Weekly #13: Let's invest like professional poker players

Why Poker Isn’t Gambling and How Its Core Competencies—Risk Management, Emotional Discipline, Patience, and Adaptability—Can Make You a Great Investor

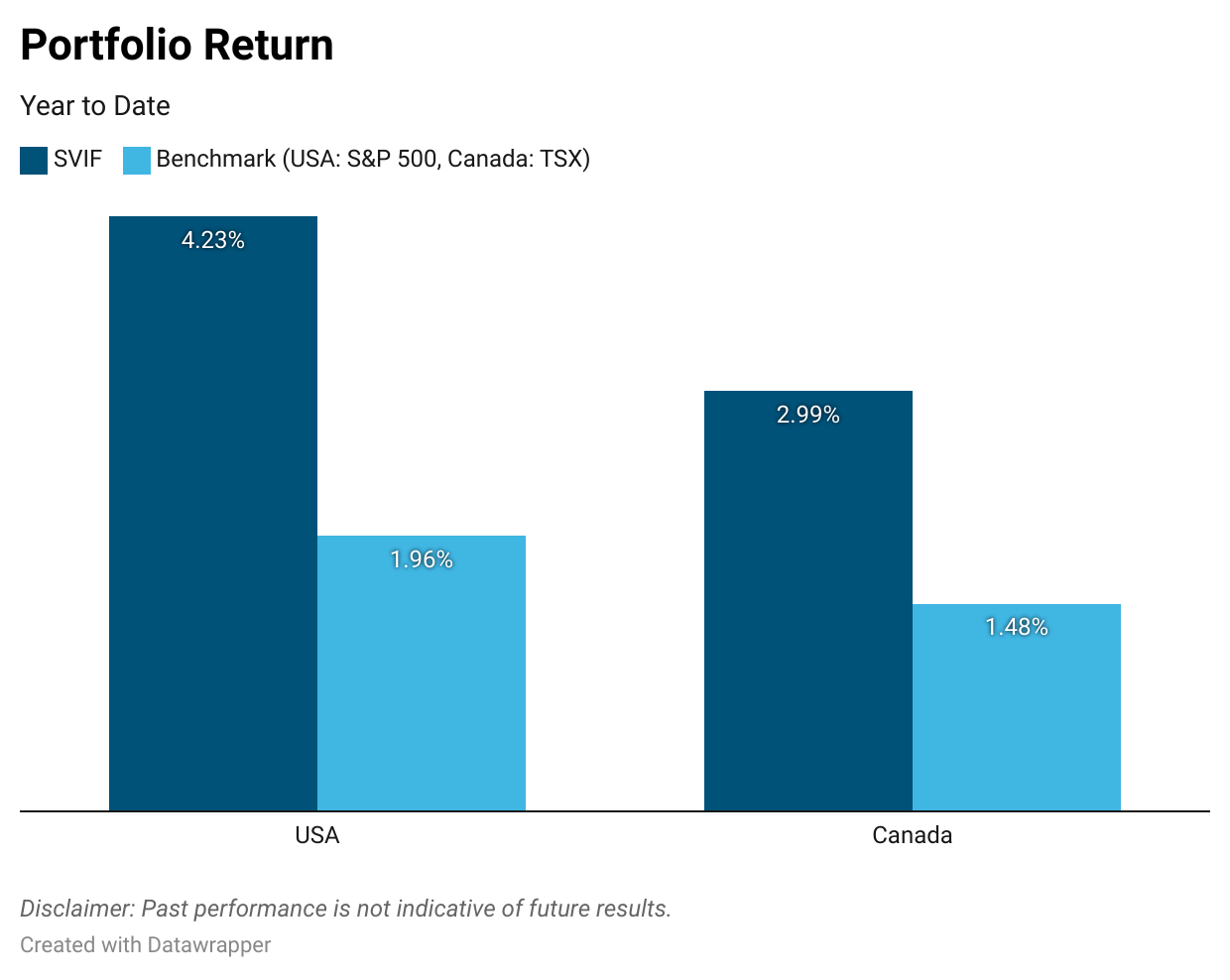

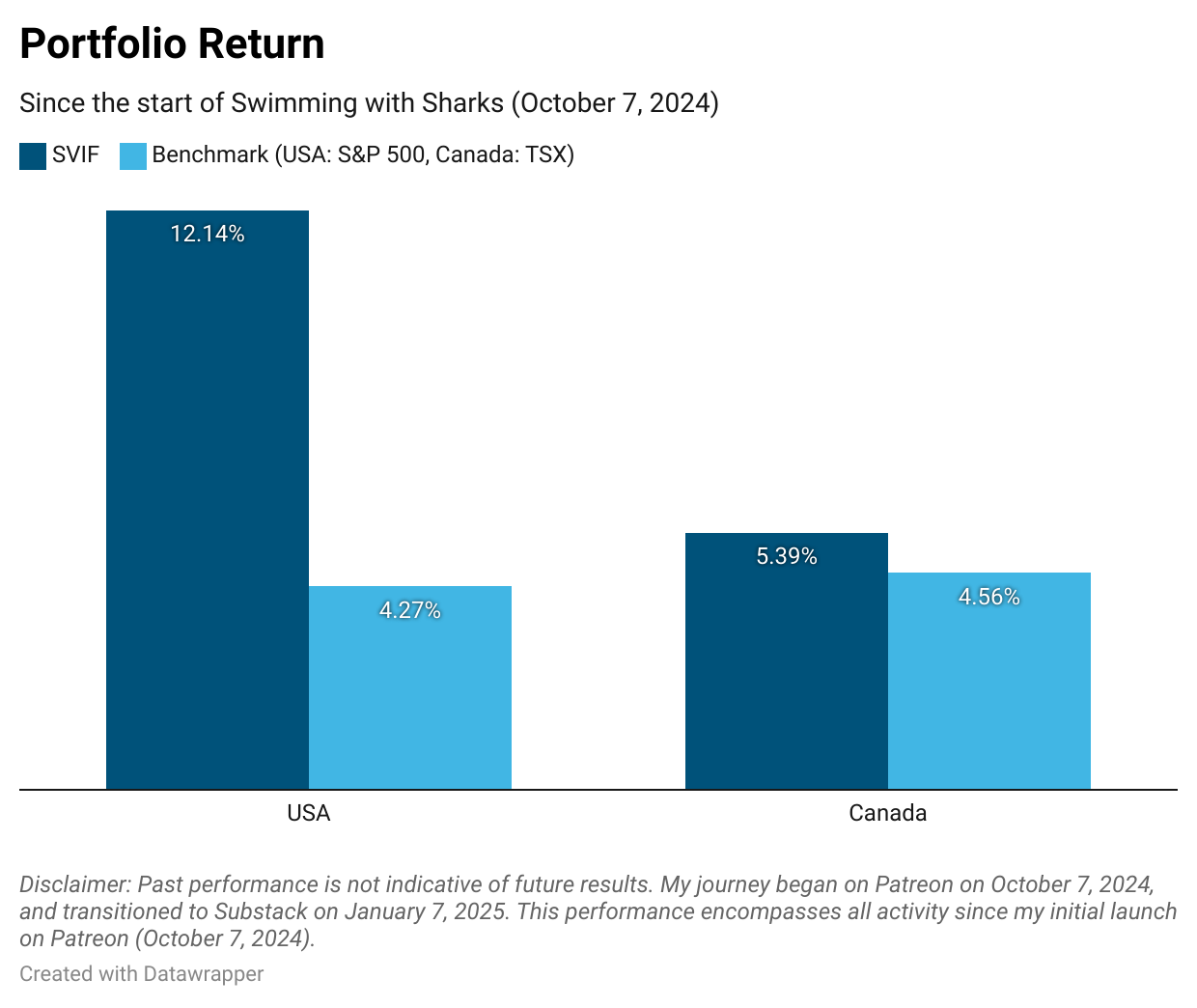

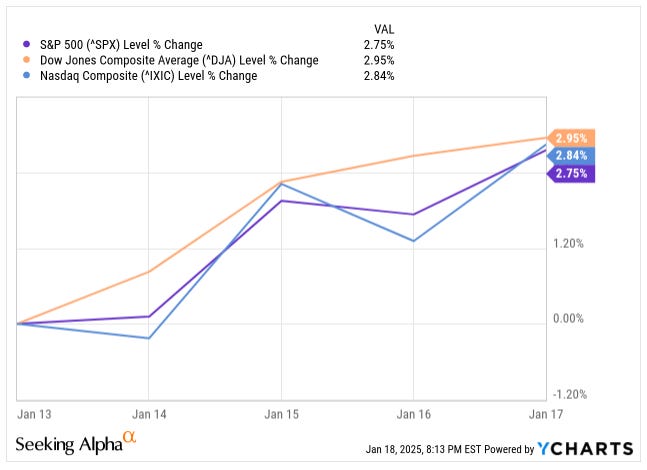

So far in 2025, both portfolios have gained double the benchmark's returns.

Since we started, the SVIF USA portfolio has tripled the benchmark.

To view the holdings of each portfolio, click below:

Let’s invest like professional poker players

There is a big misconception about poker. Poker and stock investing are remarkably similar. That’s why hedge fund managers like David Einhorn, Bill Perkins, and Dan Shak are poker players. Even Warren Buffet played in Berkshire Hathway’s private-jet subsidiary poker tournaments.

What makes a great poker player also makes a great investor. Mathematical proficiency and critical thinking are two fundamentals that overlap between the two fields. However, I want to discuss another four overlapping competencies that are not as obvious.

