Weekly #25: The Only Investing Rule That Actually Works

Why conviction comes from understanding, not timing—and what to watch for in TSMC’s upcoming earnings release.

Hello fellow Sharks,

A reminder that I moved the portfolio update to the bottom of this email.

So let’s start our Weekly!

Table of Contents:

Welcome to Disney World’s wildest roller coaster: The Stockminator

Thought of the Week: Don’t invest in what you don’t understand

Welcome to Disney World’s wildest roller coaster: The Stockminator

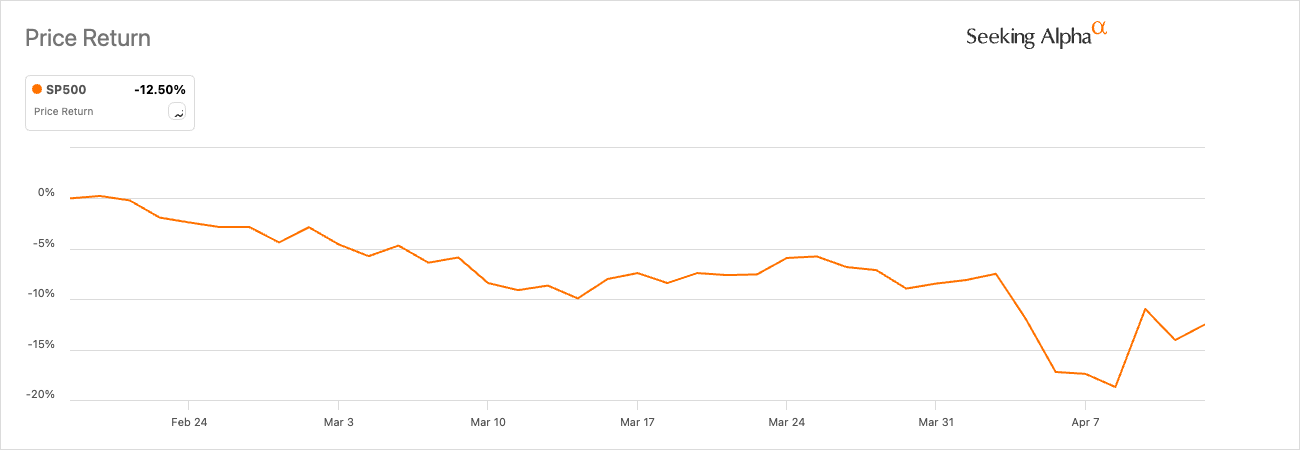

Believe it or not, on Tuesday, the S&P 500 flirted with bear market territory, closing just 19% below its mid-February record—dangerously close to the ominous 20% threshold. It felt like we’d all be huddling in the corner by the week’s end. But by Friday, investors had pivoted from doom to relief, and the index ended the week only 12.7% under its high-water mark. It’s not exactly popping champagne, but it’s better than the alternative.

