Weekly #19: Emotions, the big no-no in investing

How taming emotions can strengthen your portfolio

Fellow Sharks,

What a special week it was—at least for me. On September 28th, I became a father, my wife and daughter are fine. I have never felt anything like this before—pure joy. As you can imagine, it is a busy couple of days for me so I will keep this weekly short and sweet. As always, you can email me any questions (george@beatingthetide.com) or leave a comment on this post and I will answer as soon as I can.

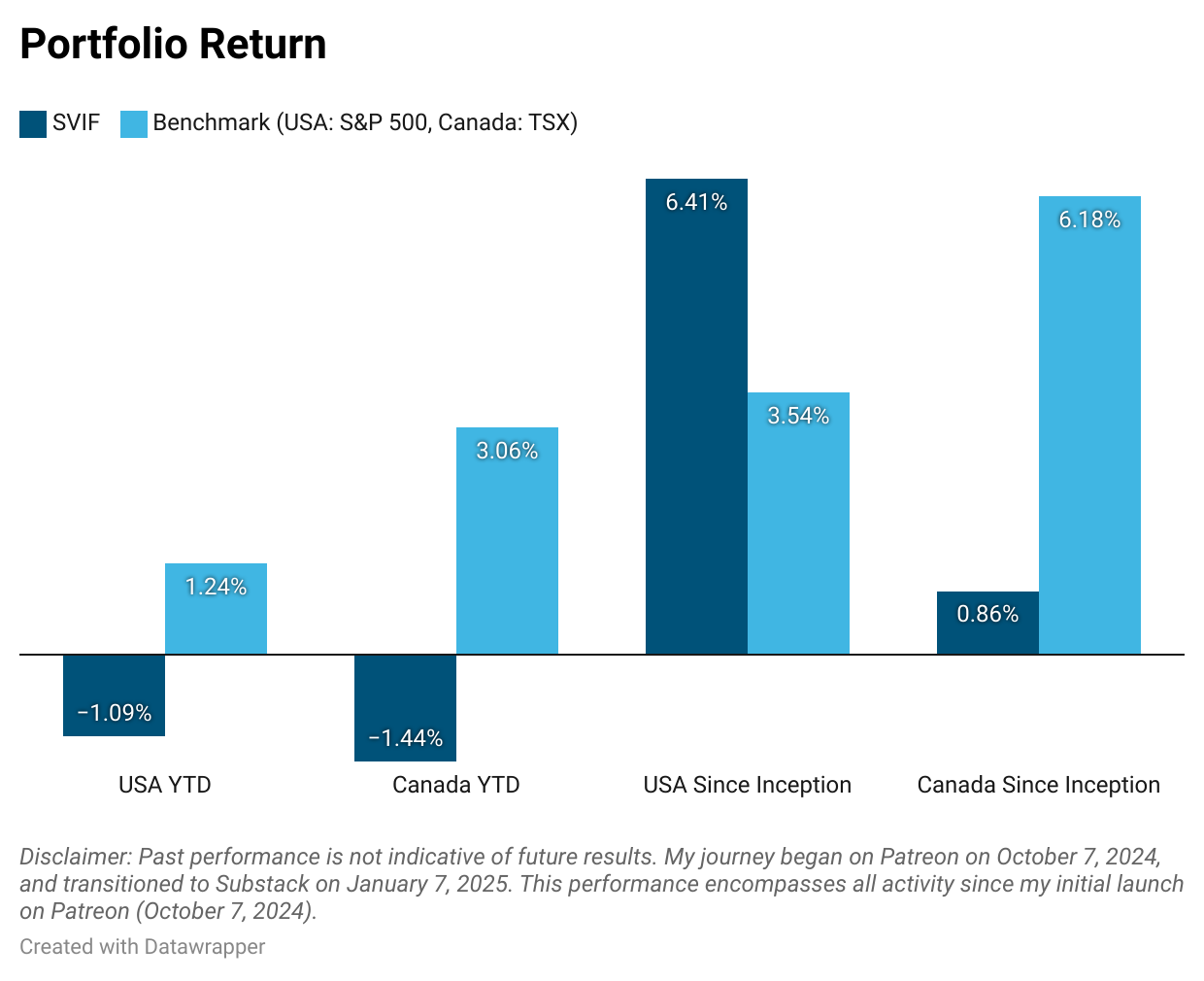

I have one bad news, two good news and one great news. The bad news is that the Canadian Portfolio dived, is in red for 2025 and has been slightly positive since the launch of the newsletter. The first good news is that half of the decline in the Canadian Portfolio is due to one stock, and actually it is our top pick that has returned well over 100% since its addition to the portfolio in October 2024. So my hands are in cold water.

The second bit of good news is that our USA portfolio improved a bit, even as the S&P deteriorated. That narrows the performance gap, and the USA portfolio is still returning twice the benchmark.

The great news is that this is all temporary and we should come out stronger out of this (more on this in the Thought of the Week section).

Here is the weekly performance of each stock in our portfolios: Weekly Stock Performance Tracker

Thought of the Week: No Place for Emotions in Stock Investing

Downturns in the market can make you feel like curling up into a ball and never checking your brokerage account again. Resist that urge. Instead, here’s a practical take on what to do:

First, look at the big picture. Has the reasoning behind why you invested changed, or has the company’s (or the market’s) fundamental structure gone wobbly? Double-check your investment thesis:

If major, long-term shifts have occurred in the industry, it might be time to move on.

If nothing structural has changed, maybe the panic is just market noise.

Second, don’t jump on margin. Yes, you might see equities bounce back at some magical future date, but you have no clue when that happens. It’s a total guess. Margin only amplifies your losses if the market stays sour for a while.

Third, cash is still king when you’ve set it aside for the long haul. If you’ve got money you don’t need for a couple of years or more, consider buying the stocks that once looked too pricey. Sometimes, a downturn serves up those “always wanted to buy but too expensive” companies. Just make sure you truly won’t need that cash soon.

Finally, beware of the emotional roller coaster. It goes like this: you see prices plummet and regret not selling earlier, then the market bounces and you jump back in at a higher price… you end up buying high and selling low, the exact opposite of what you’d intended. If that cycle makes you uneasy, consider ETFs or professional management. Some folks just aren’t built for day-to-day worry.

I’ll throw in a friendly reminder: I do manage separate managed accounts via Interactive Brokers where I only charge a variable performance fee—if you’re making money, so do I. Email me at george@beatingthetide.com if that piques your interest.

So, do you believe your current investing approach sets you up to ride through a severe market storm, or is there a specific move that still keeps you awake at night?

Stay sharp, my fellow Sharks. This is the way!