Risk Management

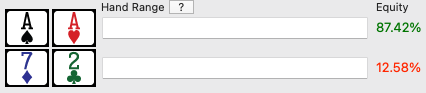

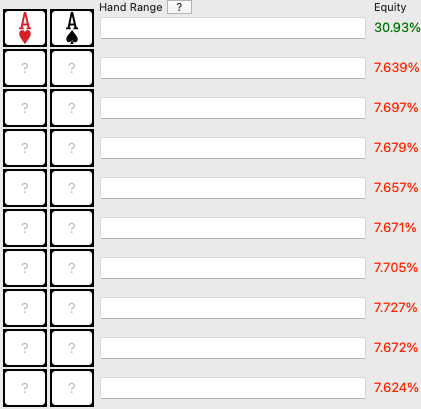

Both fields involve probabilities and decision-making under uncertainty. In poker, the best starting hand (two aces) has an 87% chance of winning against the worst poker hand (a seven and a two).

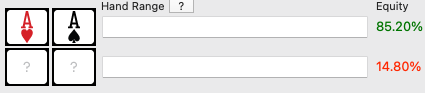

That means that every 100 times you play two aces, 13 times you would lose against a 72. In reality, two aces have an 85% chance of winning because your opponent's hand is unknown.

At a 10-player table with two aces, your chance of having the winning hand is just 31%.

Understanding the probabilistic nature of poker outcomes, poker players think probabilistically rather than deterministically. They think in expected value, known in the field as EV. EV is calculated using this formula,

Expected value = Win probability x Winning amount + Lose probability x Losing amount

If EV is positive, the move is a +EV move, if EV is negative, it is a -EV move. Successful players maximize +EV moves and minimize -EV.

Let’s analyze whether playing the Lotto is a +EV move.

The Canadian Lotto 6/49 costs $3 and you could win $5 million. You have to pick 6 numbers out of 49. The odds of winning is 1 in 13,983,816 or 0.000007151123842%. So the expected value would be,

EV = 0.000007151123842% x $5,000,000 + 99.9999928489% x $-3

EV = $-2.64

Each time you play the lotto, you lose $2.64, that is an -EV move, Sharks don’t play the lotto. Sharks don’t make -EV moves.

Feel free to click the ❤️ button on this post so that more people can discover this post on Substack.

In stock investing, unless you invest in US treasuries, any investment has a non-zero chance of going down to zero. So you need to calculate the EV for your investment before you invest.

By the way, even US treasuries are not risk-free as inflation can erode purchasing value, an increase in interest rate lowers the principal value and while very unlikely, the US could default.