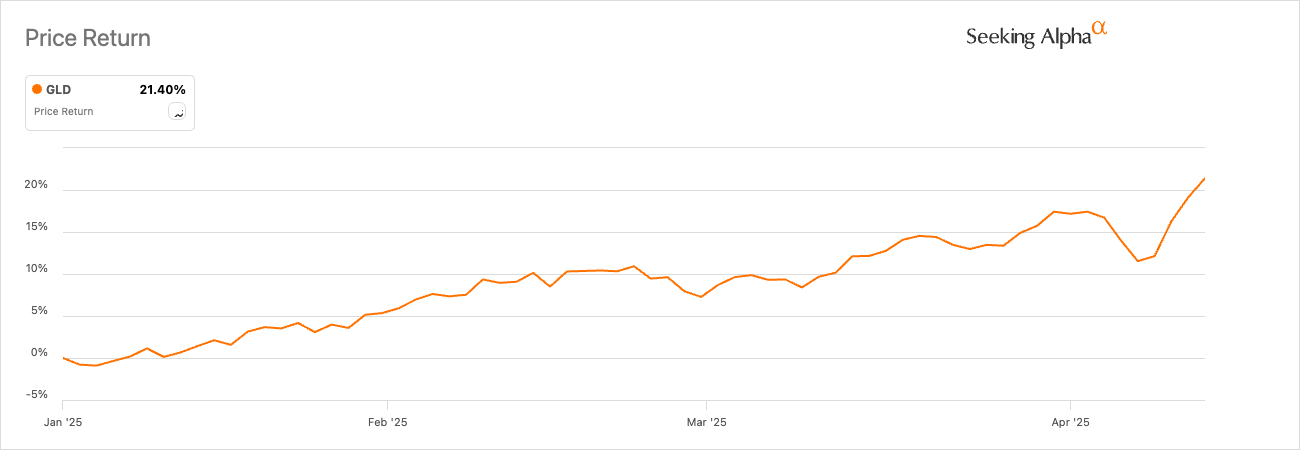

In the last Weekly, I explained how gold outperforms all other asset classes for the following 12 months after VIX hits 45 (which it did hit last week).

So far, that finding has held. Gold just notched its fifth weekly gain in the last six weeks, blasting above $3,200 per ounce for the first time in recorded memory (at least in this weird tariff-laden timeline). Then, on Friday afternoon, you looked up and saw gold floating around $3,250—so it’s up 7% for the week and a whopping 22% since January.

CPI came in at 2.4% year-over-year in March, the lowest level we’ve seen in four years, down from 2.8% in February. Even more strikingly, prices declined 0.1% month over month—the first monthly drop since May 2020. Of course, one data point doesn’t make a trend. Economists are already warning that if trade tensions worsen, the second half of the year might look a whole lot different on the inflation front.

Early reports from big banks came out Friday, and analysts predict the entire S&P 500 might post about 7.3% earnings growth. If that pans out, it’ll mark the seventh straight quarter in which companies grew their profits compared with the same stretch a year ago. Not bad, especially given the see-sawing trade headlines swirling overhead.

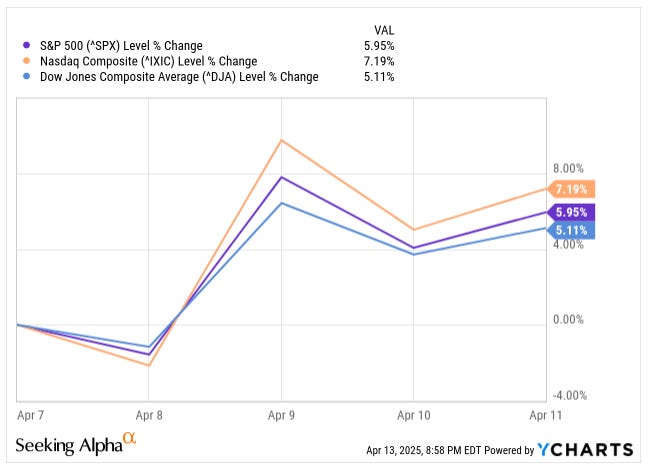

I think last week was one of the most volatile weeks I have experienced in my investment life. A single day last Tuesday saw the S&P 500 up 3.8% at midday due to a post by Walter Bloomberg that said “HASSETT: TRUMP IS CONSIDERING A 90-DAY PAUSE IN TARIFFS FOR ALL COUNTRIES EXCEPT CHINA”. But the market crashed to close 1.6% in the red as Trump denied the post.

Then, on Wednesday, the index roared ahead by 9.5%, marking its biggest single-day jump since 2008. The net result? Nasdaq soared more than 7% for the week, the S&P 500 tacked on nearly 6%, and the Dow rose about 5%.

I bet there will be many insider trading investigations coming out of this week.

