not because I think Powell should go, but because that kind of chaotic move might finally be the tipping point where the US public says, “enough.” Sure, our portfolios might tank in the short term (but eventually will recover)—but maybe, just maybe, it’s the catalyst to clean house and return to policy-driven leadership.

But that’s wishful thinking. In reality, this news feed is just another log tossed into the fire of political volatility.

This week showed us how semi-efficiency in markets creates chaos and opportunity. Panic-driven trades don’t last, but misinterpretation of long-term fundamentals can create entry points that pay off for years.

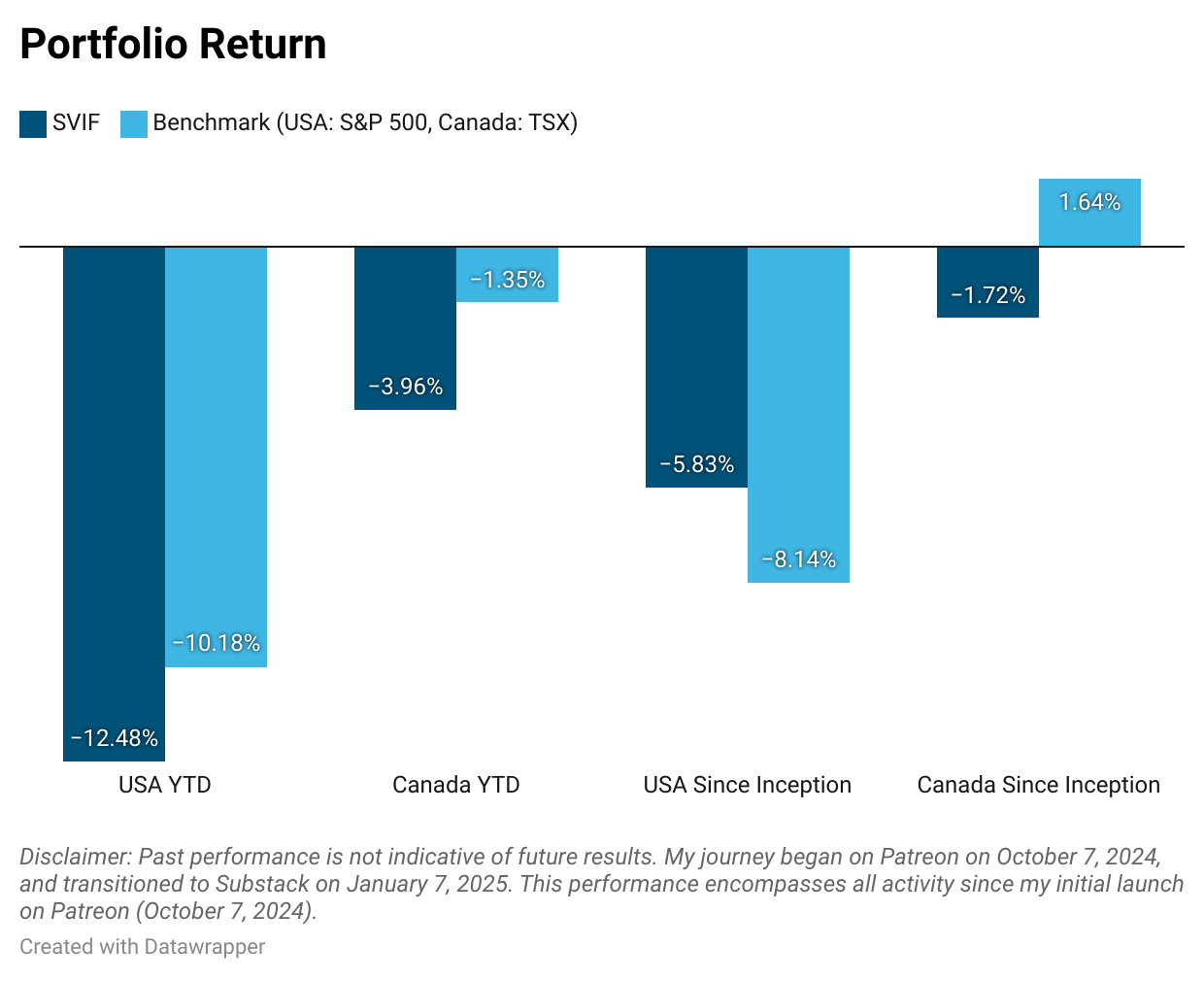

Portfolio Update

It was a good week for both portfolios. While the S&P 500 performance worsened from -8.8% to -10.2% YTD, Portfolio USA’s performance improved from -13.3% to -12.5%, narrowing the gap from -447 bps to -230 bps YTD. Also, we narrowed the performance gap in Portfolio Canada vs. the TSX from -326 bps to -261 bps YTD.

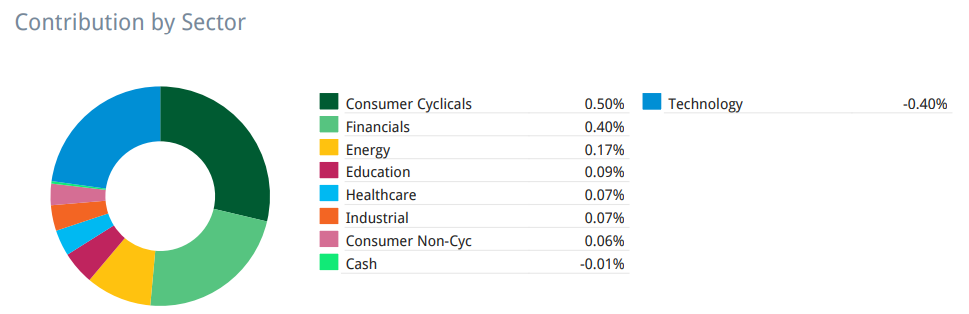

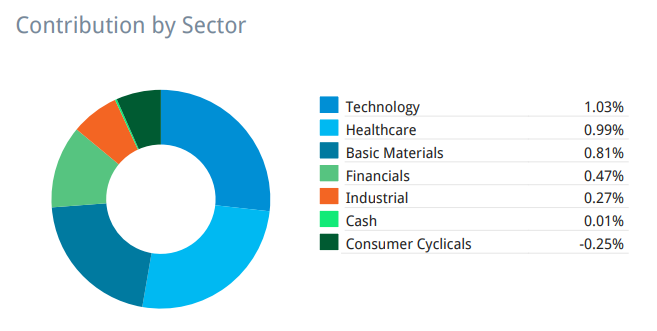

Consumer cyclicals and financials led Portfolio USA, while tech, healthcare, and gold drove Portfolio Canada.

Contribution by Sector - Portfolio USA

Contribution by Sector - Portfolio Canada

Here’s the weekly stock performance for each portfolio: Weekly Stock Performance Tracker

That’s it for this sunny Sunday.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process:

Yes, they are all wrong, I cheated, sorry. It is 9 quintillion grains, that is 9 followed by 18 zeros. The formula to get to that is:

Total grains= 20+21+22+⋯+263 = 9,223,372,036,854,775,809

That is a bit more than the estimated grain of sands on Earth (7.5 quintillion)