Emotional discipline

Emotional management is critical in poker. Imagine that you had aces and lost a significant part of your chips to a worse hand. Most players would be furious, dwelling on the play, what they should have done, and how they were ‘beaten’ by such a terrible hand.

In this mindset, players often make -EV moves and lose even more chips—a phenomenon known as tilting. Professionals would just rub it off and move on to the next hand as he knows to win he has to continue playing +EV poker.

In investing, when the market is down, some people sell and hold onto cash and when the market is up, they would double down and even go on margin. For example, one of my clients consistently trailed my funds’ performance by withdrawing funds during market downturns and depositing during upswings. I have explained this to him and he conceptually understood it but emotions get the best of him1.

Sharks separate the noise from the signal. So when the market is down, they go on a shopping spree picking up great companies at a discount and when the market is overly ‘hot’, they sell the investments that have become expensive.

Patience and Selectivity

Poker requires patience. Watching TV tournaments, people think poker requires constant action. In reality, good players play only 1 out of 5 hands.

That is why players have to be very selective on what hand they play. They assess their hand, position, opponents, and table dynamics.

People who invest suffer from FOMO. They see their neighbour driving a new Porche and then find out she made a lot of money investing in XYZ. This could lead to impulsive buying of XYZ without proper research, as they fear missing the party. Replace XYZ with Enron, Bernie Madoff, or Beyond Meat.

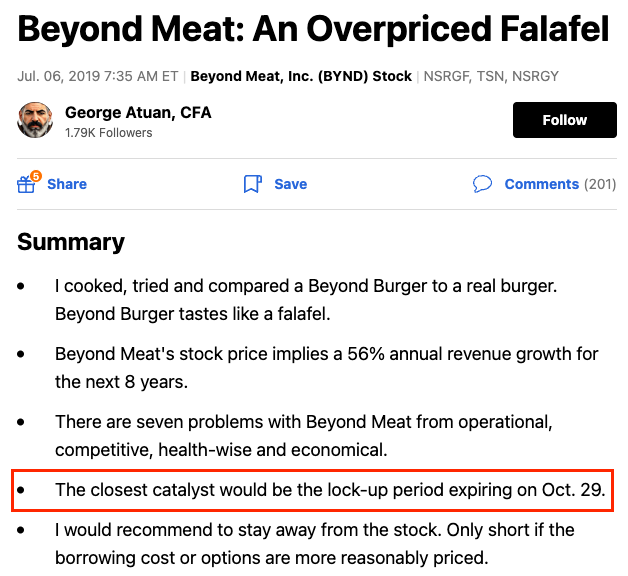

Oh Beyond Meat, it was beyond expensive. On July 6, 2019, I wrote a deep-dive on Beyond Meat with a strong sell recommendation on Seeking Alpha. Even in the summary, I gave a catalyst date!

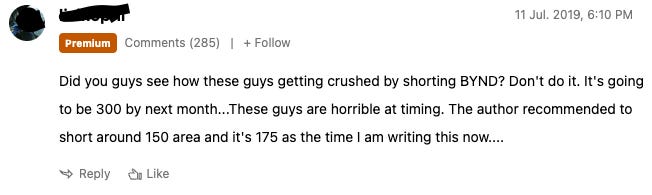

But still, I would get comments like the one below.

…and then this happened.

There are many XYZs out there, Sharks don’t have a FOMO.

Share the Love! Invite friends to join our community and earn rewards!

Adaptability

Losing players rely on fixed strategies, not adaptive ones. They play certain hands under certain conditions in a certain way. A great player has an arsenal of strategies, he has a default strategy that might be similar to that of the average player but the great player observes the dynamics of the table to exploit bad play from opponents.

For instance, if your standard strategy suggests playing a particular hand, but you observe that a very conservative (tight) player is betting ahead of you, it's wise to reassess. In this instance, you have noted that this tight player bets only aces in that spot. While standard strategy would say you play your hand, engaging in such a situation would be a -EV move.

In investing, you have to be adaptable. For example, what would happen if a fourth player enters an oligopoly where you are invested? Does it change your investment thesis? Great investors are open to changing their investment thesis.