Let’s not forget bonds. The U.S. Treasury market had a mini meltdown, with 10-year yields climbing from around 4.00% the previous Friday up to 4.47% by this past Friday. We saw similar moves across longer-dated Treasuries too, where yields are now inching closer to 4.85%.

So, the "Trump put"? Yeah, that's gone. Last week’s market nosedive made it painfully clear—Trump isn’t riding to the stock market’s rescue like he used to. Instead, we watched him fold... but not to equities. He caved to the real sheriff in town: the bond market.

We saw a coordinated selloff in Treasuries that pushed the 10-year yield from 4.0% to just shy of 4.5%. The higher the yield, the more Uncle Sam pays to roll over its mountain of debt.

So, what did we learn this week? Trump may not care about your portfolio, but he sure as hell listens when the bond market starts banging the table.

Then there was the VIX, which leapt to its highest reading in five years on Monday.

So you had your pick: stocks in whiplash territory, bonds feeling the heat, or the VIX spiking to the sky. By the weekend, though, the volatility index had fallen roughly to 35 from that Monday peak.

So, yes, the headlines screamed of potential disaster in the form of fresh tariffs, near-bear markets, and a bond vigilante revolt. And yet, we all ended the week with the major indexes sporting healthy gains and gold shining like a beacon of calm. Of course, no one’s calling it a smooth ride from here on out. Tariffs remain on the table, interest rates just jumped, and the market as a whole is grappling with daily shocks like a prizefighter bobbing and weaving. But at least we’ve got some early innings of an encouraging earnings season to distract us from the noise.

In the meantime, buckle up. Because if this week proved anything, it’s that no matter how convinced you are about where the market’s headed by breakfast, by lunch, it might be heading off in the opposite direction. After all, this is 2025—we’re living in interesting times.

TSMC Earnings Preview

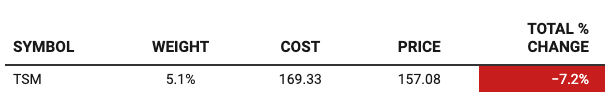

On April 17, TSMC will release earnings. They already announced the revenues for Q1 ($25.6 billion—slightly ahead of consensus estimates of $25.36 billion). That number doesn’t say much, as I believe many clients built up their inventory in anticipation of tariffs. Some of Q1’s strengths may have been borrowed from Q2—or even Q3. In other words, this quarter’s beat might already be next quarter’s headache. What’s important to understand from the earnings release is regarding capex and their outlook for the year.

Regardless, I am not going to sell based on what they say. If I trade at all, it would be to buy more if the share price drops.

On March 13, I advised my paid subscribers to rebalance and build the TSM position.

Since March, I increased the position from 1.0% to 5.1% in Portfolio USA and decreased the cost basis from $196 to $169.

If you want to know why I am so bullish on TSMC, read my deep dive below.

…and this is the perfect transition to my thought of the week.

Thought of the Week: Invest in What You Understand

This may sound like unnecessary advice, but surprisingly few people follow it. They would spend hours comparing products on Amazon to buy the best, cheapest, or most valuable. But when it comes to investing, I bet most people don’t know what they have in their 401k. Or think about Bitcoin: how many Bitcoin investors understand the technology or how blockchain works?

Last week was a clear example of why understanding what you own is critical. When the market goes down 20%, if you are not sure of what you own, you will panic-sell.

Take CLS as an example; since its peak, the share price has dropped 45%.

I haven’t bought any more because CLS already represents a large chunk of Portfolio Canada.

So when the share price went from $200 to $90, what did I do?

Nothing.

True, it sucked at first, then I became Mr. Hindsight ‘what if I took off some profit at $200 and reinvested at $100’, ‘what if I bought a put at $200,’ ‘what if I had a trailing stop’… but all those “what ifs” are useless—a waste of brainpower and time, and most importantly they are stupid. Timing the market is impossible (I will dedicate a future Weekly to why timing the market is impossible…but for now, just trust me).

So, if you cannot time the market, what is the next best thing?

Investing in stuff you understand.