Earlier in my career, I lost by clinging to initial theses and ignoring new information. I see it as an expensive tuition to learn the importance of adapting my investment thesis based on new information.

The myth that poker is gambling

The definition of gambling as per the Cambridge Dictionary is “the activity of betting money, for example in a game or on a horse race”.

This definition suggests everything in life is gambling:

Investing in stocks or bitcoins means you are betting money that the value of the stock/bitcoin will go up.

Acquiring a business means you are betting money that the value of the business will increase.

Even buying insurance is a form of betting money under the Cambridge definition!

Buying a business, insurance, or stock doesn’t feel like gambling—and I agree. That is why I want to suggest a new definition for gambling, the Shark definition.

Gambling is the act of engaging in negative expected value activities.

This makes more sense!

So when you make a -EV move in poker and just hope that your card comes up, that is gambling.

When you play the lotto, that is gambling.

And when you buy a very speculative stock that most likely would go to zero but you are hoping it goes up, that is gambling.

I would go one step further to say that, under certain conditions, even sports betting is not gambling.

If I bet on sports, it would be gambling because I have no idea what I’m doing. However, some people study the numbers and analyze extreme details when they place sports bets. They are so skilled that sports betting firms have either banned them or limited the amount they can wager. Nate Silver is one of those people. He is also a poker player. I recommend checking out his Substack.

Bill Walters is another person whose sports bets are +EV moves.

What happened this week in the market?

Enough about poker; let’s dive into what happened in the market this past week.

This week all major indices gained almost 3%.

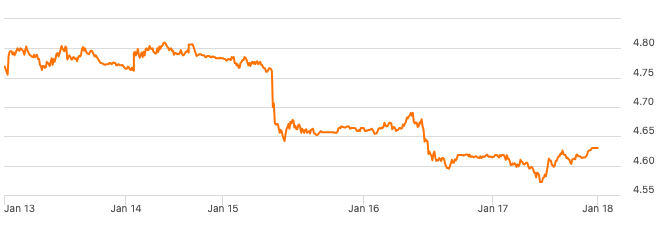

US debt yields fell from recent highs. The 10-year Treasury note yield settled at 4.61%, down from 4.77% the previous week.

US 10 Year Bond Yield

On Wednesday, stocks rose, and bond yields dropped after the release of the latest CPI report. Core CPI, excluding energy and food, rose 3.2% in December, slightly below the 3.3% expected.

Major US banks reported strong earnings, with some more than doubling their fourth-quarter profits compared to a year earlier. Analysts had anticipated nearly 40% growth in the financial sector's earnings, the highest among all 11 sectors.

JPMorgan Chase reported a 54% increase in net profits, driven by robust investment banking and trading revenues. Goldman Sachs achieved a 71% rise in net profits, attributed to increased deal-making and trading activities. Citigroup posted significant earnings growth, surpassing Wall Street forecasts, with strong performance in investment banking. Wells Fargo reported improved earnings, benefiting from higher interest income and a reduction in operating expenses. Bank of America saw net profits more than double to $6.7 billion, fueled by a 44% increase in investment banking fees and growth in loans. Morgan Stanley reported net profits more than doubling to $3.7 billion, with a 51% rise in equity trading revenues and a 35% increase in fixed-income trading.

US retailers posted a 0.4% increase in December sales, falling short of the 0.6% expected. However, November's sales gain was revised upward from 0.7% to 0.8%.

China's economy expanded at an annual rate of 5.4% in the fourth quarter, surpassing expectations and improving from the third quarter's 4.6%. For the full year 2024, growth was 5.0%, aligning with the government's target.

Germany's economy contracted for the second consecutive year, with a GDP decline of 0.2% in 2024, following a 0.3% drop in 2023. The downturn is attributed to sluggish consumer spending and challenges in the automotive industry.

That’s it for this week.

Stay sharp, swim smart, and I’ll see you next week in the ocean of opportunities.

We reached a compromise: he deleted the portfolio app and agreed to receive only annual updates on his portfolio from me. So far, he has upheld the agreement.