If you read my 6,000-word thesis on CLS, you would understand why I believe in the company.

My thesis may be right or wrong, and I might gain or lose money on that investment, but in the long-term, that doesn’t really matter; what matters is that I understand what I’m investing in. If you get it, you can hold your position in stressful periods and even increase your stake, which could help you generate generational wealth.

Why is understanding the business more important than just making money on your investment?

I know this may sound counterintuitive, but think about it this way.

What would have been your worth if you had invested $1,000 in Apple stock in the ‘80s? Adjusting for stock splits, an Apple share was trading at 12 cents in early 1981.

Your $1,000 would be worth $1.6 million as of today. However, only a few people actually realized a $1.6 million gain on Apple shares. Why? because most investors would’ve sold at the first hiccup in the share price because they did not really understand the business.

I have internal deep dives for all my holdings. But I’m currently writing digestible deep dives to share in Beating The Tide. I have started, and you can find the deep dives to date here.

Next week, I will be releasing my deep dive (to paid subscribers) for our latest portfolio addition.

This deep dive is my longest so far (10,000 words), but I felt I needed to explain many things as it is an undercover stock in an uncommon industry and with a family controlling the Class B shares.

So here’s the takeaway: conviction isn’t born from charts or headlines—it comes from understanding. When you know what you own, you’re not checking prices every hour, you’re not panicking on a red day, and you’re definitely not making emotional decisions. You’re playing the long game. That’s what separates investors from tourists. If you want to build real wealth, start by building real knowledge. The rest—volatility, fear, noise—becomes just background music.

Beating the Tide delivers stock picks backed by deep fundamental research that have outperformed the S&P 500 since 2012. It’s $130/year (or $15/month)—less than one bad trade and way more likely to pay off.

Portfolio Update

It was a very interesting week. Finally, Trump folded his hand, and the markets recovered a bit. Note that the markets did not fully recover due to the 10% blanket tariff to every country and the 125% tariff on China.

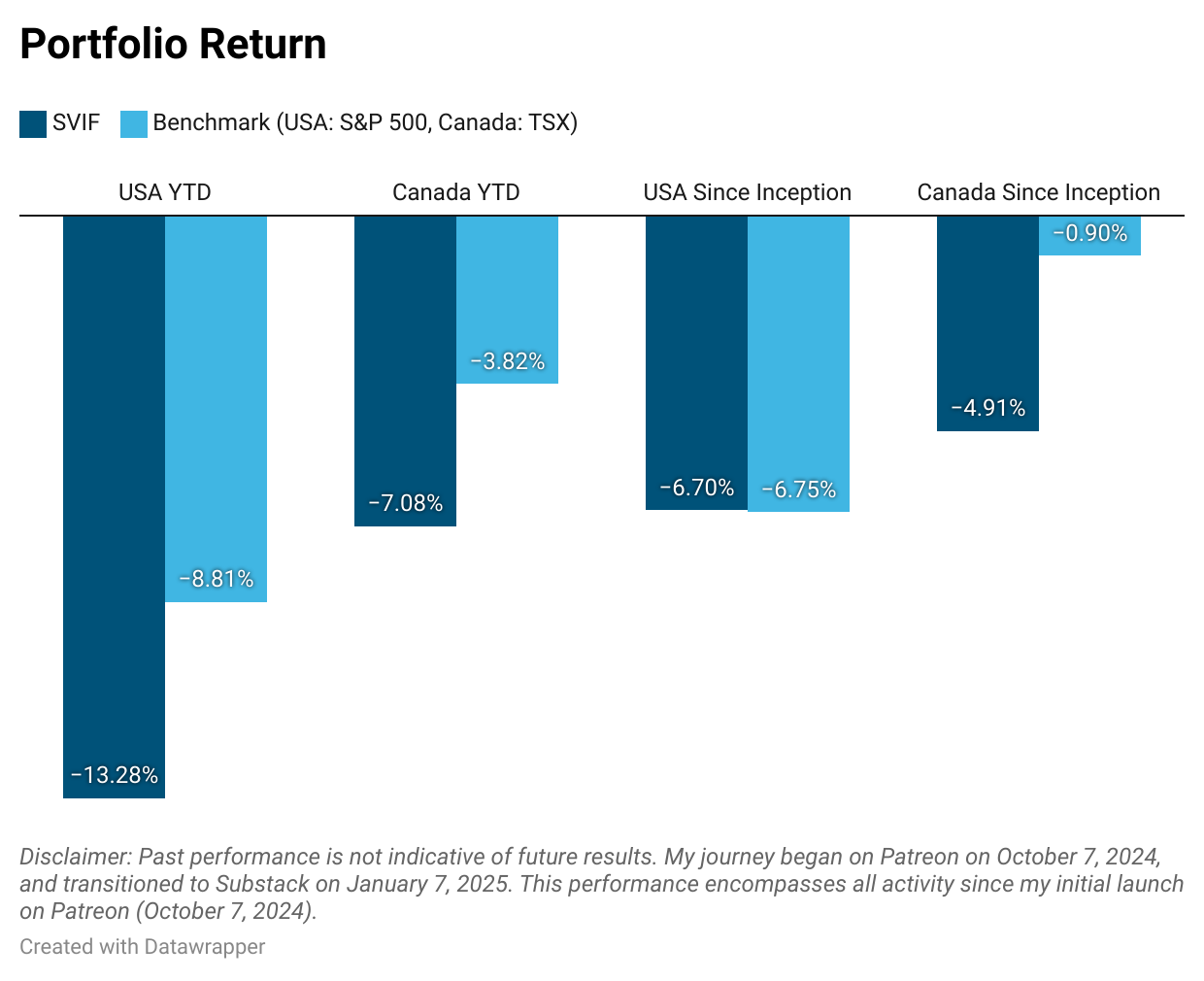

Portfolio USA’s performance versus the S&P 500 widened from -352 bps to -447 bps YTD. But Portfolio Canada halved the underperformance, narrowing the gap from -778 bps to -326 bps YTD.

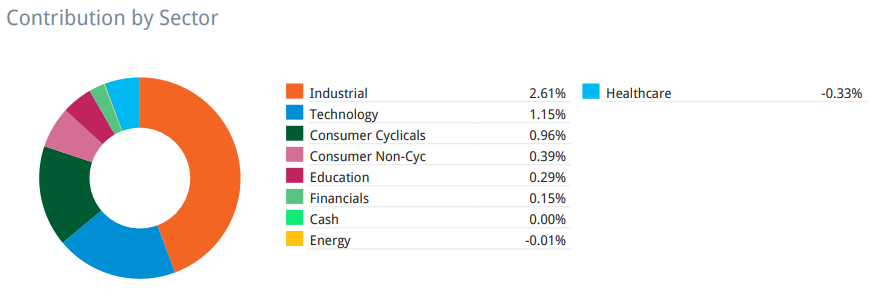

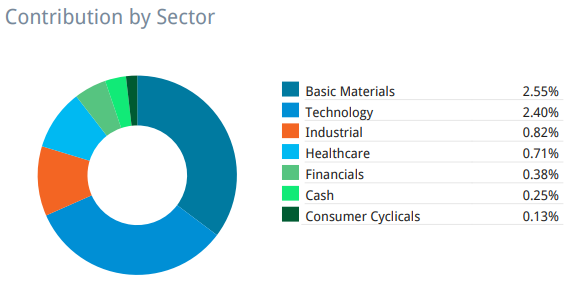

Gold led the recovery in Portfolio Canada, while technology and industrials were the main sectors to have contributed to the recovery in both portfolios.

Contribution by Sector - Portfolio USA

Contribution by Sector - Portfolio Canada

Here is the weekly performance of each stock in our portfolios: Weekly Stock Performance Tracker